Summary:

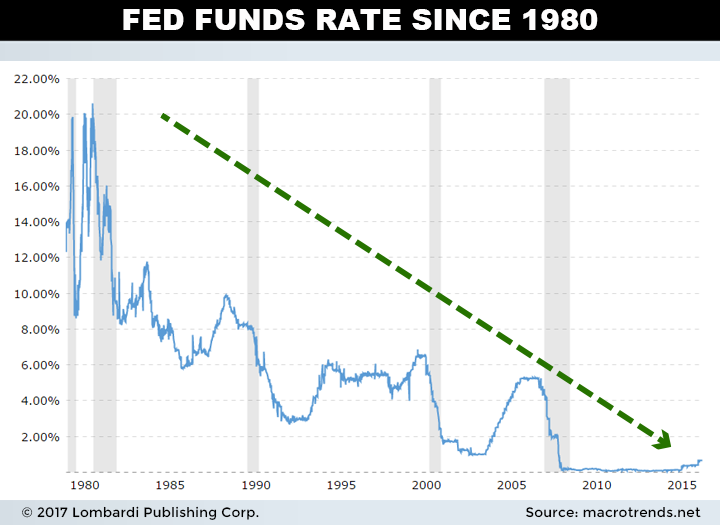

Summary: Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle. The average and median dot for Fed funds crept slightly higher. There was only one dissent to the decision. The Federal Reserve delivered the much-anticipated rate hike. There was one dissent, the Minneapolis Fed President Kashkari. In the first paragraph of the FOMC statement tweaked the assessment of business fixed investment, saying that it appears to have “firmed somewhat,” while in February it characterized it as having “remained soft.” The statement also recognized that inflation is moving closer to the Fed’s target. In the second paragraph, the Fed retained its risk assessment, which is roughly balanced. The Fed reiterated its commitment to gradual increased (though previously it said the approach was “only gradual.” The statement also inserted a new phrase regarding its monitoring of inflation developments: “about is symmetric inflation goal.” This seems to reiterate its anti-inflation commitment and leans against those interpretations suggesting the Fed is willing to let the economy run hot. Otherwise, the statement, allowing for the rate hike, was little changed. Of the 17 Fed officials, nine now look for three hikes this year. In December only six did.

Topics:

Marc Chandler considers the following as important: Featured, Federal Reserve, FX Trends, Interest rates, newsletter

This could be interesting, too:

Summary: Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle. The average and median dot for Fed funds crept slightly higher. There was only one dissent to the decision. The Federal Reserve delivered the much-anticipated rate hike. There was one dissent, the Minneapolis Fed President Kashkari. In the first paragraph of the FOMC statement tweaked the assessment of business fixed investment, saying that it appears to have “firmed somewhat,” while in February it characterized it as having “remained soft.” The statement also recognized that inflation is moving closer to the Fed’s target. In the second paragraph, the Fed retained its risk assessment, which is roughly balanced. The Fed reiterated its commitment to gradual increased (though previously it said the approach was “only gradual.” The statement also inserted a new phrase regarding its monitoring of inflation developments: “about is symmetric inflation goal.” This seems to reiterate its anti-inflation commitment and leans against those interpretations suggesting the Fed is willing to let the economy run hot. Otherwise, the statement, allowing for the rate hike, was little changed. Of the 17 Fed officials, nine now look for three hikes this year. In December only six did.

Topics:

Marc Chandler considers the following as important: Featured, Federal Reserve, FX Trends, Interest rates, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Fed made mostly minor changes in the statement as it hiked the Fed funds rate for the third time in the cycle.

The average and median dot for Fed funds crept slightly higher.

There was only one dissent to the decision.

Tags: Featured,Federal Reserve,Interest rates,newsletter