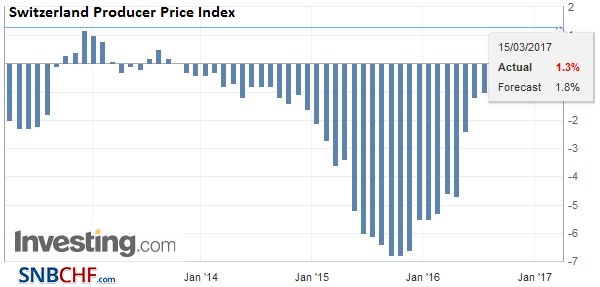

Swiss Franc Switzerland Producer Price Index (PPI) YoY, February 2017(see more posts on Switzerland Producer Price Index, ) Source: Investing.com - Click to enlarge GBP/CHF Today is crucial for Swiss Franc exchange rates with a number of economic releases and political events happening around the world which are likely to have a direct bearing on the direction of the Swiss Franc. The US Federal Reserve interest rate decision is released this evening where it is a near certainty that there will be an interest rate hike from 0.75% to 1%. Another two increases are expected later this year. The Swiss Franc is likely to be impacted by this decision as in my view there is likely to be a return of funds to the US dollar following the higher yield and away from Switzerland. Any reaction however is likely to be muted considering the markets should have completely priced in this event. Tomorrow is also key with the Swiss National Bank interest rate decision. No change is expected but the central bank has been known historically to throw up some surprises and also may be concerned with the strength of the Franc. The Dutch elections being held today could also see a movement away from the Euro and into the safety of the Swiss Franc.

Topics:

Marc Chandler considers the following as important: Brexit, Featured, Federal Reserve, FX Trends, GBP, Netherlands, newslettersent, U.K. Average Earnings Index, U.S. Core Consumer Price Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

Switzerland Producer Price Index (PPI) YoY, February 2017(see more posts on Switzerland Producer Price Index, ) Source: Investing.com - Click to enlarge |

GBP/CHFToday is crucial for Swiss Franc exchange rates with a number of economic releases and political events happening around the world which are likely to have a direct bearing on the direction of the Swiss Franc. The US Federal Reserve interest rate decision is released this evening where it is a near certainty that there will be an interest rate hike from 0.75% to 1%. Another two increases are expected later this year. The Swiss Franc is likely to be impacted by this decision as in my view there is likely to be a return of funds to the US dollar following the higher yield and away from Switzerland. Any reaction however is likely to be muted considering the markets should have completely priced in this event. Tomorrow is also key with the Swiss National Bank interest rate decision. No change is expected but the central bank has been known historically to throw up some surprises and also may be concerned with the strength of the Franc. The Dutch elections being held today could also see a movement away from the Euro and into the safety of the Swiss Franc. Should Geert Wilders party perform better than expected then the Swiss Franc could strengthen materially. Any further cracks in the EU will undoubtedly see the Euro weaken so CHF EUR could see some good gains. As far as GBP CHF is concerned political events in the UK particularly surrounding SNP Nicola Sturgeon’s call for a second referendum which will be voted on in the Scottish parliament next week will continue to be the main driving force here. Already polls this morning suggest that there isn’t the appetite for a second Scottish independence referendum so it will be interesting to see how politician vote on Wednesday. |

GBP/CHF - British Pound Swiss Franc, March 15(see more posts on GBP/CHF, ) |

FX TrendsThe US dollar is paring yesterday’s gains as the market awaits the outcome of the well-telegraphed FOMC meeting. In recent weeks, the combination of data and official comments have swayed market, which had previously anticipated a hike in May or June. A hike today is as nearly a foregone conclusion as these things can get. The idea of not wanting to surprise the market, which some Fed officials underscored, works both ways. It means market expectations are primed. It also means that when there is a nearly 100% chance discounted, not to deliver would also be a destabilizing surprise. Investors will quickly look past a 25 bp hike. Indeed, the market will be looking for clues on the timing of the next one. There are two elements here. One is the dot plot. We expected the median and average to creep up, and suspect many may be underestimating the hawkishness of the regional presidents. The other element is the assessment of the balance of risks. Despite the prospect of slower Q1 growth (which is also consistent with the pattern since the financial crisis), the risks may be tilted higher going forward. |

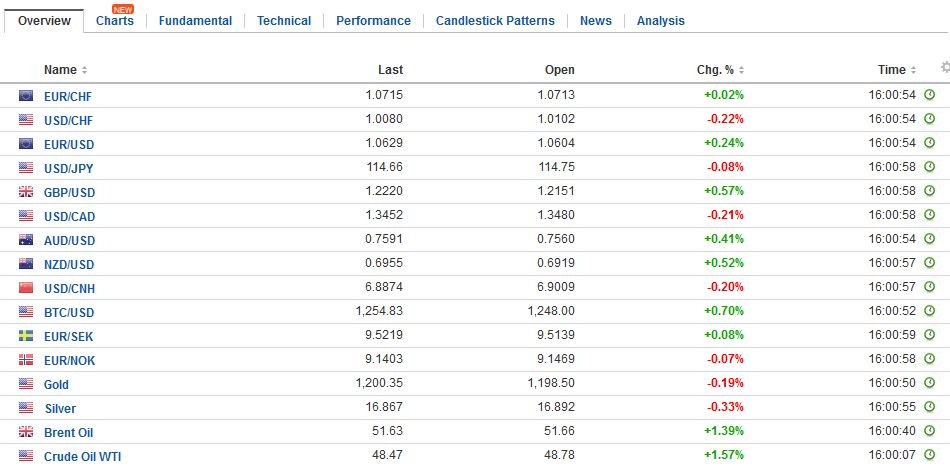

FX Daily Rates, March 15 |

| A Wall Street Journal survey found almost 70% of responding economist expect the next hike in June and 8.5% say July. A fifth expected the Fed to wait until September. Based on the current information set, we are inclined toward June. It is partly based on the understanding that gradual hikes rule out back-to-back meeting moves now. Our view is also informed by indications that the Fed’s leadership has grown more confident of the resilience of the US economy and is no longer looking for confirmation. Instead, we think the Fed has shifted to looking for opportunities to normalize policy. Also, expectation assumes European politics will not be significantly disruptive to the markets (which means no populist-nationalist victories).

Today’s Dutch election is the first test of this last point. Recent polls suggest the populist-nationalist PVV has waned in recent weeks. The Dutch themselves, and by and large, the investment community has never been particularly worried about the outcome. It is recognized that Wilders does express a current among the Dutch electorate, but it is not growing. The fragmented and decentralized nature of Dutch politics puts a premium on coalition building which serves to temper extreme views. Many investors have been more worried about next month’s French presidential elections. In a turn of events, all three leading candidates have legal problems. Le Pen and Fillon’s legal issues have been around for weeks, while Macron’s problems came to light yesterday, involving a contract awarded without an open bidding process when he was the Economic Minister. Meanwhile, sterling has recovered from yesterday’s spike to almost $1.21. Royal assent for Brexit is expected tomorrow, and that will leave triggering Article 50 in Prime Minister May’s hands. What kind of UK will leave? This was a factor that weighed on sterling yesterday. Scotland wants another crack at independence, and Northern Ireland voted to remain, and the unification of Ireland has been broached with Sinn Fein seeking a referendum as soon as practical. Leaving aside the polls conducted by Scottish companies, the others, like YouGov/Times shows that outcome of a referendum has not changed much. Spain has made it clear; it would not allow Scotland to join the EU. It wants to give its own independent-minded regions no incentives. Hence, Sturgeon’s interest in the EFTA instead. |

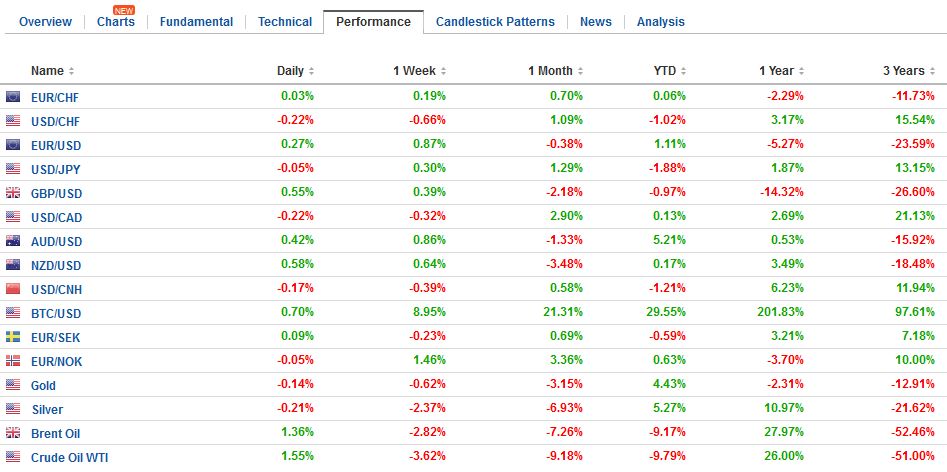

FX Performance, March 15 |

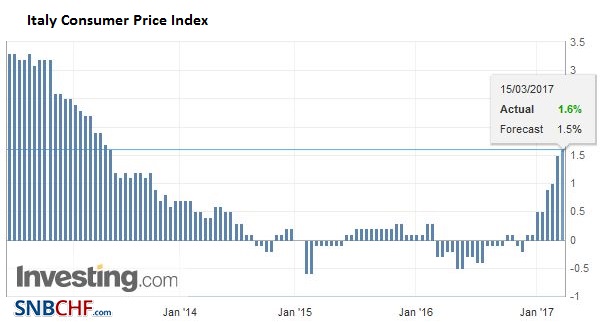

ItalyMay has signaled that she will not attend the EU summit to celebrate the 60th anniversary of the Treaty of Rome on March 25. Instead, within a day or two of it (March 27?) she is expected to formally trigger Article 50. Once that takes place, the UK’s initiative is lost and it passes to the EU, including on when to begin the negotiations. Some press reports suggested formal talks might not begin until June. |

Italy Consumer Price Index (CPI) YoY, February 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

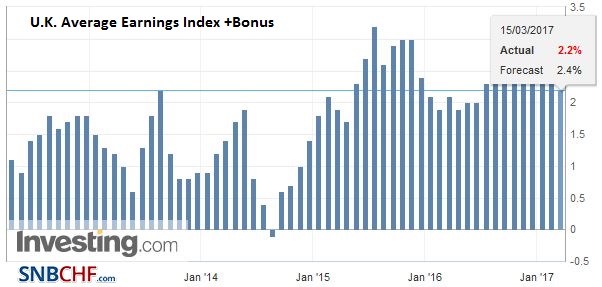

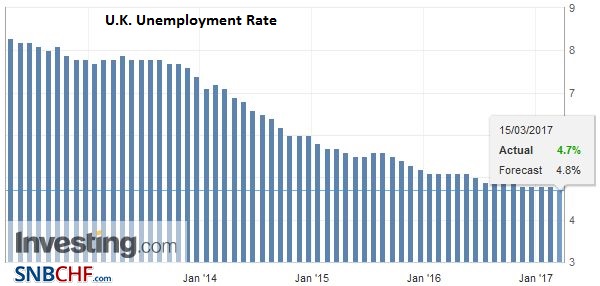

United KingdomSterling retreated today after the labor report showed a steeper slowing of wage growth than had been anticipated even though the claimant count fell (-11.3k in February after a 41.4k decline in January) and the unemployment rate slipped to 4.7% (in three months through January), which is the lowest since 1975. Average weekly earnings (three months, year-over-year through January) slowed to 2.2% from 2.6%. The Bloomberg median forecast was for 2.4% increase. It is the weakest wage growth since last April. The shadow MPC at the UK Times seems out of step. Three favor a hike tomorrow, and another three think the next meeting. A Reuters poll results don’t see a hike until 2019. Look for a unanimous decision tomorrow from the BOE’s MPC to keep rates steady. The BOJ and SNB also meet tomorrow and are expected to keep policy on steady. |

U.K. Average Earnings Index +Bonus, February 2017(see more posts on U.K. Average Earnings Index, ) Source: Investing.com - Click to enlarge |

| The suspension of the US debt ceiling in October 2015 expires today. It is already having an impact on the T-bill market, where yields are elevated. In the past, fiscal concessions are sought in exchange for lifting the cap. It is not clear how this will play out this time. There are numerous measures the Treasury Department can and will take to avoid disruptions. This can extend for several months. Meanwhile, the spending authorization may be more pressing as it reaches its limit next month. Also, as early as tomorrow President Trump is expected to unveil the first outlook for the FY18 budget. |

U.K. Unemployment Rate, February 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

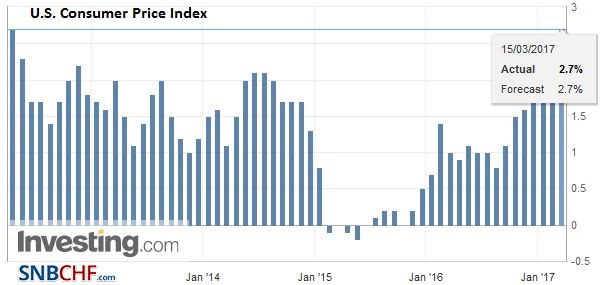

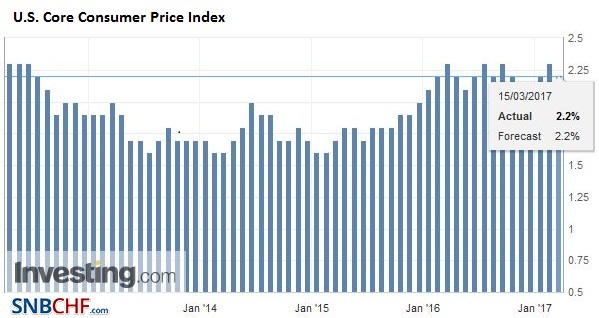

United StatesThe North American session also features US CPI (core expected 2.2% from 2.3% in January. The US also reports retail sales. |

U.S. Consumer Price Index (CPI) YoY, February 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The risk seems to be on the downside after the 0.4% rise in February at the headline and core (GDP components). |

U.S. Core Consumer Price Index (CPI) YoY, February 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

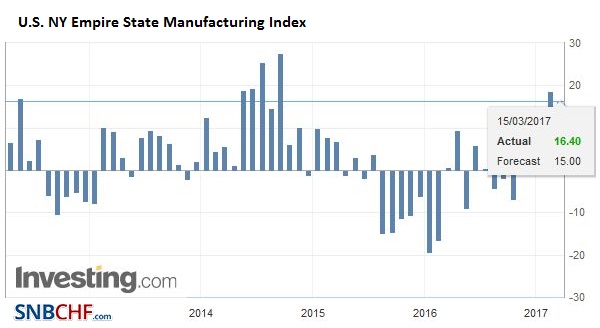

| The Empire State manufacturing survey for March (one of first March readings) may soften from 18.7 in February. |

U.S. NY Empire State Manufacturing Index, February 2017(see more posts on U.S. NY Empire State Manufacturing Index, ) Source: Investing.com - Click to enlarge |

China

Lastly, the other development worth highlighting here is the strong rally in iron ore and steel. In China, iron ore prices rose 5.2% today after 4.3% yesterday. Steel reinforcement bar rose 1.3% to the highest in nearly four years. It has risen 27% this year already. Recent Chinese data showed that steel output rose 6% in the January-February period year-over-year. Oil prices are also recovering today after the April light sweet futures contract approached $47 a barrel yesterday. API reported an unexpected drawn down. The EIA data will be reported in the US morning.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,Brexit,Featured,Federal Reserve,Netherlands,newslettersent,U.K. Average Earnings Index,U.S. Core Consumer Price Index