When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure there’s really any win to be had for the Chinese people. Zero COVID has “worked” in the sense that it has limited the number of infections and deaths so far but it has also limited immunity since fewer have been infected. Opening up completely, even if they decide to import mass quantities of western

Topics:

Joseph Y. Calhoun considers the following as important: 10 year treasury yield, 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, Apple, bonds, China, commodities, Crude Oil, currencies, economy, Euro, Europe, Featured, Interest rates, Markets, newsletter, Real estate, REITs, Russia, stock market, stocks, Ukraine, US dollar, value stocks

This could be interesting, too:

investrends.ch writes US-Gericht: Google muss Chrome und Android nicht verkaufen

investrends.ch writes Apple: Zölle kosten schon 900 Millionen Dollar

investrends.ch writes EU: Apple und Meta müssen 700 Millionen Euro Strafe zahlen

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

When we think about the challenges facing an investor today, the big problems, the things we worry about that could cause a lot more harm than some interest rate hikes, are mostly outside the United States. China is prominent this weekend because of demonstrations against their zero COVID policies. The Chinese people appear to be pretty well fed up with the endless lockdowns and have finally decided to try and do something about it. Unfortunately, I’m not sure there’s really any win to be had for the Chinese people.

Zero COVID has “worked” in the sense that it has limited the number of infections and deaths so far but it has also limited immunity since fewer have been infected.

Opening up completely, even if they decide to import mass quantities of western vaccines, likely means a lot of infections and deaths. Their healthcare system would, unlike in most developed countries, be overwhelmed. I think we forget sometimes how poor and undeveloped most of China actually is.

There are some obvious implications for the rest of the world if China continues its rolling lockdowns. Supply chains for many US and European multinationals are dependent on Chinese production. Shutdowns in Zhengzhou mean no iPhones for consumers. Unless China opens up, we could have a return of the supply chain issues that so many have blamed for the current bout of global inflation (which is ridiculous and not inflation by the way). It may seem a bit petty to worry about iPhone supply considering the conditions the Chinese people have been laboring under, but investors often have to be cold blooded that way.

Apple, to continue that example, has been moving production out of China but estimates are that it would take a decade or more to significantly reduce Apple’s reliance on China. There are, no doubt, many other western companies facing similar problems. What I think is less often considered is that China is as reliant on Apple as Apple is on China. Their response to the demonstrations about zero COVID are limited by that fact. If they react too strongly, they risk further alienating every western country manufacturing in China. If they do nothing, they risk a full scale uprising. They will have to do something to quell the demonstrations and get people back to work. I’m not sure how they’ll do that but do it they must. The limited reaction in US markets so far seem to indicate that investors believe Xi will find a way.

The other big international problem is, obviously, the Ukraine/Russia conflict. The impact from that has mostly fallen on Europe in the form of higher energy prices but the US has been impacted too. Exporting LNG to Europe to close their energy supply gap has pushed up prices domestically. There were also costs for US companies who pulled out of Russia wholesale and there will be ongoing costs in shortages of some natural resources from both Ukraine and Russia. But the direct impact on the US has been and probably will continue to be more political than economic.

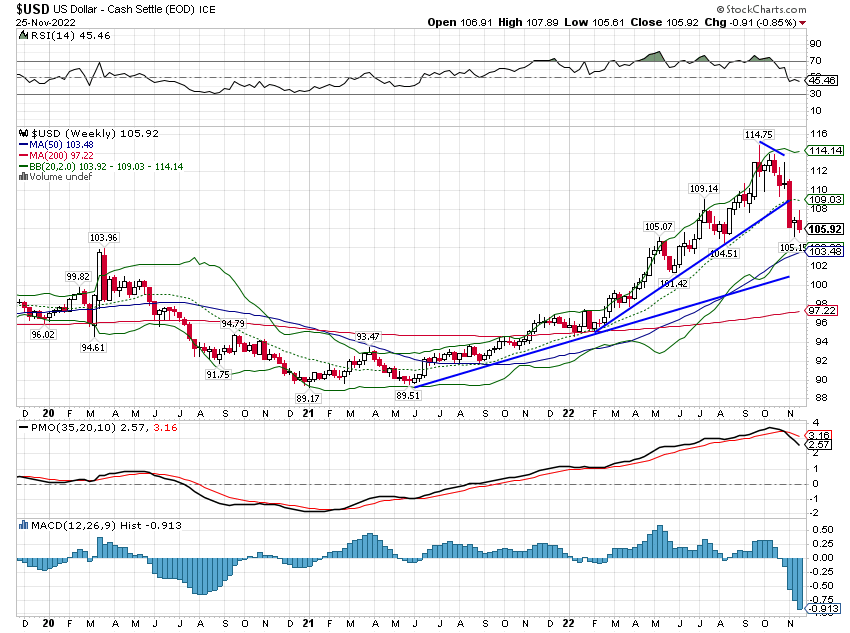

These external problems, along with an aggressive Federal Reserve, have pushed up the value of the dollar this year. And in truth, the rise in the dollar really started in 2021 when a consensus developed that the best place to invest in a post COVID world was right here in the US of A. The emergence of the Ukraine war and its impact on energy prices and the plethora of potential issues in China (real estate implosion, zero COVID policies, response to aggressive US tech policies and the ever simmering issue of Taiwan) merely reinforced the narrative that the US was the safe haven, the most insulated from the world’s problems.

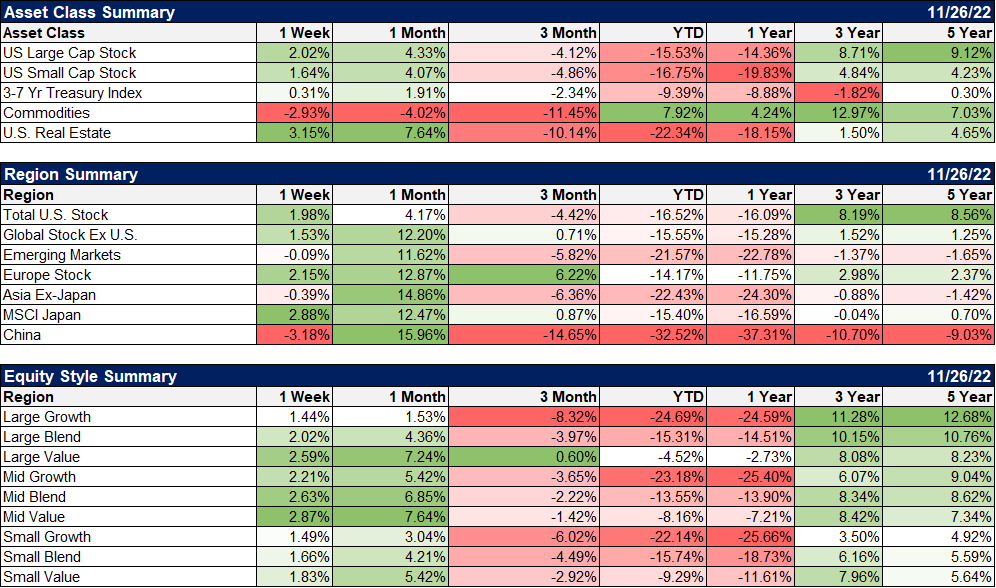

That narrative has proven to be largely true since the onset of COVID if measured by stock market performance. In dollar terms the S&P 500 has outperformed the EAFE international stock index 30.6% to 6.9% since February 1, 2020. What is interesting though is that over the last year it is EAFE that has outperformed even in the face of a strong dollar. Over the last 12 months EAFE is down 9.94% and the S&P 500 is down 11.0%. Not exactly what you would expect is it?

Considering that Russia’s invasion of Ukraine only started in February and that the impact on Europe’s energy supply has been so dramatic, one would expect that European stocks would be doing terribly in comparison to the US. But that is not the case. The Eurozone stock ETF (EZU) has underperformed the S&P 500 but only by 1.7% (-16.04% to -14.31%). Germany has underperformed by the most (-20.6%) but France, Spain and Italy have outperformed by a pretty good margin (-11.5%, -5.5% and -13.01% respectively. The UK isn’t really Europe anymore but I’m sure you’ve heard how terrible things are there. And yet, the UK ETF is down a mere 4.3% this year.

When we look at some of these countries in their home currencies they look even better. In Euros, the German DAX is down only 8.5%, the French CAC40 -6.2%, Spain’s IBEX -3.4%. In Pounds, the FTSE 100 is up 1.4% ytd. There are other countries whose stock markets have also beaten the US in their home currencies. The Nikkei is down just 1.8% YTD, Canada down 4%, Australia down 4.3%, Singapore up 3.9%, Brazil up 4% (and the Real is up against the dollar this year), Mexico up 4.3% (and the Peso is up against the dollar too), Indonesia up 8.7% and finally Chile up 22%.

Some of this outperformance has been obscured by the rise of the dollar but with the dollar now in a short term (for now) downtrend, investors need to pay attention to what is actually going on rather than just relying on the simple narratives one hears about the rest of the world. Europe has been negatively impacted by the Ukraine war, no doubt. But what I hear from my contacts there is that they know they have to change their energy policies and they are getting on with it. They don’t really see much impact on everyday life – at least not yet – other than the rise in their home energy bills. But the scare stories you’ve been hearing about Europe are just that – stories.

Home country bias is real and especially for US investors. A big part of that bias is built on the US dollar’s global dominance. We see everything through the prism of a US dollar that dominates world trade and provides us with enormous advantages. Over the last 10 years the S&P 500 is up 245%. In dollars none of the other markets I mentioned above have even cracked triple digits, the closest being France at 96.7%. And a big part of that is the dollar, up over 50% during that time and adding directly to the bottom line of US based investors.

Whether the recent outperformance of non-US shares continues likely depends on the dollar. If its recent drop is merely a correction in an ongoing uptrend then the US will remain the place to be. But if the dollar has peaked, international markets are likely to continue to outperform, in dollars as well as Euros or Yen or Pesos. The US stock market, as a whole, is still not cheap but non-US markets are. Europe trades for 1.3 times book value and less than 1 times sales. Japanese stocks are 1.1 times book and 0.9 times sales. EM ex-China is 1.5 times book and 1.1 times sales. And that’s after they’ve rallied off their lows.

Non-US stocks are cheap and they are performing well this year even with the strong dollar. Imagine what they could do if the dollar really does pull back substantially.

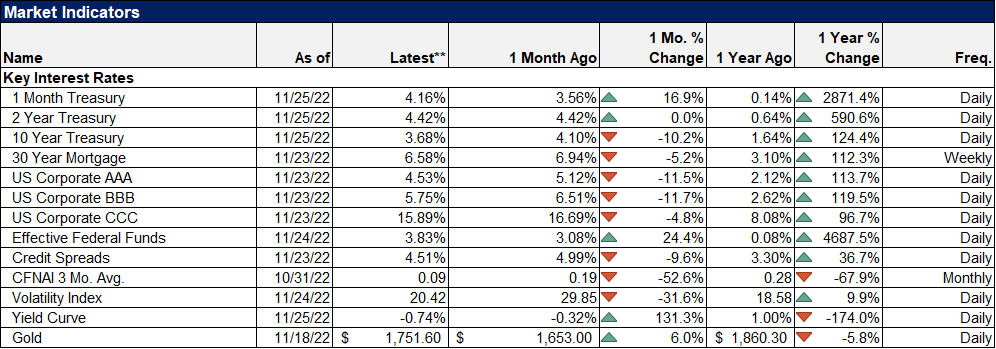

EnvironmentThe 10 year rate and the dollar were both down on the week; the rebound I expected just didn’t happen (yet). That does not appear to be due to US economic weakness as the data for the week was actually pretty good. It more likely represents relative change as Europe’s outlook continues to improve somewhat. German PPI was down 4.2% in October as natural gas prices dropped while GDP for Q3 was positive (0.4% quarterly, 1.3% YOY) and the IFO Business Survey’s Climate and Expectations continued their improvement in November. |

|

| For all that Europe has suffered this year, it is probably surprising to the entire world that Germany hasn’t reported a negative quarter to quarter GDP change since Q1 2021.

Maybe it isn’t so surprising that European stocks are outperforming US stocks this year and over the last 12 months. The dollar, as I said last week, is now in a short term downtrend. At around 106, the buck has support at 103 and appears to be headed for the intermediate term uptrend line at around 102. To break the long term uptrend that dates back to 2011 would ultimately require a drop to less than 92/93, a move that would likely take quite a while. We are really more interested in the intermediate term trend so a drop under that 102 area would get us very interested in ramping up weak dollar investments. We’re not there yet but the move down has been pretty rapid so far. It should be noted too that the dollar could still rally to 110 or even a little higher and still be in a short term downtrend. I suspect the immediate future is going to be very choppy. Large speculators continue to trim their long dollar positions by the way. Most of the flow seems to be going to the Euro but the A$ and C$ are also seeing reductions in shorts. Maybe the most surprising currencies this year – although they aren’t really impacting the DXY – are the Mexican Peso and the Brazilian Real, both up on the year against the mighty dollar. Latin America is looking more and more interesting. |

|

| The 10 year Treasury yield closed the week down about 13 basis points (3.69%) with support still a bit lower around 3.5%. I continue to believe though that this move down in rates is not signaling recession (yet) and that rates are likely to rebound, if not to new highs.

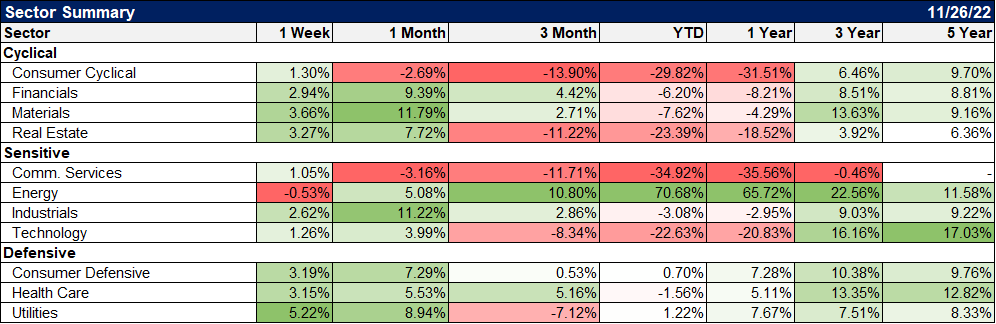

The key indicator here is the 2 year note yield which has fallen much less than the 10 year. If the market perceives that recession is imminent, it won’t matter what the fed wants to do, the 2 year yield will drop rapidly and steepen the yield curve. We aren’t there yet. I do think short rates are peaking as shorts to continue to cover in the Eurodollar market. The Eurodollar curve is pointing to a peak in rates around 5.25% in late spring/early summer next year which would likely put any recession somewhere beyond that. But, as I’ve said many times, that is subject to rapid change; it is just snapshot. Personally, I don’t think rates will get that high but we’ll get a bumper crop of economic data next week that may clear things up. MarketsStocks and bonds were higher last week while commodities once again fell with crude oil. The drop in crude, by the way, isn’t what the economic bears want it to be. As I pointed out last week the drop in WTI crude is more likely about pipeline maintenance than a drop in demand. While WTI is in a slight contango – which we normally associate with reduced near term demand – Brent crude remains in solid backwardation. We’ve seen this type of contango develop before due to pipeline capacity issues (2015) so it isn’t anything new. The reduced pipeline capacity can also be seen in the Brent/WTI spread which has more than doubled from $3.54 to $8.70 since October 26th. Again, pretty typical for this type of issue and also seen in 2015 when the spread widened to $11. |

|

| Real estate had another good week with the fall in rates and I expect that to continue even if rates start to creep back up. Earnings in the real estate sector are up nearly 20% year over year, second only to energy which you might note has performed a tad better. REIT distributions are also rising so the yield effect will be muted if rates rise again.

Value resumed its outperformance last week and I think the trend has more to go. We are going to need to see better earnings growth if the trend is to continue but based on some of the industrials earnings that may not be much of a worry. Financials are the largest allocation in S&P 500 value and have not performed well earnings wise but that has been more than offset by double digit gains (triple in the case of energy) in real estate, energy and healthcare. S&P 500 value (IVE, Alhambra owns) is now down just 4.5% YTD and 2.7% year over year. The Select Dividend index ETF (DVY, Alhambra owns), another version of value, is up 4.7% YTD and 9.6% year over year. (Alhambra and its clients own IVE, DVY and SDY.) International value also continues to outperform with the EAFE Value ETF (EFV) down just 5.8% YTD and 1.4% year over year. And yes, Alhambra owns that one too. We do own some underperformers too, most prominently Japan where the drop in the Yen has hurt a lot more than the Euro has hurt European performance. The Nikkei is down just 1.8% this year but the yen is down 17%. Fortunately, our Japan position is much smaller than our value bets at just 2.7% of the typical moderate risk portfolio. It still hurts but we’ve owned Japan for most of the last decade and have no intention of ending that now; Japan is still a lot cheaper than most of the rest of the world. International stocks performed well last week too with Europe and Japan both beating the S&P 500. Both are also beating the US YTD and Europe is outperforming year over year. That doesn’t fit the narrative of the US being the best place to invest but markets are speaking a different language than the pundits. |

|

| Stocks are quite overbought in the short term and I expect some kind of pullback but if inflation and rates have peaked as I think they have, another big downleg seems unlikely. Of course, a bad recession might change that, but for now the market isn’t predicting that outcome. Rates are expected to peak at 5.25% in the middle of next year and come back down some based on the Eurodollar curve but only to around 4% by June 2024. That would be a very mild recession or none at all if it comes true.

Economically sensitive and interest sensitive issues led last week while energy finally fell some with crude oil. Maybe we’ll finally get a decent correction in energy stocks we can buy. Tech also continues to struggle although I’m beginning to see some bargains in that space. Credit spreads narrowed again last week to now just 4.5%; there is no stress in credit markets. Mortgage rates are also coming down and the housing market actually produced some mildly positive news last week. Mortgage rates are still elevated relative to the 10 year Treasury though and would be about 1% lower if that normalized. If rates have peaked, housing has probably seen its worst. |

A lot of you are no doubt aware of the money illusion concept introduced by Irving Fisher in the 1920s. All it says is that people tend to think in nominal rather than real, inflation adjusted, terms. I don’t find that controversial at all because I think of inflation in terms of currency and most people have no idea what’s going on in forex markets. The alternative, to believe that people understand inflation and currencies and act rationally, sounds nice but is refuted by mounds of evidence to the contrary.

When we are talking about global investing, currency illusion better describes the effect. If we only see other markets in dollar terms we may miss important information. The fact that the German stock market is only down 8.5% in Euro terms tells you something, that maybe the harm from the Ukraine war isn’t as bad as we perceive it to be from here. What about gold? Is it up or down this year? That depends on your perspective. If you view it in terms of the Euro it is up; in the dollar it is down. Crude oil? Up just 1.4% in dollars but 10% in Euros.

Don’t be fooled by the currency illusion. And don’t let home country bias prevent you from seeing good investments wherever they are.

Joe Calhoun

Tags: 10 year treasury yield,Alhambra Portfolios,Alhambra Research,Apple,Bonds,China,commodities,Crude Oil,currencies,economy,Euro,Europe,Featured,Interest rates,Markets,newsletter,Real Estate,REITs,Russia,stock market,stocks,Ukraine,US dollar,value stocks