The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 150,000 jobs in October, month over month. The unemployment rate rose slightly from 3.8 percent to 3.9 percent over the same period. The headline payroll increase of 150,000, however, was possibly among the best news to be found in today's new jobs data, however. Once we delve more deeply into the numbers, we find substantial evidence that the "strength" of the job situation is greatly overstated by the payroll numbers while employed persons, wages, and other measures point to trouble ahead in in economy already strained by growing bankruptcies, mounting debts, and disappearing savings. For example, more than one-third of all

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

The Bureau of Labor Statistic (BLS) released new jobs data on Friday. According to the report, seasonally adjusted total nonfarm jobs rose 150,000 jobs in October, month over month. The unemployment rate rose slightly from 3.8 percent to 3.9 percent over the same period.

The headline payroll increase of 150,000, however, was possibly among the best news to be found in today's new jobs data, however. Once we delve more deeply into the numbers, we find substantial evidence that the "strength" of the job situation is greatly overstated by the payroll numbers while employed persons, wages, and other measures point to trouble ahead in in economy already strained by growing bankruptcies, mounting debts, and disappearing savings.

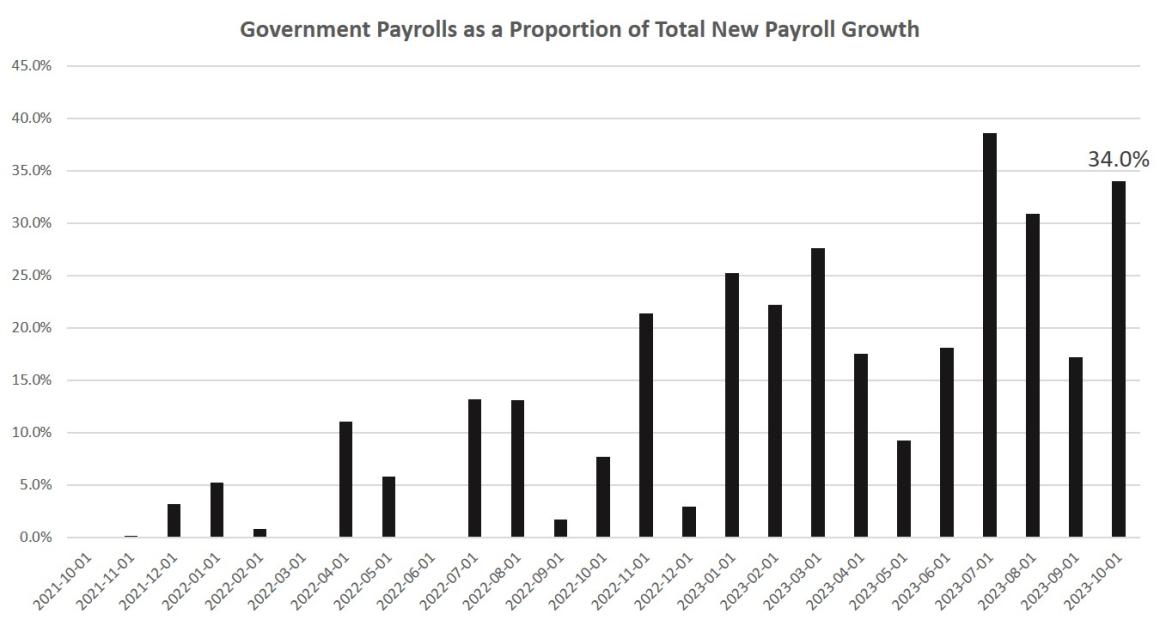

For example, more than one-third of all new employment growth in the payroll survey for October came in the form of government jobs. Specifically, out of the alleged 150,000 new jobs produced in October (month over month), 51,000 of them were government jobs. Looking at growth in new government jobs as a percentage of all new jobs, October's measure of 34 percent was the second-highest in more than a decade. Since 2010, only July of this year showed a higher proportion of government jobs as the driver of new job creation. Moreover, the trend over the past two years has been clearly upward:

In other words, over the past two years, the "good" jobs numbers have depended more and more on growth in government jobs to deliver those "blow out" jobs totals we've seen since over the past two years.

Where is the money coming from for all these government jobs? Tax revenues are falling, so a lot of that government employment must come from deficit spending. As Daniel Lacalle recently noted, the current claims of continued economic growth have been made possible my immense amounts of deficit spending. That is, without our ongoing trillion-dollar-plus deficits, economic growth measures would turn negative, since—as we've seen—as much as a third of new job creation would vanish. Or, as Lacalle puts it: "the country is in a recession disguised by bloated deficit spending."

Employed Persons vs. Total Jobs

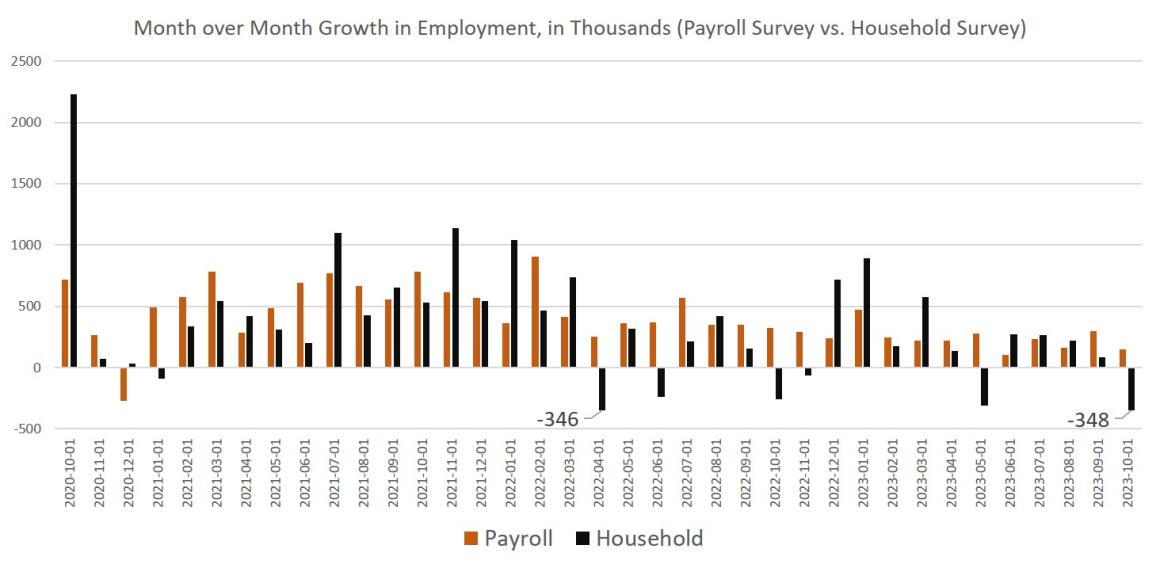

So far, we've only looked at the payroll survey, however. The payroll survey (i.e., the establishment survey)—which estimates total jobs, both part time and full time—shows actual job growth. The household survey, on the other hand, shows that the total number of employed persons actually fell by 348,000 in October, month over month. That's the largest month-over-month decline in employed persons since April 2020, in the midst of the Covid Panic:

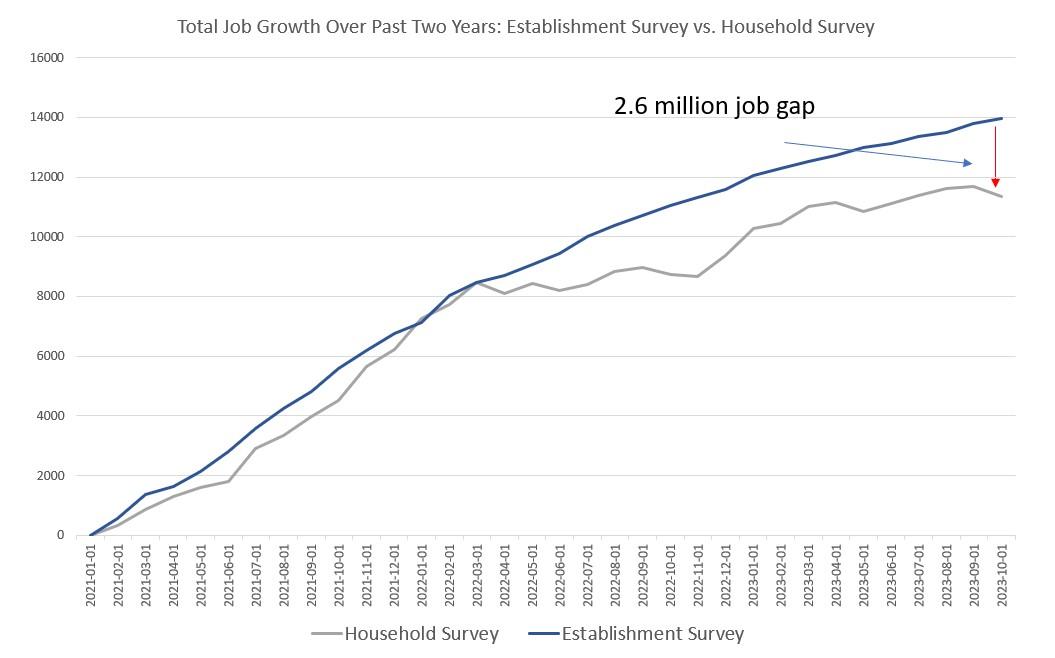

Moreover, the gap between the two surveys in estimated job growth has repeatedly grown larger since early 2022. Prior to that time, the two surveys tended to track together. This has not been the case in recent years, however, with the establishment survey claiming significantly more growth than the household survey. For October, this gap was at 2.6 million:

This gap also suggests that more workers are holding multiple jobs. Today's jobs data does indeed show that multiple job holders rose to a new high. Of course, multiple jobholding could be a sign of a boom, as was the case in 2007 and 2019. However, in an economy marked by entrenched price inflation, as is now the case, a rising number of multiple job holders may be a sign that more workers must work more hours to make ends meet. This latter scenario is plausible given that today's employment data also points to continued slowing in hourly earnings. Year over year, average hourly earnings in October were up 4.1 percent. That the most sluggish growth rate in 29 months.

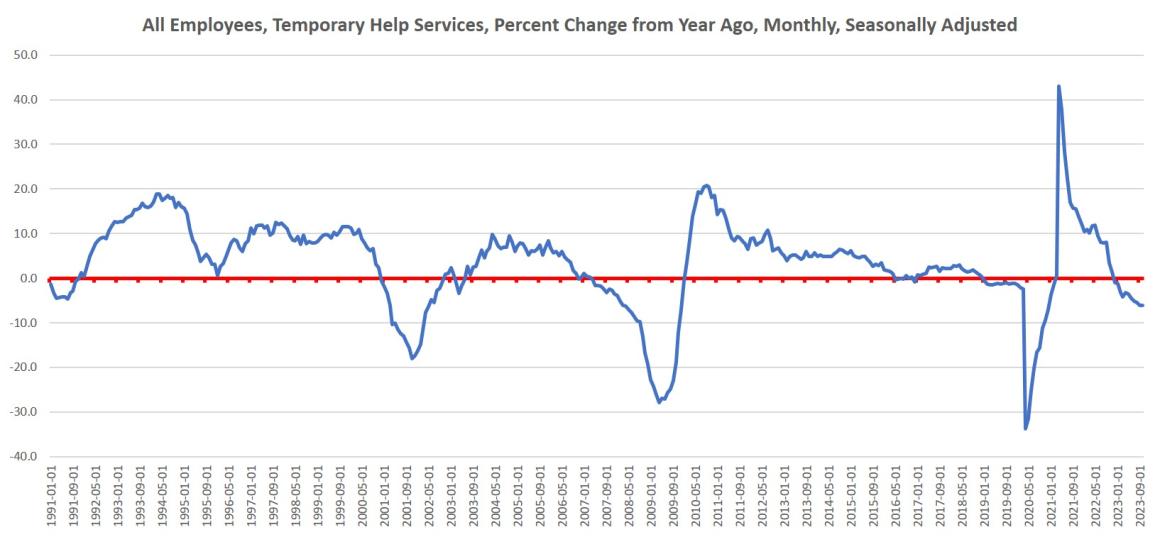

Another piece of bad news from today's job report is the fact that "temporary help services" went deeper into negative territory. Year over year, temporary help services were down 6.1 percent. That's the largest drop since the Covid Panic, and strongly suggests that recession is on the way. During the last four recessions, negative temporary job growth has preceded recessions, and year-over-year temp-job growth has now been negative for eleven months in a row:

Overall, however, employment tends to be a lagging indicator of where the economy is headed. Since the early 1970s, significant job losses tend to materialize only after a recession has already started.

We must look elsewhere to get some more reliable hints about what the future holds. Such measures include the yield curve, whish is currently negative and points to a brewing recession. The money supply—which is currently experiencing the largest declines since the Great Depression—also points to declining economic activity. Meanwhile, bankruptcies are rising, the saving rate is falling, and the leading economic index continues to drop.

The Experts Assure Us Everything Is Great

None of this prevents the corporate media from continuing to insist that the economy couldn't be much better than it is. Phrases like "there's no recession in sight" are a favorite phrase, and an article by Greg Ip at The Wall Street Journal this week carried the title "The Economy Is Great. Why Are Americans in Such a Rotten Mood?"

The Ip article continues a growing tradition of high-earning economists and reporters acting perplexed as to why anyone could think the economy isn't excellent. Paul Krugman, for example, recently declared the economy to be "surreally good."

Such analyses, of course, ignore numbers such as October's loss of 348,000 jobs and thoroughly lackluster wage growth. Moreover, there is little acknowledgement that consumers are acutely aware of the real-world effects of price inflation since the covid crisis. Shelter prices, for example, have increased 17 percent since 2021 while average earnings have increased by only 13 percent. In many markets, rising prices are far worse than this.

True believers in the consumer price index attempt to assure us that price inflation is now fully under control, and real wages are now headed upward. To find the good news in these claims, however, we'd have to forget that real wages went down for a full two years from 2021 to 2023, and that the CPI likely understates the true magnitude of rising prices. In any case, the fact that real wage may be positive this month for many people doesn't magically erase the pain that consumers enduring throughout 2021 and 2022. Even worse, as many saw their real wages fall, they exhausted their savings in the process.

Meanwhile, the Federal Reserve has painted itself into a corner, and it has to choose between continued economic weakness, or to unleash more price inflation on the economy. With 40-year highs in price inflation barely behind us (let's hope), inflation indicators remains double the Fed's arbitrary goal of two-percent inflation. The Fed has been forced to allow interest rates to rise in order to combat this ongoing price inflation, but rising interest rates will lead to more bankruptcies and the end of countless zombie companies that depend on ultra-low interest rates to stay afloat. Those business that don't fail will face higher debt costs and less access to capital as new business loans become more expensive. This all means layoffs and falling demand for workers.

Does the Fed have a plan to pull a rabbit out of hat and steer the economy into a soft landing? Of course not. It never has had a plan. After all, Fed economists were still claiming there was no recession as late as mid-2008, when the nation had been in recession for months. Fed forecasts are notoriously unreliable as they virtually always err on the side of promulgating sunny news about the economy.

Once the Fed decides to take action, however, its options are limited. Then, as now, the only tool in the Fed's tool box is to force down interest rates and flood the economy with new money at the first sign of trouble. Whether or not this happens at the first undeniable sign of a jobs recession will depend on whether the Fed—for political reasons—fears price inflation more than recession. Wall Street is betting that the Fed will return to dovish policy again soon in an attempt to counter bad employment news: markets ended up this week in response to the weak jobs numbers.

Tags: Featured,newsletter