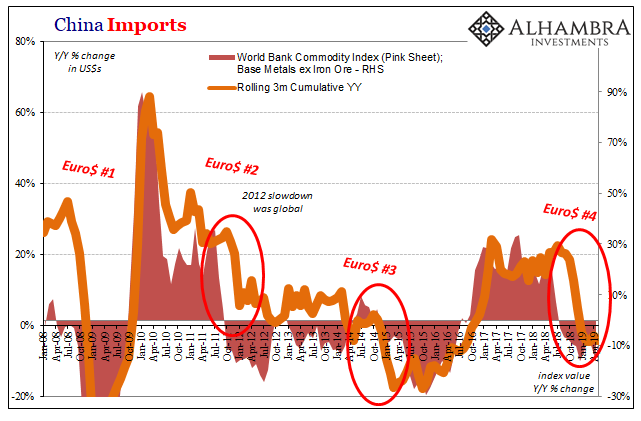

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016. Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month, that level nearly matches January and the biggest negative price change in three years. There is a noteworthy and remarkable absence of a turnaround. Pessimism in commodities markets stands in sharp contrast to the mainstream outlook. This price change began showing up around June and July last year –

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, China Exports, China Imports, currencies, demand, economy, EuroDollar, exports, Featured, Federal Reserve/Monetary Policy, global trade, imports, Markets, newsletter, PBOC, rrr, stimulus, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016.

Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month, that level nearly matches January and the biggest negative price change in three years. There is a noteworthy and remarkable absence of a turnaround.

Pessimism in commodities markets stands in sharp contrast to the mainstream outlook. This price change began showing up around June and July last year – following May 29 and in eurodollar futures the shift toward inversion. Commodities as they stand between financial factors and real world equilibriums, including physical supply and demand, they are an important gauge of actual economic perceptions as they intersect financial and monetary conditions.

Thus, when presented with growing warning signs especially following last May 29, Economists and policymakers have entirely discounted or ignored the commodity signal. The behavior of these prices, however, presented more forward-looking evidence for a looming globally synchronized slowdown.

The mainstream now accounts for that slowdown, grudgingly, but now views it as temporary. Whatever it was, it has been assumed in the past tense. Commodity prices in May, however, suggest again otherwise. Not transitory but still ongoing.

Any chance for a quick rebound in the global economy is either predicated on the US unemployment rate or Chinese “stimulus.” In the former, the perceived strength of the American labor market is supposed to provide a basis for weak consumer and business spending to turn around. That doesn’t appear to be the case in more recent data which continues to show as an inflection if not further deterioration.

| In China, the PBOC has been consistently described as unleashing monetary power – mostly in the form of RRR’s. Therefore, even in the wake of what’s being chalked up to trade wars the Chinese are by most accounts revving up their internal economic engine to offset political forays into both sides of protectionism.

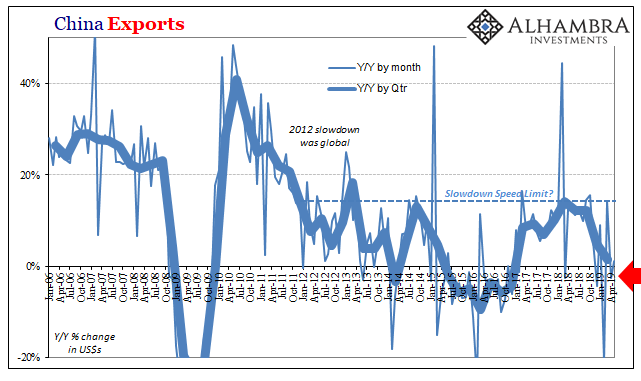

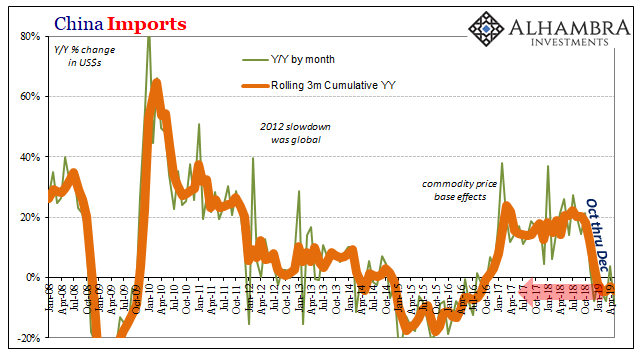

In figures released yesterday, that country’s General Administration of Customs actually presented nearly the opposite case. The total dollar value of China’s exports rose 1.1% in May 2019 year-over-year following a 2.7% annual decline in April. While that’s nowhere close to a decent month, it also doesn’t fit the profile of increasingly harsh trade wars. Neither does the much more important import estimate. If China’s RRR’s are working, then internal demand would be rising substantially regardless of exports and global trade. Instead, imports are contracting – in every way consistent with the behavior of commodity prices. In May, the total dollar value of China’s imports fell a sharp 8.5% when compared to the same month in 2018. That brings the 6-month average change down to -4.4%, a very clear and apparent downturn in the internal Chinese economy which in imports seems to have begun right in that October to December window we’ve been describing since the very start of it. |

China Exports, 2006-2019(see more posts on China Exports, ) |

Relating, importantly, to what’s supposed to be stimulus, I wrote in early October 2018 when the country reopened from its National Golden Week holiday how it was actually a contrary indication of what really matters:

|

China Imports, 2008-2019 |

| Consistent with more recent data on the US labor market (other than the unemployment rate) and therefore the true underlying condition of US demand, China’s imports register the same change and therefore the true underlying condition of Chinese demand.

The behavior of commodity prices, along with US$ curves, both continue to suggest a more durable downtrend in both places. Not transitory, this globally synchronized downturn which has stalled economic growth everywhere still very likely in its beginning stages. If the US labor market isn’t actually strong and Chinese monetary authorities aren’t actually stimulating, it’s hard to argue with commodities. Policymakers will do so nonetheless, just as they had in later 2018 to no avail. |

China Imports, 2008-2019(see more posts on China Imports, ) |

Tags: China,China Exports,China Imports,currencies,demand,economy,EuroDollar,exports,Featured,Federal Reserve/Monetary Policy,global trade,imports,Markets,newsletter,PBOC,rrr,stimulus