The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient “saves” of a system that is unraveling due to its fragility and brittleness. There are two standard-issue narratives about the Federal Reserve’s agenda: the Fed’s official narrative is that the Fed’s mandate is to keep inflation under control while promoting full employment. The unofficial mandate that’s obvious to all is to prop up assets, especially the stock market, which has become the Fed’s preferred signifier of prosperity and the rightness/goodness of Fed policies. The other narrative results from “following the money”: the Fed is owned by private-sector banks, and so behind the curtain of happy-talk (full

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

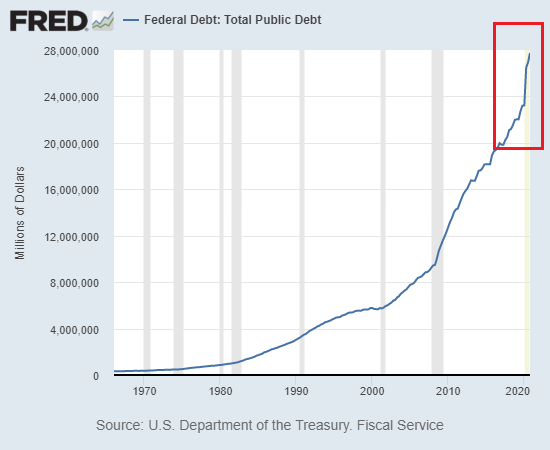

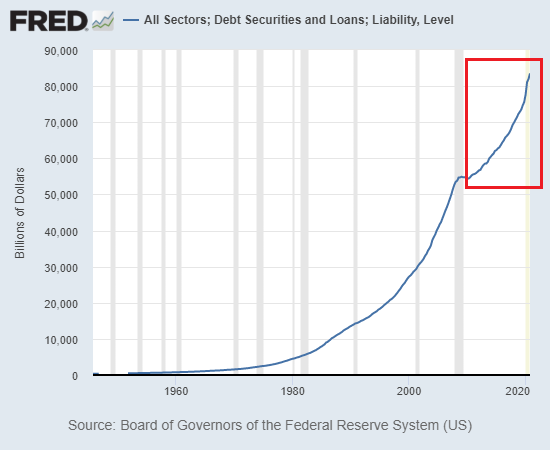

The Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient “saves” of a system that is unraveling due to its fragility and brittleness. There are two standard-issue narratives about the Federal Reserve’s agenda: the Fed’s official narrative is that the Fed’s mandate is to keep inflation under control while promoting full employment. The unofficial mandate that’s obvious to all is to prop up assets, especially the stock market, which has become the Fed’s preferred signifier of prosperity and the rightness/goodness of Fed policies. The other narrative results from “following the money”: the Fed is owned by private-sector banks, and so behind the curtain of happy-talk (full employment, blah-blah-blah), the Fed’s only real agenda is to further enrich banks and too big to fail/jail financiers–something it has managed to do with remarkable success. That the Fed inflated the 1999-2000 dot-com bubble and the 2005-2008 housing bubble is undeniable, as is the Fed’s 2008-09 bailout of the global financial system and too big to fail/jail mortgage originators and a vast array of other profiteering, embezzler-scoundrels. The Fed’s zero-interest rate policy (ZIRP) and unprecedented quantitative easing monetary stimulus have pushed the Fed balance sheet, federal debt and systemic debt to heights that heretofore would have been inconceivable. (Charts below) |

Total Assets: Wednesday Level, 2005-2021 |

| While pursuing these non-mutually-exclusive agendas–we came to do good and stayed to do well– the Fed has generated destabilizing extremes of wealth and income inequality, a reality that the Fed risibly denies. (There must be much mirth about this BS behind closed doors.)

Allow me to posit a third agenda which doesn’t negate either conventional agenda but does explain some of the Fed’s actions since 2008. As the system unravels, the Fed’s primary imperative is to save the financial system and economy from the greed-soaked incompetence of the other players, public and private, by taking charge of critical swaths of the financial system and economy. After the subprime debacle almost took down the entire global financial system, the Fed (with a bit of help from Congress) essentially took over the entire $10 trillion US mortgage market. Private-sector lenders had figured out how to issue guaranteed-to-default mortgages and pass off the fraudulent mortgage-backed securities (MBS) to pension funds in Norway and a global cast of suckers who believed America’s financial system was properly regulated. (Haha, the joke’s on you.) In response, the Fed basically nationalized the mortgage market, buying more than $1 trillion in mortgage-backed securities and ensuring that virtually all mortgages in the U.S. were guaranteed or originated by federal agencies: Fannie Mae and Freddie Mac (after their bankruptcy as quasi-private agencies), FHA and VA. |

Federal Debt: Total Public Debt, 1970-2021 |

| More recently, the Fed realized the private broker-dealer banks that handle the all-important issuance of Treasury bonds could no longer be trusted. As this article explains, Fed Prepares To Go Direct With Liquidity, “The Fed’s primary concern is not employment or inflation, but rather keeping the market for Treasury securities functioning.”

In response, the Fed is cutting the broker-dealers out as unreliable players. The Treasury market and the US dollar are the foundations of federal spending and power, and so the Fed has realized that, just as it did with the greedy, fraudulent embezzlers of the private-sector mortgage market, it has to bypass or neuter the private-sector players as threats to stability. Next up on the Fed’s agenda: take charge of the issuance of new money to households and cut Congress out of the loop. If you read up on the Fed’s plans for its own digital currency and the FedNow system, you’ll come to understand that the Fed has concluded that supporting consumption (i.e. giving money to households to enable more spending) is too important to leave in the corrupt hands of the legislative bodies (Congress) or the Treasury, which must issue debt to raise cash to distribute to households, debt that further burdens federal revenues and spending. The Fed has concluded that supporting demand / consumption is too important to be left to the partisan antics and pay-to-play corruption of Congress. So the Fed’s plan is to create new money out of thin air and deposit it directly in household accounts via the FedNow system. |

All Sectors; Debt Securitirs and Loans; Liability, Level, 1960-2021 |

| We can’t count on you, broker-dealers or Congress, so we’re taking charge, as the system is now so over-extended that any misadventure by other players could well be catastrophic. So the only alternative from the Fed’s point of view is to take charge and cut the untrustworthy, self-serving incompetents out of the loop.

The danger of this power grab is that the Fed will misjudge the situation, and that will prove catastrophic because the system has been stripped of resilience, feedback and redundancy. I suspect the Fed sees itself as trapped by the incompetence and greed of the other players and by its own policy extremes that were little more than expedient “saves” of a system that is unraveling due to its fragility and brittleness. This Federal Reserve paper is typical of the groundwork being laid for the Fed digital currency and direct deposits to households via FedNow accounts.

|

|

Tags: Featured,newsletter