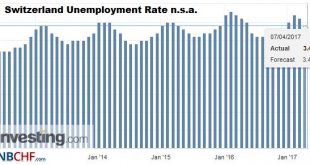

Unemployment Rate (not seasonally adjusted) Registered unemployment in March 2017 – According to the State Secretariat for Economic Affairs (SECO) surveys, 152,280 unemployed persons were registered at the regional employment services centers (RAV) at the end of March 2017, 7,529 less than in the previous month. The unemployment rate thus fell from 3.6% in February 2017 to 3.4% in the reporting month. Switzerland...

Read More »Swiss mountaineer aims for new Everest record

Swiss mountaineer Ueli Steck is training for a new record: Climbing Mount Everest, descending via the South Col and re-ascending the Lhotse...all without supplemental oxygen. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »Goats’ milk is booming

Products made from goats' milk are enjoying growing popularity in Switzerland. For farmers, producing this niche product is becoming increasingly worthwhile. Dairy companies such as Emmi have more than doubled their production. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch...

Read More »Motocraft Mark O’Byrne talks Kit and bike prep

More O'Byrne gives us a very experienced over view of what kit and bike equipment to bring.

Read More »Some UN consultants thought their income was tax free. They were wrong.

Photo: Phillip Judd Some United Nations consultants haven’t paid taxes on their income, thinking it was exempt. When the tax authorities catch up with them they’ll risk paying back taxes and fines. As a general rule, foreign UN functionaries are not required to pay local taxes on their income. On the other hand UN consultants must. Over the weekend, Swiss broadcaster RTS, explain the details of a system misunderstood by...

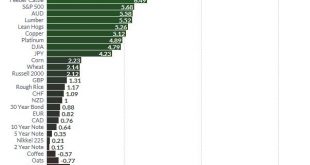

Read More »Gold, Silver Best Performing Assets In Q1, 2017

– Gold, silver two of the best performing assets in the first quarter of 2017 with gains of 8% and 14% respectively – Gold outperforms benchmarks – S&P 500 up 6%, MSCI (All Country World Index) up 6.4% (see tables) – Nasdaq and German DAX rise 11.8% and 7.6% – Silver best performing currency in quarter – Five best performing currencies in Q1 are in order – silver, bitcoin, Mexican peso, Russian ruble and gold –...

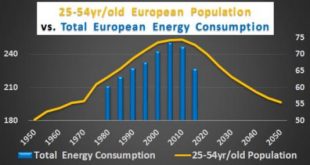

Read More »Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

Authored by Chris Hamilton via Econimica, The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives...

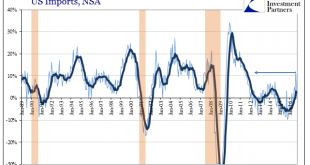

Read More »February US Trade Disappoints

The oversized base effects of oil prices could not in February 2017 push up overall US imports. The United States purchased, according to the Census Bureau, 71% more crude oil from global markets this February than in February 2016. In raw dollar terms, it was an increase of $7.3 billion year-over-year. Total imports, however, only gained $8.4 billion, meaning that nearly all the improvement was due to nothing more...

Read More »Swiss Consumer Price Index in March 2017: Up +0.6 percent against 2016, +0.2 percent last month

The consumer price index (IPC) increased by 0.2% in March 2017 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.6% compared with the same month the previous year. These are the results of the Federal Statistical Office (FSO). Switzerland Consumer Price Index (CPI) YoY, March 2017(see more posts on Switzerland Consumer Price Index, ) Source: investing.com - Click to...

Read More »A fifth of Swiss can’t cope with an unexpected expense of 2,500 francs

In 2015, 21.7% of Switzerland’s population was unable to cover an unexpected expense of CHF 2,500 within a month, says a report from the Swiss Federal Statistics Office. ©-Alex-Hinds-Dreamstime.com_ - Click to enlarge Single parent families were the least able to cope with 46.1% of them falling into this camp. Single parent families were followed by single people under 65 (27.1%) and two-parent families (24.0%)....

Read More » SNB & CHF

SNB & CHF