The Fed’s “choice” is as illusory as the “wealth” the Fed has created with its perfection of moral hazard. The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn’t so deeply tragic, for the Fed doesn’t even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven “saves” it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable. The irony is the...

Read More »America’s Social Order is Unraveling

The unraveling of America’s social order is accelerating, and denial will not save us from the consequences of the plundering of the social contract. What kind of nation boasts a record-high stock market and an unraveling social order? Answer: a failed nation, a nation that has substituted artifice for realism for far too long, a nation that now depends on illusory phantoms of capital, prosperity and democracy to prop up a crumbling facade of “wealth” that the...

Read More »It Always Ends The Same Way: Crisis, Crash, Collapse

Risk has not been extinguished, it is expanding geometrically beneath the false stability of a monstrously manipulated market. One of the most under-appreciated investment insights is courtesy of Mike Tyson: “Everybody has a plan until they get punched in the mouth.” At this moment in history, the plan of most market participants is to place their full faith and trust in the status quo’s ability to keep asset prices lofting ever higher, essentially forever. In other...

Read More »Front-Running the Crash

What if everyone in the market realizes it’s now the moment to front-run the crash? We have a fine-sounding word for running with the herd: momentum. When the herd is running, those who buy what the herd is buying and sell what the herd is selling are trading momentum, which sounds so much more professional and high-brow than the noisy, dusty image of large mammals (and their trading machines) mindlessly running with the herd. We also have a fine-sounding phrase for...

Read More »The Sources of Rip-Your-Face-Off Inflation Few Dare Discuss

We’re getting a real-world economics lesson in rip-your-face-off increases in prices, and the tuition is about to go up–way up. Inflation will be transitory, blah-blah-blah–I beg to differ, for these reasons. There are numerous structural sources of inflation, which I define as prices rise while the quality and quantity of goods and services remain the same or diminish. Since the word inflation is so loaded, let’s use the more neutral (and more accurate) term...

Read More »Post-Pandemic Metamorphosis: Never Going Back

People caught on that the returns on the frenzied hamster wheel of “normal” have been diminishing for decades, but everyone was too busy to notice. The superficial “return to normal” narrative focuses solely on first order effects: now that people can dispense with masks and social distancing, they are resuming their pre-pandemic spending orgy with a vengeance, which augurs great profits for Corporate America and higher tax revenues. Yea for “return to normal. “This...

Read More »(Not) Living Large on Social Security

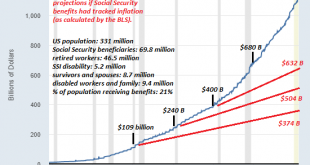

For about 1 in 4, Social Security provides at least 90 percent of their income. How many retired workers are getting less than $1,000 per month in Social Security benefits? The question came up and I was curious enough to find the answer, and download the data into an Excel spreadsheet which I saved as a PDF that you can review here. Note that this data is for the 46.5 million retired workers only, and does not include benefits paid to survivors, spouses,...

Read More »Increasingly Chaotic Volatility Ahead–The New Normal Few Think Possible

That the era of stability has ended and a new era of increasingly chaotic volatility has begun is not on anyone’s radar as a possibility. The standard debate about the future of the economy is: which will we get, high inflation or a deflationary collapse of defaults and asset bubbles popping? The debate goes round and round in widening circles of complexity as analysts delve into every nuance of the debate. A recent conversation with my friend A.T. raised a third...

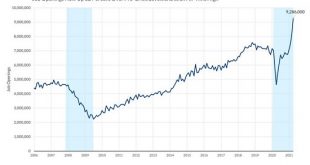

Read More »Systemic Risks Abound

If you wanted to design a system guaranteed to collapse in a putrid heap, you’d make moral hazard ubiquitous and you’d make the system 100% dependent on a hubris-soaked faux savior. For the past 22 years, every time the stock market whimpered, wheezed or whined, the Federal Reserve rushed to soothe the spoiled crybaby. There are two consequential results of the Fed as savior: 1. The Fed has perfected moral hazard: everyone from the money manager betting billions to...

Read More »FOMO Is Loco

We can also posit a general rule that those who inherit wealth and succumb to FOMO are eventually less wealthy while those who are wealthy and take a pass on FOMO / hoarding at the top of the manic frenzy increase their wealth.Judging by the panic buying of everything from homes to yachts to lumber futures, it seems the world has run out of everything except newly issued central bank trillions, and so the logical response is FOMO (fear of missing out) and hoarding:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org