It’s all so pathetic, isn’t it? The only way left to get ahead in America is to leverage up the riskiest gambles. It’s painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin? The obvious answer is because others have reaped a decade or two of wages in a few weeks, and skimming a couple hundred thousand dollars in a few weeks or months is the only way an average wage earner is going to be able to buy a house, fund a retirement account, afford to have a family, etc. Look at the reality of wage stagnation: I made an hour in 1986, and I wasn’t some highly paid

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

It’s all so pathetic, isn’t it? The only way left to get ahead in America is to leverage up the riskiest gambles. It’s painfully obvious that the only way left to get ahead in America is crazy-risky speculation, but nobody seems to even notice this stark and stunning reality. Why are people piling into crazy-risky bets on speculative vehicles like Gamestop and Dogecoin? The obvious answer is because others have reaped a decade or two of wages in a few weeks, and skimming a couple hundred thousand dollars in a few weeks or months is the only way an average wage earner is going to be able to buy a house, fund a retirement account, afford to have a family, etc. Look at the reality of wage stagnation: I made $12 an hour in 1986, and I wasn’t some highly paid techno-guru or Wall Street shill. $12 an hour was an OK wage in 1986 but it wasn’t fantastic. Now 35 years later, $12 is still an OK wage. A lot of people make less than $12/hour. But what happened to the cost of healthcare, housing, childcare and everything else required to have a family in those 35 years? These costs have exploded higher. It was already a stretch to buy a house in 1986 making $12/hour, but now–are you joking? Depending on the region, the cost of a modest house has tripled or gone up five-fold or even ten-fold in the past 35 years. As for getting ahead by starting your own business–that’s another bitter joke. In 1986 I was able to provide our single employees decent healthcare insurance for $50 each and those with families for about $150 per month. Our employees did not pay a dime for this coverage. We (the employers) paid all the healthcare insurance costs as well as workers compensation, liability insurance and unemployment insurance (federal and state). |

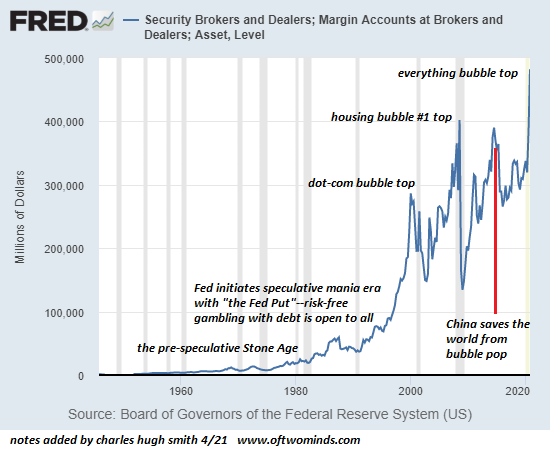

Security Brokers and Dealers, 1960-2020 |

| According to the Bureau of Labor Statistics (BLS), the consumer price index (CPI) has risen such that what $1 bought in 1986 now costs $2.40. Try buying real healthcare insurance for an employee today for $50 X 2.4 = $120 per month. The CPI is a pathetic joke when it comes to housing, childcare, healthcare, higher education and all the other big-ticket expenses of having a family.

All the expenses of operating a business have soared even as liability exposure, compliance costs and junk fees have skyrocketed. And by definition, you’re “rich,” even if you’re losing money, because you’re a business owner, so there’s a tax target on your back as state and local governments jack up junk fees, penalties, fines and taxes on everything that isn’t already overtaxed. As for getting a graduate degree to place yourself above the competition–credential inflation is even worse than price inflation. There are 100 other equally credentialed candidates for every high-paying slot, and if you (foolishly) accept the big-bucks job, your life outside of work is over. You are essentially a well-compensated indentured servant of your Corporate America masters. And now that you’re “rich,” you’re also a Tax Donkey, paying between 40% and 50% of your earnings in taxes. The billionaires and their corporations pay little or nothing, as they’ve got the tax dodges (philanthro-capitalist foundations, offshore tax gimmicks, subsidies enacted by cheaply-bought politicians, etc.), but you, indentured servant of Corporate America–you’re “rich” and should pay more. So please work harder and make even more income, and if you’re lucky we’ll let you keep a slice of the higher earnings. But maybe not, because, well, you’re “rich.” You don’t own anything and can barely afford a family, but you’re “rich” in terms of earnings, and that’s what counts. |

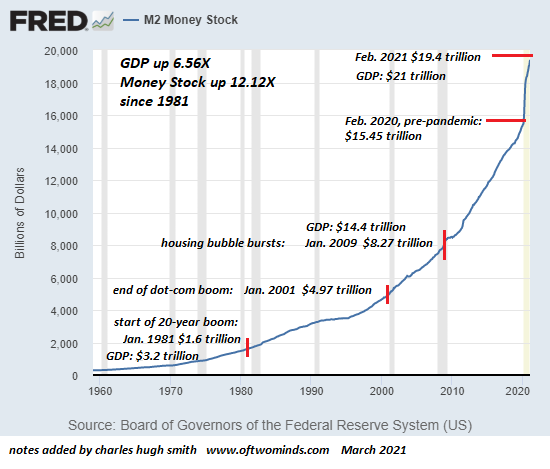

M2 Money Stock, 1960-2020 |

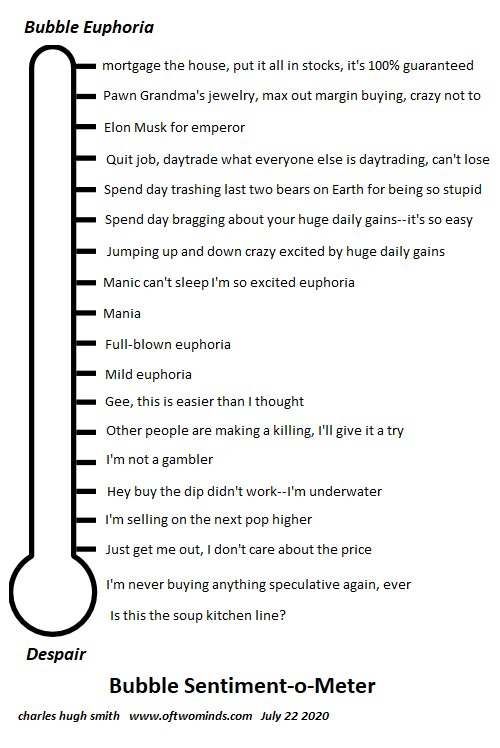

| And so the last best hope for the non-elite workforce without the privileges of a wealthy well-connected family is to play the riskiest tables in the Federal Reserve’s casino, maxing out margin (borrowing money against one’s stock portfolio) and buying options, which expire worthless if the bet goes south.

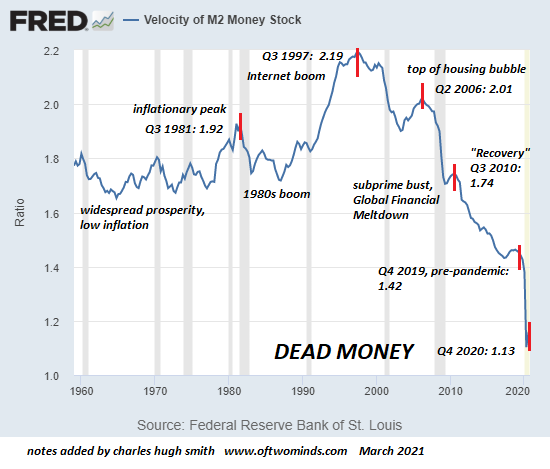

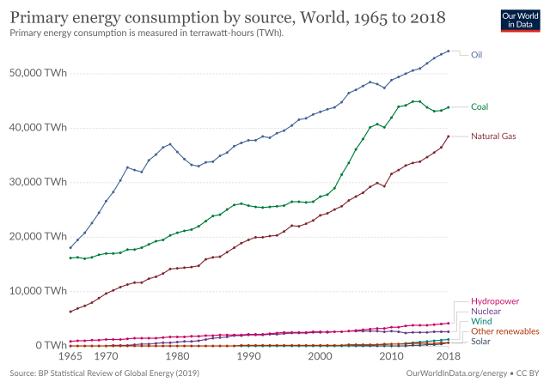

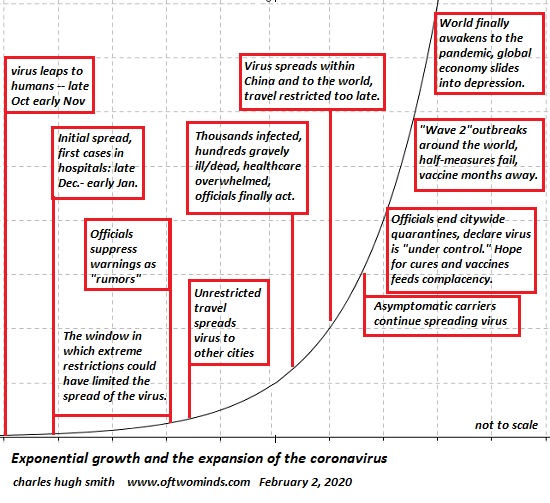

Because the reality of American life is the ways to get ahead are down to: 1) choose wealthy parents 2) win the lottery 3) follow the FIRE path (financial independence, retire early) which requires a high-paying job and super-low expenses, 4) join a friend’s software start-up that gets bought by Microsoft, Google, Apple or Facebook for mega-millions, or 5) gamble and win at the Fed casino’s riskiest tables. Take a look at three charts: margin debt (all-time high), M2 money supply (all-time high), and money velocity (all-time low). The Fed creates trillions of dollars out of thin air which flows into speculative asset bubbles, punters with no other realistic options to get ahead max out their margin accounts to boost their bets at the riskiest tables and meanwhile, back in the real economy, stagnation reins supreme: stagnant wages, stagnant family / household formation, stagnant business formation and the velocity of money is in a free-fall to dead money. It’s all so pathetic, isn’t it? The only way left to get ahead in America is to leverage up the riskiest gambles at the riskiest tables, betting that everyone will be a winner at the Fed’s rigged tables–but you have to play to win. Or lose, but nobody mentions that. All you’ll hear in the Fed’s casino is the Fed has our back, until the entire casino collapses in a putrid heap of fraud, corruption, greed, systemic risk and hubris. |

Velocity of M2 Money Stock, 1960-2020 |

Tags: Featured,newsletter