The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the Qualitative and Quantitative Easing (QQE). There is nearly universal agreement that the FOMC will hikes rates at Powell’s first meeting. This is being taken for granted. The failure to raise interest rates would be significantly more disruptive than a hike at this juncture. Indeed,

Topics:

Marc Chandler considers the following as important: Bank of England, ECB, EUR, Featured, FOMC, FX Trends, GBP, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the Qualitative and Quantitative Easing (QQE).

There is nearly universal agreement that the FOMC will hikes rates at Powell’s first meeting. This is being taken for granted. The failure to raise interest rates would be significantly more disruptive than a hike at this juncture. Indeed, the focus is not so much on the rate hike, but the forward guidance provided by the FOMC statement and the Fed’s forecasts (dot plot).

The FOMC statement is thought to be largely crafted by the Fed chair. We locate Powell well within the recent tradition of the Fed and would be surprised with any significant innovation with the statement. We suspect the statement will look past the recent string of economic data that has prompted downward revisions to Q1 GDP estimates below 2%, including the Atlanta Fed’s GDPNow tracker.

The confidence Powell expressed in his recent testimony before Congress and the claim that what were headwinds have become tailwinds is unlikely to be undermined by some high frequency data, like the disappointing retail sales report and the lack of progress on the core PCE deflator. Consumer confidence, the March Fed surveys, with the impact of the tax cuts and government spending increase still in the pipeline, suggest that, for whatever reason, the post-crisis pattern of soft Q1 data may repeating itself.

The main interest of investors is in the forecasts for the Fed funds target this year. There had been speculation that the Fed would signal that four rate hikes are likely this year, or three after this one. Several investment banks have done so, but we do not expect a fourth hike will be indicated in the week ahead. By hiking rates at his first meeting, Powell would brandish his “hawkish bias.” To also indicate a fourth hike would be overkill.

A criticism levied against the Federal Reserve is that is has overpromised and under-delivered. The market has been skeptical of the pace of Fed tightening. Last year, Fed officials led the market by the nose through strong word cues of its intent to hike rates in March and again in June. We noted that it took Powell’s testimony to convince many investors of the three hikes suggested by the December dot plot.

United StatesDespite the forecast of a few private sector economists, the market is not clamoring for a fourth rate hike. Supply concerns appear to account for the backing up in US interest rates this year. Arguably, the flattening of the US yield curve plays on fears that Fed tightening will once again proceed an economic downturn. The University of Michigan’s Consumer Sentiment survey (preliminary for March) showed a jump in the one-year inflation forecast while the longer-term (5-10 years) was stable. Tactically, there is no need to signal a fourth hike at this juncture. That hike would not come until later this year. Hence there is no sense of urgency and policymakers are often loath to make a decision until they must. The prudent thing to do is to wait for more data to clarify the strength of the economy and the trajectory of prices. There is little to gain in terms of the Fed’s or Powell’s anti-inflation credentials by indicating a fourth hike now. There is risk that due to no fault of its own, like August 2015 when market volatility seemed to steady the Fed’s hand and deterred the hike that many expected in September to December, a fourth hike may not be delivered. The operative issue is how much the Chair influences the forecasts of the regional presidents. The Fed was designed so that the Board of Governors has a majority in the rate decisions, but presently there are only three governors. We suspect that the median dot may edge higher than in December, as some doves (e.g. Brainard) recognize the likelihood of three hikes. However, we do not expect it to signal a fourth hike. |

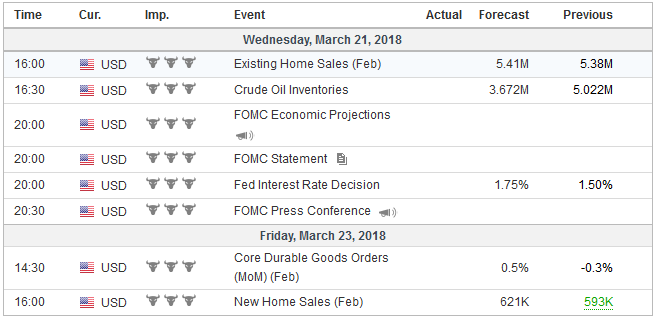

Economic Events: United States, Week March 19 |

EurozoneIt is not just the US economy that appears to have lost some momentum since the end of last year. Survey data and some real sector data suggest the eurozone economy also has lost some momentum, and last week February CPI was revised town. The flash March PMI for the eurozone will be reported. It is expected to continue to soften, though it remains at elevated levels. This coupled with the downward revision to the February CPI has seen market sentiment shift toward a slower change o the ECB’s guidance. Draghi’s recent comment reiterated the importance of patience and perseverance. He does not sound like a man on the verge of changing the current guidance. ECB President Draghi has indicated that the most significant risks are exogenous to the eurozone. This assessment has some merit given Brexit and potential US defection from the multilateral trading system it was instrumental in building. However, it is incomplete, or does not seem to give sufficient due to internal risks, like an Italian crisis, and premature tightening of financial conditions, which would include a substantial (relative to ECB purchases) repayment of TLTRO funds beginning in Q2. |

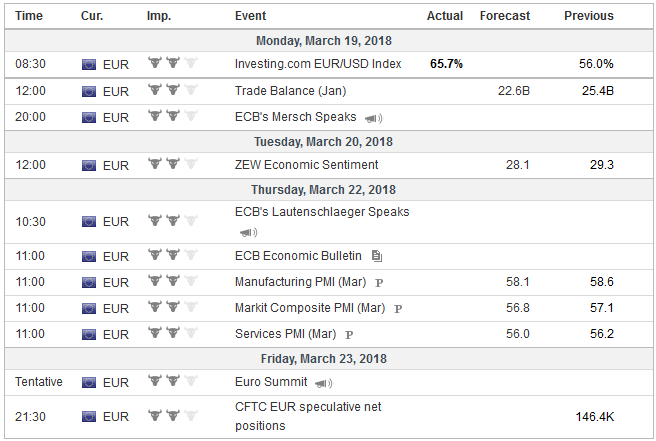

Economic Events: Eurozone, Week March 19 |

United KingdomThe Bank of England also meets in the week ahead, but the decision to stand pat will likely be unanimous. A dissent would strengthen ideas of hike in Q2. The market is pricing in about little more than a two-thirds chances of a hike in May, and the odds have drifted higher over the past couple of weeks. While Carney is unlikely to dissuade the investors from such expectations, the tightening that the central bank seems determined to provide is taking place as the economy is slowing. The economy peaked (year-over-year GDP) in 2014 a little above 3%. The market expects 1.5% growth this year. Price pressures appear to have peaked last year, and the February CPI, which will be reported before the BOE meeting, is expected to ease to 2.8% from 3.0%. Prices are proving to be stickier than many thought, after the past depreciation of sterling dropped out of the year-over-year comparisons. Employment and earnings data will also be reported before the BOE meeting. The UK is widely understood to be near full employment. Average monthly earnings (3-months year-over-year) rose at 2.5% pace throughout Q4. The median forecast calls for a 2.6% increase in January (data is reported with an extra month lag), which would be the highest since November 2016, which itself was the highest since September 2015. The higher nominal wages are not fueling consumption. February retail sales, which will be reported a few hours before the BOE’s decision next week, are trending lower. They are expected to have risen by 1.2% in the year through February (excluding petrol). Retail sales averaged 2.1% last year and was 3.5% last February. The logic may be that driving down inflation will boost the purchasing power of households. The increased demand will offset the impact higher rates. We are suspicious. Due the prevalence of variable rate mortgages, higher interest rates feed through the households relatively quickly. Pro-cyclical monetary policy may aggravate the slowdown. This could be a big week for Brexit. The EC is to decide if sufficient progress has been made on the transition period that the next and last chapter—the new relationship—can be addressed. We remained concerned that it might not be the macro issues that may prove the thorniest, but rather two issues that the UK government may not have under-estimated, the Irish border and Scotland and Wales reluctance to agree to the Withdraw Bill on grounds that it would erode their local autonomy. Sterling may respond according to the EC’s decision, with a delay being negative. However, even if negotiations go forward, by the time they are launched, there will be less than a year to do what would seem to normally take a couple of years. Looking further out, a poor showing for the Tories in the local elections (May) could spur a leadership challenge, which could disrupt negotiations. |

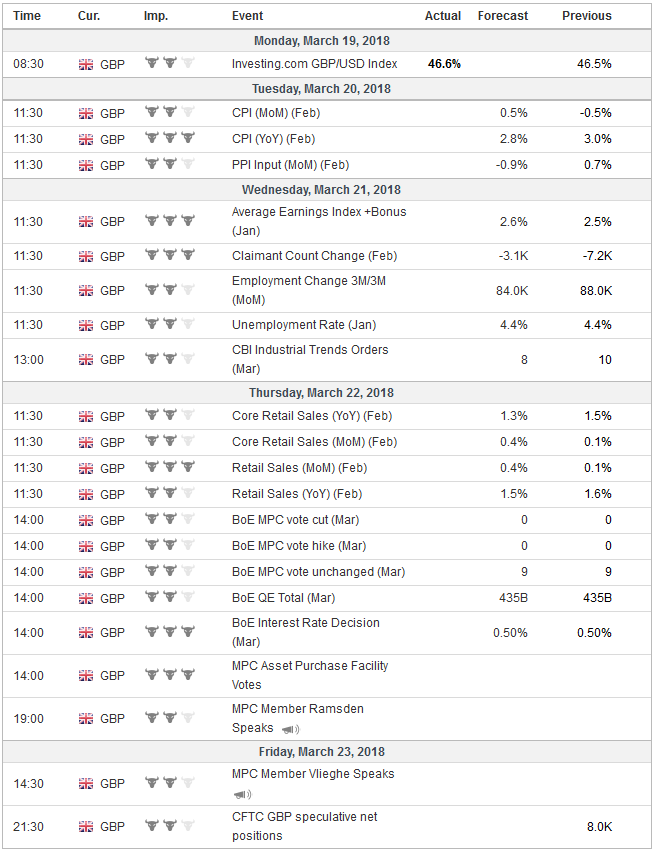

Economic Events: United Kingdom, Week March 19 |

Switzerland |

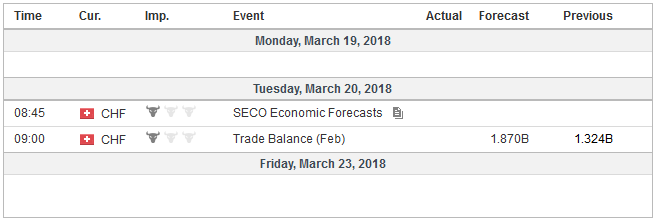

Economic Events: Switzerland, Week March 19 |

Tags: #GBP,#USD,$EUR,Bank of England,ECB,Featured,FOMC,newsletter,U.K.