Swiss Franc EUR/CHF - Euro Swiss Franc, March 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland. It is also not clear precisely when May will formally invoke Article 50. Some expect Parliament to be told tomorrow during the Prime Minister question time in the House of Commons. Others suspect May might wait until later this month for the EU Summit to celebrate its 60th anniversary, to formally begin the two-year amputation negotiations. In any event, there is little uncertainty that Article 50 will be invoked before the end of the month. Sterling has taken it on the chin. Its two-day rally, the first, since February 20-21 has ended with an exclamation point. Sterling haws been sold through the shelf it had carved last week in the .2135 area to record its lowest level in nearly two months. It found support in the European morning ahead of .2100.

Topics:

Marc Chandler considers the following as important: Brexit, China Fixed Asset Investment, China Industrial Production, China Retail Sales, EUR, Eurozone Industrial Production, Featured, FX Trends, GBP, Germany Consumer Price Index, Germany ZEW Economic Sentiment, India, JPY, newsletter, Spain Consumer Price Index, U.S. Producer Price Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 14(see more posts on EUR/CHF, ) |

FX RatesUK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland. It is also not clear precisely when May will formally invoke Article 50. Some expect Parliament to be told tomorrow during the Prime Minister question time in the House of Commons. Others suspect May might wait until later this month for the EU Summit to celebrate its 60th anniversary, to formally begin the two-year amputation negotiations. In any event, there is little uncertainty that Article 50 will be invoked before the end of the month. Sterling has taken it on the chin. Its two-day rally, the first, since February 20-21 has ended with an exclamation point. Sterling haws been sold through the shelf it had carved last week in the $1.2135 area to record its lowest level in nearly two months. It found support in the European morning ahead of $1.2100. We have been targeting the trend line off last October’s flash crash low and the mid-January low. It is found today near $1.2055. |

FX Daily Rates, March 14 |

| For its part, the euro is trading firmly against sterling, but it has been unable to rise above the two-day cap near GBP0.8785. The intraday technicals warn that if the euro is going to go through the GBP0.8800, it needs a running start, which means lower levels first. A pullback toward GBP0.8730 should not be surprising.

Against the dollar, the euro has shed a little more of its recent upticks. There is potential toward $1.0595-$1.0620. Initial resistance is now pegged in the $1.06660 area. Meanwhile, the US10-year yields holding around 2.60%, the dollar is again probing the JPY115.00 level. In the past two months, despite several pushes, the greenback has only been able to close above this cap once since January 11. Immediate support is pegged near JPY114.80. |

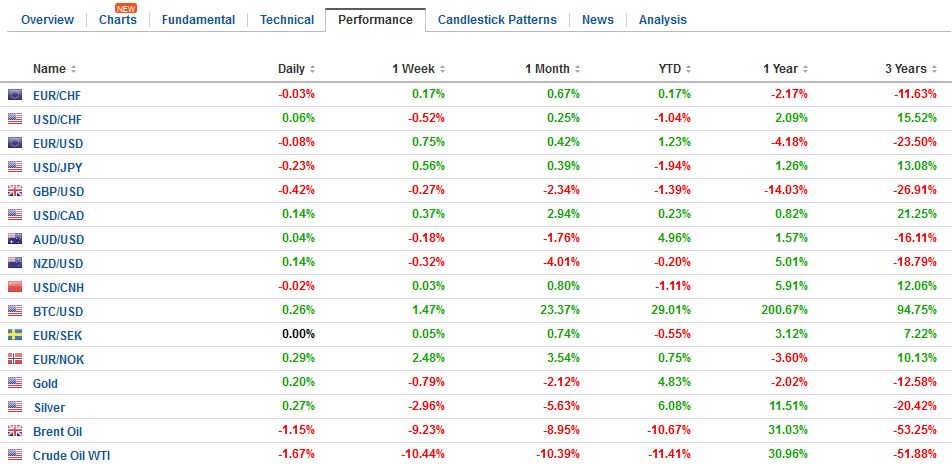

FX Performance, March 14 |

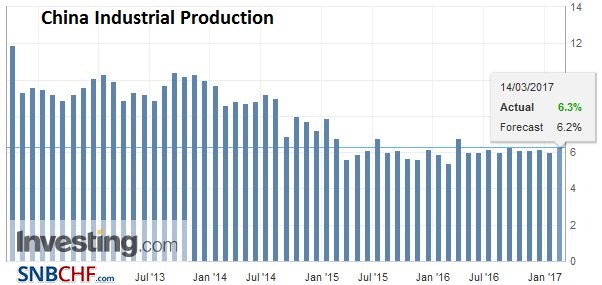

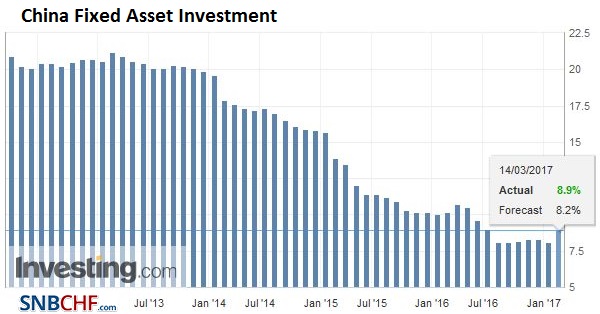

ChinaThe main economic news today comes from China. The general thrust of the data is constructive and suggest that the world’s second-largest economy is off to a firm start. Due to the Lunar New Year distortions, China reports January-February data combined. Industrial output rose 6.3% year-over-year. This was a little better sequentially and slightly above expectations. Fixed investment rose 8.9%, which is also an improvement from the last report and above expectations. |

China Industrial Production YoY, February 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

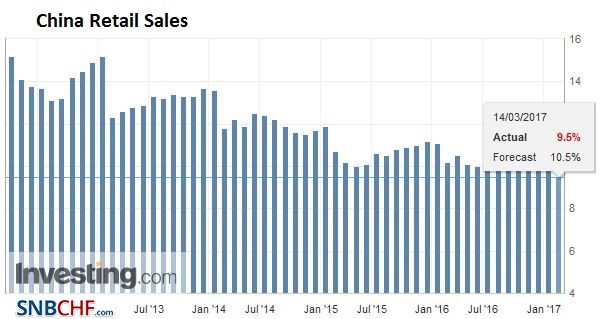

| To the extent, there was the disappointment it came from retail sales. The 9.5% increase is the first sub-10% reading since 2003. The incredible year-over-year growth in retail sales has been slowing gradually for several years. Recall the 12-month average year-over-year rate peaked in 2008 near 21.4%. It is now at 10.2%. |

China Retail Sales YoY, February 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

| News of the BJP’s overwhelming victory in Uttar Pradesh (312 seats out of 403, up from 47 seats five years ago), lifted Indian equities, with the Nifty 50 Index reaching new record highs. The rupee rallied to about 0.65% to reach an 11-month high. Excluding Japan, the MSCI Asia Pacific Index rose 0.25%, its third successive gain and the sixth of the past seven sessions. Japan’s stocks edged lower, snapping a three-day advance. |

China Fixed Asset Investment YoY, February 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

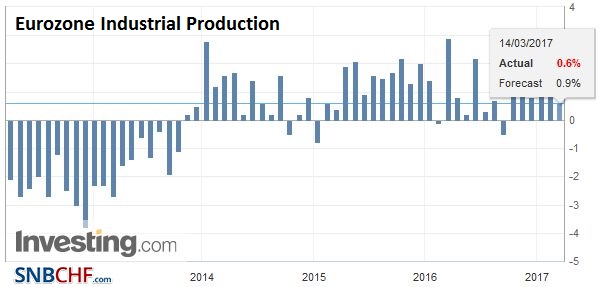

EurozoneEuropean shares are mostly heavier, with the Dow Jones Stoxx 600 off 0.25% in late morning turnover. It remains within yesterday’s ranges. Most sectors are lower but consumer staples, health care, and utilities. With the weakness of sterling lending support, the FTSE 100 is holding onto minor gains. |

Eurozone Industrial Production YoY, February 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

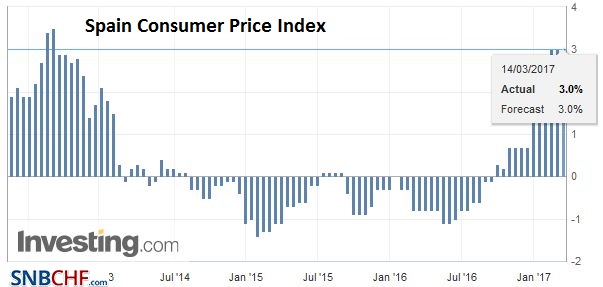

Spain |

Spain Consumer Price Index (CPI) YoY, February 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

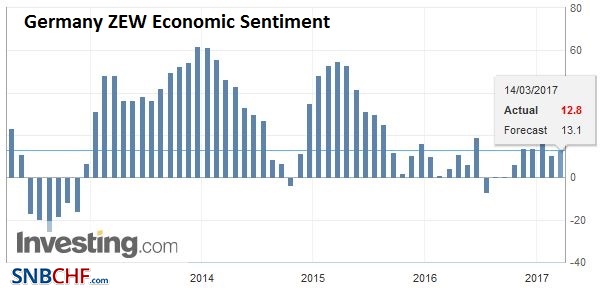

GermanyThe German ZEW investor survey showed improvement over February, but not as much as the median survey response expected. The assessment of the current situation rose to 77.3 from 76.4 (median Bloomberg guesstimate was 78.0). Expectations rose to 12.8 from 10.4 (median was 13.0). There was little market reaction. |

Germany ZEW Economic Sentiment February 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

| UK lawmakers were scathing in criticism of BOE Deputy Governor Hogg. At the heart of the issue was a failure to disclose that her brother works for a UK bank. Hogg was put in charge of markets and banking at the start of March. |

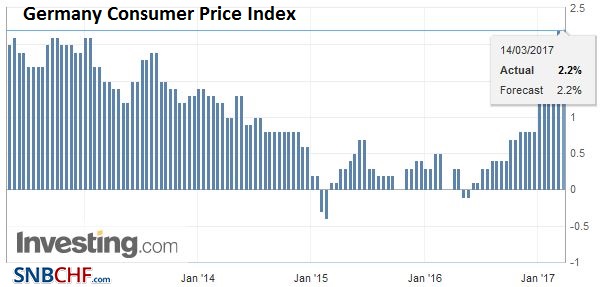

Germany Consumer Price Index (CPI) YoY, February 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

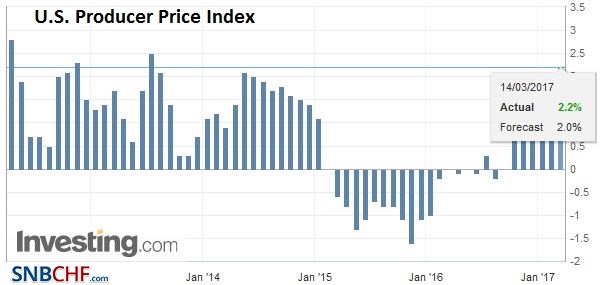

United StatesThe North American session may be hobbled by the winter storm in the Northeast. The economic data features PPI ahead of tomorrow’s CPI and retail sales. The FOMC’s two-day meeting gets underway today. Nearly everyone expects a 25 bp hike in the Fed funds target range tomorrow (to 0.7%-1.0%). The key point of interest is the forward guidance and the prospects for another hike at the end of Q2. The CBO scoring of the Republican health care plan was released late yesterday. This will be much discussed today. On the one hand, the CBO is not infallible, and its earlier forecasts of the Affordable Care Act (“Obamacare”) was not particularly accurate regarding participation. On the other hand, it projects that 14 mln more will be uninsured next year (rising to 24 mln by 2026). The CBO reckons it will reduce the deficit by $337 bln over ten years ($935 bln from lower savings, with a $599 bln offset from lower taxes). |

U.S. Producer Price Index (PPI) YoY February 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,Brexit,China Fixed Asset Investment,China Industrial Production,China Retail Sales,Eurozone Industrial Production,Featured,Germany Consumer Price Index,Germany ZEW Economic Sentiment,India,newsletter,Spain Consumer Price Index,U.S. Producer Price Index