Those looking up from their “free fish!” frolicking will see the tsunami too late to save themselves. It’s an amazing sight to see the water recede from the bay, and watch the crowd frolic in the shallows, scooping up the flopping fish. In this case, the crowd doing the “so easy to catch, why not grab as much as we can?” scooping is frontrunning inflation, the universally expected result of the Great Reflation Trade. You know the Great Reflation Trade: the world...

Read More »About That +6.8 percent GDP Forecast: Remember That GDP = Waste

Any economy stupid enough to rely on the insane distortions of GDP “growth” as its primary measure will richly deserve a Darwin Award when it inevitably collapses in a putrid heap of squandered resources and capital. We’re told the gross domestic product (GDP) measures growth, but what it really measures is waste: capital, labor and resources that are squandered and then mislabeled “growth” for PR purposes. If we only manage what we measure, then we’re mismanaging...

Read More »What “Normal” Are We Returning To? The Depression Nobody Dares Acknowledge

Perhaps we need an honest national dialog about declining expectations, rising inequality, social depression and the failure of the status quo. Even as the chirpy happy-talk of a return to normal floods the airwaves, what nobody dares acknowledge is that “normal” for a rising number of Americans is the social depression of downward mobility and social defeat. Downward mobility is not a new trend–it’s simply accelerating. As this RAND Corporation report documents,...

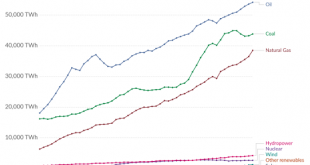

Read More »Oil and Debt: Why Our Financial System Is Unsustainable

How much energy, water and food will the “money” created out of thin air in the future buy? Finance is often cloaked in arcane terminology and math, but the one dynamic that governs the future is actually very simple. Here it is: all debt is borrowed against future supplies of affordable hydrocarbons (oil, coal and natural gas). Since global economic activity is ultimately dependent on a continued abundance of affordable energy, it follows that all money borrowed...

Read More »What Poisoned America?

America’s financial system is nothing more than a toxic waste dump of speculation, fraud, collusion, corruption and rampant profiteering. What Poisoned America? The list of suspects is long: systemic bias, special interests dominating politics, political polarization, globalization and the offshoring of productive capacity, over-regulation, the rise of rapacious cartels and monopolies, Big Tech’s gulag of the mind, the permanent adolescence of consumerism, permanent...

Read More »Gains Are Unreal, Losses Are Real

Why would anyone sell when further gains are guaranteed? Because the gains are unreal but the losses are real. When markets are soaring and your portfolio is rocketing higher, the gains seem unreal. Did I really make that much in one day, week, month? Wow! With the gains higher every time you look, it would be foolish to sell because look at the flood of media reports on “the Roaring 20s” that are predicted with such certitude that it’s essentially guaranteed, the...

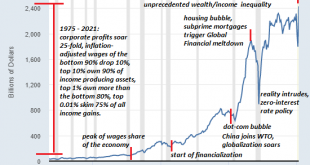

Read More »What Collapsed the Middle Class?

The middle class has already collapsed, but thanks to debt and bubbles, this reality has been temporarily cloaked. What collapsed the middle class? In many ways the answer echoes an Agatha Christie mystery: rather than there being one guilty party, a number of suspects participated in the collapse of the middle class. Can we consolidate these dynamics into a few core causal factors? I’ve made the case in the pst few posts that yes, we can: many of these causes are...

Read More »The Top 10percent Is Doing Just Fine, The Middle Class Is Dying on the Vine

Please study these charts as a means of understanding the inevitability of economic stagnation and a revolt of the decapitalized middle class. I’ve been covering the decline of America’s middle class for over a decade with charts, data and commentary on the social depression that has accompanied the decline. While there are many mutually reinforcing dynamics in this 45-year decline–demographics, global energy costs, financialization and globalization, to name a few–...

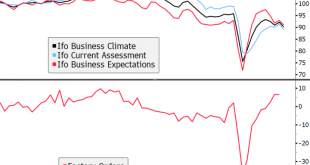

Read More »Dollar Consolidates Its Gains Ahead of Jobs Report

Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI German data is showing further signs of weakness; BOE delivered a less dovish than expected hold; Deputy Governor Ramsden said he envisions slowing the pace of QE later this year Japan...

Read More »Silver Swans, Maginot Lines and the Unforeseen Risks of Collapse

Our Nobility’s assessment of risk and their war-gaming of vulnerabilities are fatally deficient.Many people have heard of Nassim Taleb’s black swan but fewer understand how few events qualify as black swans. Per Wikipedia, a black swan is an unpredictable or unforeseen event, typically one with extreme consequences, an event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org