[unable to retrieve full-text content]If America somehow managed to educate millions of college students without burdening them with $2 trillion in debt in 1993, why is it now "impossible" to do so, even as America's wealth and gross national product (GDP) have both rocketed higher over the past 27 years?

Read More »Have We Reached “Peak Self-Glorifying Billionaire”?

Perhaps we should update Marie Antoinette’s famous quip of cluelessness to: “Let them eat space tourism.” As billionaires squander immense resources on self-glorifying space flights, the corporate media is nothing short of worshipful. Millions of average citizens, on the other hand, wish the self-glorifying billionaires had taken themselves and all the other parasitic, tax-avoiding, predatory billionaires with them on a one-way trip into space. Have we reached Peak...

Read More »Big Tech: “Our Terms Have Changed”

So go ahead and say whatever you want around all your networked devices, but don’t be surprised if bad things start happening. I received another “Our Terms Have Changed” email from a Big Tech quasi-monopoly, and for a change I actually read this one. It was a revelation on multiple fronts. I’m reprinting it here for your reading pleasure: We wanted to let you know that we recently updated our Conditions of Use. What hasn’t changed: Your use constitutes your...

Read More »How Breakdown Cascades Into Collapse

Maintaining the illusion of confidence, permanence and stability serves the interests of those benefiting from the bubbles and those who prefer the safety of the herd, even as the herd thunders toward the precipice. The misconception that collapse is an all or nothing phenomenon is common: Either the system rights itself with a bit of money-printing and rah-rah or it collapses into post-industrial ruin and gangs are battling over the last stash of canned beans....

Read More »Here’s Why America’s Labor-Shortage Will Drive Inflation Higher

Great swaths of the American workforce are already on strike or slipping away from the dead-end treadmill. America’s labor shortage is complex and doesn’t lend itself to the simplistic expectations favored by media talking heads. The Wall Street cheerleaders extol the virtues of “getting America back to work” which is Wall-Street-speak for getting back to exploiting workers to maximize corporate profits. Long-term demographics have combined with cultural changes and...

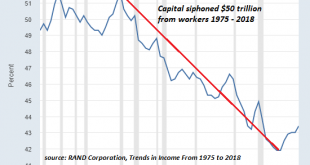

Read More »The $50 Trillion Plundered from Workers by America’s Aristocracy Is Trickling Back

As I often note here, when you push the pendulum to an extreme of wealth and income inequality, it will swing to the opposite extreme minus a tiny bit of friction. The depth of America’s indoctrination can be measured by the unquestioned assumption that Capital should earn 15% every year, rain or shine, while workers are fated to lose ground every year, rain or shine. And if wages should ever start ticking upward even slightly, then the Billionaires’ Apologists are...

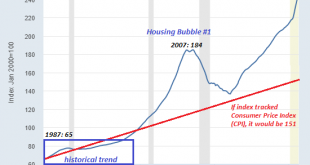

Read More »Housing Bubble #2: Ready to Pop?

All debt-fueled speculative bubbles pop, even as cheerleaders claim otherwise. The expansion of Housing Bubble #2 is clearly visible in these two charts of house valuations, courtesy of the St. Louis Federal Reserve database (FRED). The first is the Case-Shiller Index, which as you recall tracks the price of homes on an “apples to apples” basis, i.e. it tracks price movements for the same house over time. Note that this is an index chart where the index is set at 100...

Read More »A Few Things About Reinforced Concrete High-Rise Condos

There is a downside to steel reinforcing bars: they rust. The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger. Before we accept this conveniently feel-good conclusion,...

Read More »Virus Z: A Thought Experiment

What’s striking about our thought experiment is how little reliable data we have about the transmissibility of our hypothetical Virus Z and the long-term consequences of its mutations. Let’s run a thought experiment on a hypothetical virus we’ll call Virus Z, a run-of-the-mill respiratory variety not much different from other viruses which are 1) very small; 2) mutate rapidly and 3) infect human cells and modify the cellular machinery to produce more viral...

Read More »The Systemic Risk No One Sees

The unraveling of social cohesion has consequences. Once social cohesion unravels, the nation unravels. My recent posts have focused on the systemic financial risks created by Federal Reserve policies that have elevated moral hazard (risks can be taken without consequence) and speculation to levels so extreme that they threaten the stability of the entire financial system. These risks are well known, though largely ignored in the current speculative frenzy. But...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org