The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last opportunity to avoid a further escalation of trade tensions between the world’s two largest economies, in a repeat of the Buenos Aires gathering at the end of last year. FOMC US jobs data disappointed, and prices were soft. The 3-month to 10-year yield curve continues to be inverted. After the May

Topics:

Marc Chandler considers the following as important: 4) FX Trends, China, EMU, Featured, Federal Reserve, newsletter, trade

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last opportunity to avoid a further escalation of trade tensions between the world’s two largest economies, in a repeat of the Buenos Aires gathering at the end of last year.

| FOMC

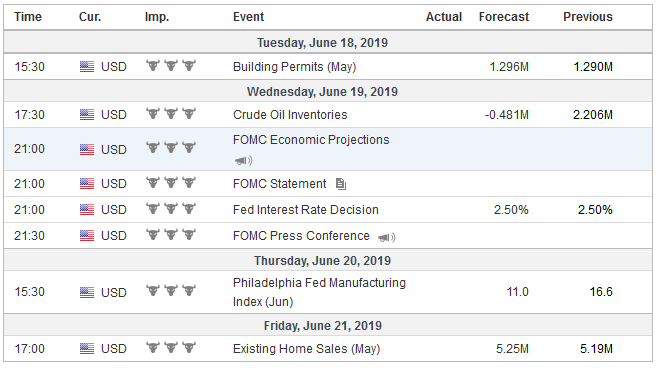

US jobs data disappointed, and prices were soft. The 3-month to 10-year yield curve continues to be inverted. After the May retail sales data that showed a resilient consumer, the interpolated odds of a rate cut now were halved to around 15%. The implied yield of the January 2020 futures contract is about 1.705%. Currently, the effective average fed funds rate is 2.37%. That implies 67 bp of easing continues to be discounted, which is 100 confidence of two 25 bp moves and roughly a 2/3 chance of a third cut this year. The odds of a third cut this year may be a bit exaggerated if one assumes the Fed could lower the interest on reserves further away from upper-end of the target range. After next week’s meeting, there are four meetings left in the year. The FOMC statement will likely recognize that the slowing of jobs growth, which is still sufficient to keep the unemployment rate at the lowest in the generation and new cyclical lows of the underemployment rate. It will also recognize that prices pressures remain soft. Previously, the Fed maintained that the weaker inflation readings for transitory. It may be too early to abandon such views, the confidence in the assertion may have weakened. The same crosscurrents that led the Fed to shift to its current patient and wait-and-see stance from the previous tightening bias are likely to drive the FOMC to adopt a more formal easing bias in its word cues. These crosscurrents include trade tensions, the slowing of global growth, the risk of a disruptive UK exit from the EU, as well as the fading fiscal stimulus in the US and the maturing of the expansion. At the same time, the Fed officials have recognized that the strength of the labor market, and the retail sales report points to stronger household consumption. The point is that while the Fed has the same information set, if not a bit more than market participants, it does not have the urgency to move. It wants to assure the market that it can and will ease policy when the outlook warrants. A more moderate position looked for the Fed to take out an insurance policy as it were, later in late Q3 or early Q4, if the crosscurrents have been lifted. The economy outperformed in Q1 and maybe have slowed below trend in Q2. The Atlanta Fed’s GDPNow tracker for Q2 rose to 2.1% (from 1.4%) after revising the annualized personal consumption component of GDP to a very respectable 3.9%. This implies that net-net the other parts of the economy (government, investment, and net exports) contracted in Q2. The economic performance in early Q3 and the global outlook may be more important than the current economic readings. An insurance policy does not require a 50 bp move, the resumption of asset purchases, or the start of a monetary cycle. |

Economic Events: United States, Week June 17 |

| EMU Flash PMI:

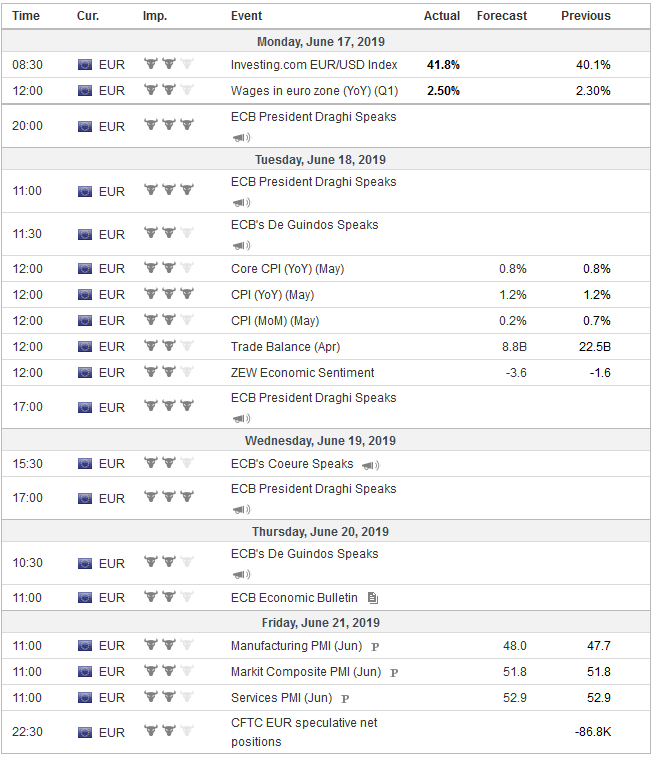

There is a certain pessimism that hangs over discussions about Europe. The export-oriented model has been undermined by the slowing of global growth and in particular China, but also Turkey. Italy and the EC are sliding toward a confrontation. The risks of no-deal Brexit and falling back to WTO commitments are increasing, and although the ineptitude of the UK is broadly recognized, a failure to reach an agreement does not reflect well on the EU either, and it will bear some cost to the disruption. The eurozone hit a soft patch, but it appears to be emerging from it even in not in a spectacular way. The flash PMI readings for June are the most important and do a fairly good job of anticipating the final even though the month is barely half over. The manufacturing PMI has been below the 50 boom/bust level since January and averaged 49.1 in Q1. It appears to have bottomed in March at 47.5. If it were to up to 48.0 as the median forecast in the Bloomberg survey shows, it would be a four-month high. The services PMI has been more resilient, which also underscores the source of the “shock” is external. It averaged 52.4 in Q1 after bottoming in last December and January at 51.2. The composite put in a low in January and February, 50.9-51.0. It averaged 51.5 in Q1, and if it ticks up like the economists project, the Q2 average will be a little higher. The ECB does not need to feel action is urgent. It will provide new targeted refinancing loans. The macro situation is at crossroads, and the outcome will be considerably clear later this year. Two foreseeable potential shocks are a no-deal Brexit and trade conflict with the US. The escalation of the US-China trade war is not good for Europe either on several different levels. Since Draghi’s term is nearly over, there is an understandable reluctance to pre-commit, such as extending the forward guidance out much further (now mid-2020), The other policy levers, rates, and asset purchases, could come at a high price–deeper negative yields and credibility issues after ending the purchases so recently. As US tariffs on China will have the unintended consequence of accelerating local companies’ climb up the value-added ladder, so too will the US criticism of Europe and the weaponization of access to the dollar market accelerate Europe’s commitment to pursue alternatives. It is not just about the sanctions on Iran, but also the threats of sanctions on Germany and companies involved with constructing the pipeline with Russia. And just like the US can threaten to remove the special treatment is gives goods from Hong Kong (not subject to the tariffs on China), it can threaten to exempt the UK from a tariff on European autos. Sun Tzu taught to divided your enemies, but the US appears to go out of its way to unite them. Just like Huawei will break the US duopoly on mobile operating systems, many countries want to break the US dollar clearing monopoly, which allows it to project its authority where ever there are dollar payments. The combination of the UK leaving the EU and the US erratic politics (Bush-Obama-Trump) is a force that can forge a more united Europe if some modus vivendi can be found on the monetary and economic union. If European leaders cannot seize this opportunity, it will be ill-prepared for the pressure comes as the world’s two largest economies simultaneously pursue import-substitution strategies. |

Economic Events: Eurozone, Week June 17 |

Trade

While the UK leaves and the US economic nationalism rises, the EU has been securing new trade agreements: Canada, Japan, and soon Mercosur. To secure alternative supplies to America, China has reduced the tariffs it charges others. What this means is that the average tariff in the US is going up while the average tariff of many other countries is falling. The US has to play catch-up more than setting the bar. The Trans-Pacific Partnership and Japan-EU agreement and China’s non-US tariff cuts have put US farmers and factories at a disadvantage.

Imagine that after hemming and hawing, Chinese President Xi was going to accept the invitation to meet Trump on the sidelines of the G20 meeting. Then an impatient Trump threatens China. If Xi does not meet him, the US will slap a 25% tariff on the remaining $300 bln of Chinese goods that are not yet covered. If Xi meets, he is bowing to Trump, and the tariffs could still come into effect, or be used again as leverage on China. If Xi does not meet Trump, he faces tariffs and more.

Xi is unlikely to refuse outright Trump’s invite despite increasing evidence that America aims to contain China’s growth and development and prevent it from being the world’s superpower, to paraphrase the American President. Trump’s economic adviser Kudlow also reiterated that the US has no interest in a balanced deal: because the US has been disadvantaged for so long, it is insisting on better terms for itself. It is virtually a warning that any agreement will see China lose. It might be like buying a negative yielding bond.

Trump took the initiative by threatening China. Xi can take it back by signaling that while he cannot meet with Trump at the G20 meeting, he would be happy to see the US President in China at some later date in Beijing. Chinese officials likely assume that the tariffs on nearly all of its exports to the US will be implemented no matter way it does.

China went into the gunfight with Trump with a knife. It assumed Trump was interested in a transactional trade deal that reduced the bilateral deficit substantially. And this is what Treasury Secretary Mnuchin had secured a year ago, which Trump summarily rejected. Yet it seems that it has only been since Trump tweeted the end of the tariff truce, and his subsequent candid comments, that Chinese officials recognize a Rubicon has been crossed. That is what the references to the Long March mean. There seem to be many signs that China is preparing a long, sustained, multifaceted, and global rivalry with the US.

The economic hardship that cannot be offset through government policies can be blamed on the US and foster Chinese nationalism. China has a long history of scars that it can point to how it has been wronged by Westerners. In its narrative, China blurs US role, despite it having defended China’s territorial integrity in the face of European and Japanese imperialism in late19th and early 20th centuries. Yet now there are many points of diverging interest, including, not asking but telling China it can no longer purchase Iranian oil. The US acknowledges one China but insists on selling advanced fighter jets to one breakaway province and protests when a special administrative region considers a law that allows China to extradite people back to the mainland for breaking Chinese laws.

The US is seen by Chinese officials as trying to frustrate it at every turn, like the AIIB and the Belt Road Initiative. Merely reducing the bilateral deficit and adhering the rules of the WTO will not be sufficient to appease America. Many experts argue that the WTO rules are not enough to manage to the cunning PRC and seem to advocate ex-post facto regulations designed to outlaw specific current Chinese practices.

Trump says he wants a grand deal or no deal, and apparently, the judgment about the security risks posed by Huawei can be part of the discussion. Xi knows that no such grand deal is possible. For a US President who seemingly does not appreciate nuance, this is seen as a rejection. By accepting as inevitable new tariffs on more Chinese goods, Xi effectively neutralizes Trump’s thought-to-be leverage.

This calculation that Xi may have more to lose than to gain by meeting Trump at the G20 should inform US policymakers. It should warn investors the risk of a market disturbance as they position for the G20 meeting, which could mean unwinding some current exposures. At the same time, businesses should recognize that the one-worldism since the collapse of the Soviet Union and the advent of the world wide web appears increasingly likely to be divided.

Tags: China,EMU,Featured,Federal Reserve,newsletter,Trade