Swiss Franc EUR/CHF - Euro Swiss Franc, March 16(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF Sterling vs the Swiss Franc has fallen again as the US Federal Reserve have raised interest rates last night. This has seen the Pound fall against most major currencies and the safe haven status of the Swiss Franc has once again helped to improve CHF/GBP rates We now also have the news of the Dutch election where current Prime Minister Mark Rutte has defeated the right-winged Geert Wilders. The news for Europe has been taken positively so all European currencies including the Swiss Franc have strengthened against the Pound. The Pound is also continuing to remain under pressure as it has not yet been made clear as to when Article 50 will be triggered. Brexit secretary David Davis has confirmed that it will happen by the end of the month but as yet no official date has been announced. The Pound is at its lowest level to buy Swiss Francs since January and I think we could see further losses ahead as even when Article 50 has been triggered this will in effect bring about 2 years of uncertain negotiations ahead and one thing is for sure is that currency does not like uncertainty.

Topics:

Marc Chandler considers the following as important: AUD, CAD, China, Featured, FX Trends, GBP, Netherlands, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 16(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge |

GBP/CHFSterling vs the Swiss Franc has fallen again as the US Federal Reserve have raised interest rates last night. This has seen the Pound fall against most major currencies and the safe haven status of the Swiss Franc has once again helped to improve CHF/GBP rates We now also have the news of the Dutch election where current Prime Minister Mark Rutte has defeated the right-winged Geert Wilders. The news for Europe has been taken positively so all European currencies including the Swiss Franc have strengthened against the Pound. The Pound is also continuing to remain under pressure as it has not yet been made clear as to when Article 50 will be triggered. Brexit secretary David Davis has confirmed that it will happen by the end of the month but as yet no official date has been announced. The Pound is at its lowest level to buy Swiss Francs since January and I think we could see further losses ahead as even when Article 50 has been triggered this will in effect bring about 2 years of uncertain negotiations ahead and one thing is for sure is that currency does not like uncertainty. With the Bank of England due to meet at midday and the subsequent press conference to come it will be interesting to see what Bank of England governor Mark Carney has to say for himself. If he mentions any negative comments about the Brexit effect I think we could see GBPCHF exchange rates fall further so if you’re thinking about buying Swiss Francs at the moment it may be worth organising something in the near future. |

GBP/CHF - British Pound Swiss Franc, March 16(see more posts on GBP/CHF, ) |

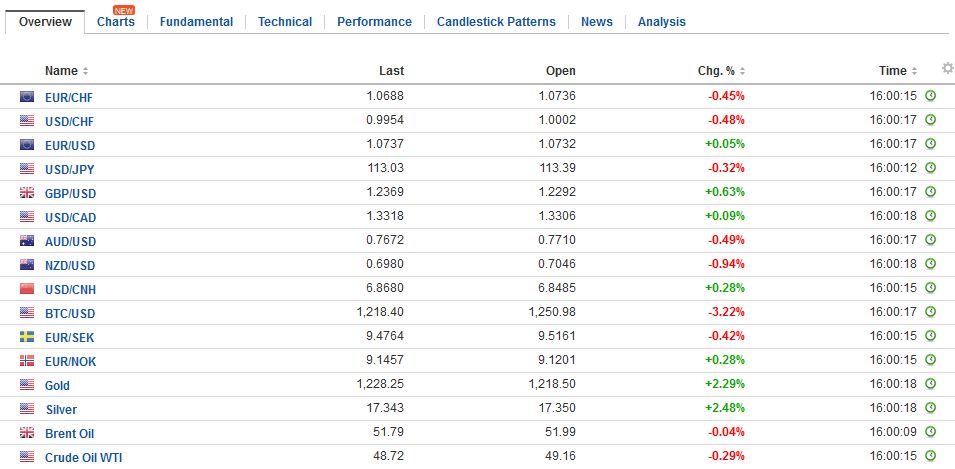

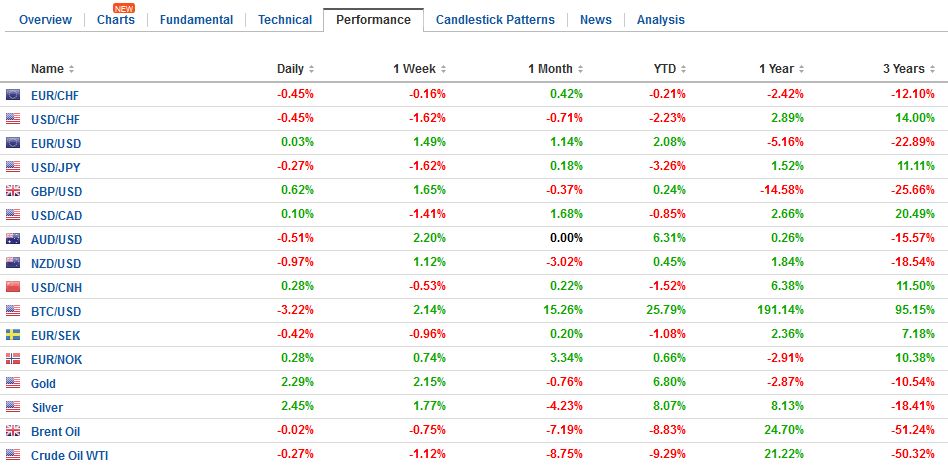

FX RatesThe US dollar remained under pressure in Asia following the disappointment that the FOMC did not signal a more aggressive stance, even though its delivered the nearly universally expected 25 bp rate hike. News that the populist-nationalist Freedom Party did worse than expected in the Dutch elections also helped underpin the euro, which rose to nearly $1.0750 from a low close to $1.06 yesterday. European activity has seen the dollar recover a little, but the tone still seems fragile, even though US interest rates have stabilized and the 10-year Treasury yield is back above the 2.50% level. The US premium over Germany on two-year money peaked a week ago near 2.23. After the US yield fell in response to the Fed’s move, the spread finished near 2.12%, from which it has not moved far. Initial euro support has been found a little above $1.07. The first retracement target of the run-up is a little below there at $1.0690. The other retracement targets are seen near $1.0675 and $1.0655. Few expected the Wilders in the Netherlands to have a say in the next Dutch government. He drew about 13% of the vote and will hold about 20 seats, which is five more than currently. Prime Minister Rutte’s party appears to have received the most votes and 33 seats, down from 41. The other coalition partners did worse. In particular, the disastrous showing of Labor means that Dijsselbloem, the current finance minister and head of the Eurogroup of finance ministers is unlikely to hold his post. Labor may have less than 10 seats in the new parliament, down from 38. The other coalition partner, Liberals, lost eight seats. |

FX Daily Rates, March 16 |

| The new parliament will sit in a week and negotiations for a new government will begin. It will take some time. The last election (2012) toook 54 days to sort out, while in 1977 in took more than 200 day to form a new government.

The Fed hike and Dutch election were not very surprising. The surprise of the day was China. The PBOC announced a 10 bp increase in its medium lending facility loans and open market operation repos. Its statement did try to temper the surprise by noting that these increases were not the same as an increase in the benchmark rates. This seems to suggest that the increase in rates is unlikely to be passed on to households or business. Three other central banks have met today, and as expected, did not change policy. The Bank of Japan, the Swiss National Bank and Norway’s Norges Bank stood pat. The focus shifts to the Bank of England. It too is widely expected to maintain its neutral stance. |

FX Performance, March 16 |

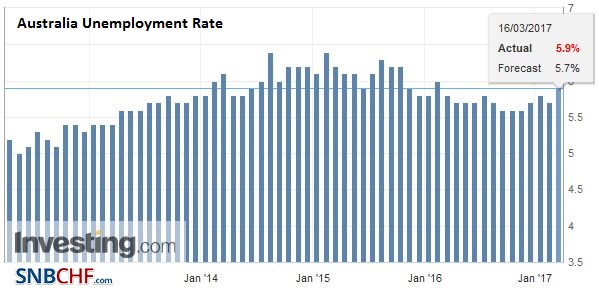

AustraliaThe Australian and New Zealand dollars are under some pressure independent of the US dollar. Both reported poor data. Austral reported a 6.4k drop in employment. The Bloomberg survey’s median forecast was for a 16k increase after 13.5k in January. The unemployment rate ticked up to 5.9% from 5.7%, while the participation rate was unchanged at 64.6%. One positive aspect of the report was the mix of full and part-time jobs. Full-time positions increased by 27.1k after a 44.1k decline previously, while there were 33.5k less part-time jobs after a 57.5k surge in January. New Zealand reported Q4 GDP expanded by 0.4% not the 0.7% expected and Q3 growth was revised to 0.8% from 1.1%. This puts the year-over-year rate at 2.7% down from a revised 3.3% (was 3.5%) in Q3. The Australian dollar pushed back from the nearly $0.7720 high seen in the US to a little below $0.7680 in Asia. However, it has been better supported in the European morning, perhaps helped by the reports of a large foreign acquisition in the energy space. The drop in US yields weighed on the dollar against the yen. It fell from the upper end of its two-month range toward the middle of it. It was near JPY114.50 before the Fed announcement and was pushed a little through JPY113 in early European activity. It managed to recover to around JPY113.50 before stalling, seemingly awaiting fresh cues from the US session. |

Australia Unemployment Rate, February 2017(see more posts on Australia Unemployment Rate, ) Source: Investing.com - Click to enlarge |

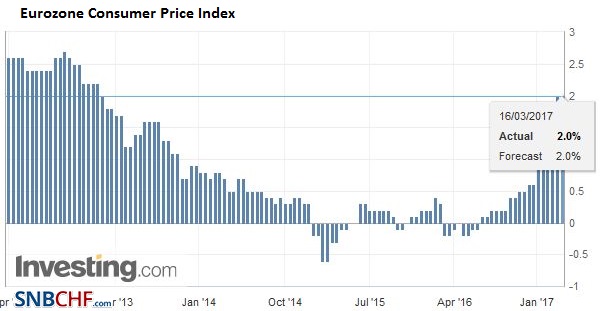

EurozoneRisk appetites like the confluence of political and economic developments. European peripheral bonds are firmer, while core bonds are mostly heavier. MSCI Emerging Market equity index is extending its rally into a sixth consecutive session and the nearly 2% gain thus far today is the most since last July. The MSCI Asia-Pacific Index rose nearly 1.5%, for a five-day streak. European markets are following suit. The Dow Jones Stoxx 600 is up 0.6%, after a gap higher opening. It is the second advance in a row, and six of the past seven sessions. Materials are up the most, followed by energy and financials. Iron ore prices edged higher to bring this week’s rise to 11%. Rebar steel eased after yesterday’s rally lifted it its highest closing level since December 2013. Oil prices are up about 1%, helped by the first decline in US inventories this year and the heavier dollar tone. |

Eurozone Consumer Price Index (CPI) YoY, February 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

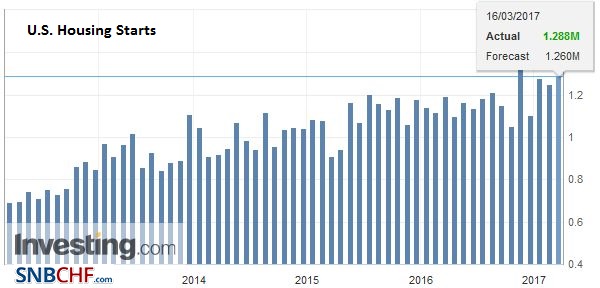

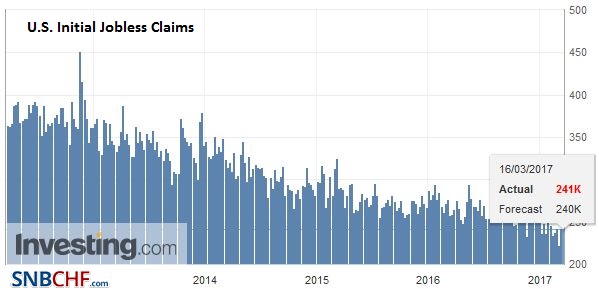

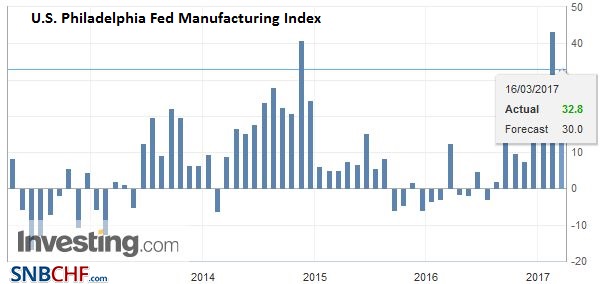

United StatesThe US session features February housing starts and permits, weekly jobless claims JOLTS and the March Philadelphia Fed. Given the Fed’s move, we suspect the market will not be particularly sensitive to the data. Attention may shift to fiscal policy where President Trump has provided an outline for the budget for the remainder of the year. It looks to increase defense and security spending (and a little for education) and cutting other programs, some like the State Department and Environment Protection Agency deeply. The opposition from the Republican Party appears to be based more in the Senate than the House. |

U.S. Housing Starts, February 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

U.S. Initial Jobless Claims, February 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

|

U.S. Philadelphia Fed Manufacturing Index, February 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$TLT,China,Featured,Netherlands,newsletter