Summary:

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The SNB’s expansionary monetary policy is aimed at stabilising price developments and supporting economic activity. The Swiss franc is still significantly overvalued. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency. Compared to December, the new conditional inflation forecast is slightly higher for the next few quarters. Increased oil prices in particular contribute to the rise in inflation in the short term. Over the longer term, however, the conditional inflation forecast is marginally lower. The inflation forecast for 2017 has risen to 0.3%, compared to 0.1% in the previous quarter. For 2018, the SNB anticipates inflation of 0.4%, compared to 0.5% in the previous quarter. The forecast for 2019 is 1.1%.

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB Press Releases

This could be interesting, too:

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The SNB’s expansionary monetary policy is aimed at stabilising price developments and supporting economic activity. The Swiss franc is still significantly overvalued. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency. Compared to December, the new conditional inflation forecast is slightly higher for the next few quarters. Increased oil prices in particular contribute to the rise in inflation in the short term. Over the longer term, however, the conditional inflation forecast is marginally lower. The inflation forecast for 2017 has risen to 0.3%, compared to 0.1% in the previous quarter. For 2018, the SNB anticipates inflation of 0.4%, compared to 0.5% in the previous quarter. The forecast for 2019 is 1.1%.

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB Press Releases

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

Swiss National Bank leaves expansionary monetary policyunchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The SNB’s expansionary monetary policy is aimed at stabilising price developments and supporting economic activity. The Swiss franc is still significantly overvalued. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency.

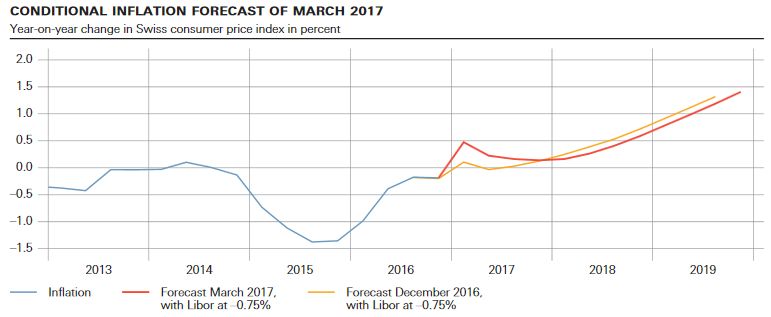

Compared to December, the new conditional inflation forecast is slightly higher for the next few quarters. Increased oil prices in particular contribute to the rise in inflation in the short term. Over the longer term, however, the conditional inflation forecast is marginally lower. The inflation forecast for 2017 has risen to 0.3%, compared to 0.1% in the previous quarter. For 2018, the SNB anticipates inflation of 0.4%, compared to 0.5% in the previous quarter. The forecast for 2019 is 1.1%. The conditional inflation forecast is based on the assumption that the three-month Libor remains at–0.75% over the entire forecast horizon.

The global economy expanded in line with expectations in the fourth quarter. GDP growth was once again robust in the US, where the labour market has returned to full employment and inflation is approaching the Federal Reserve’s target. Against this backdrop, the Federal Reserve decided on 15 March to raise its key interest rate by a further 25 basis points. The other major economic areas likewise developed favourably in the fourth quarter. The euro area, Japan and China all reported encouraging growth rates, and economic growth in the UK was once again surprisingly strong.

|

Conditional Inflation Forecast, March 2017 |

|

Indicators available at the beginning of the year suggest the outlook for the global economy will continue to improve. Industrial activity and international trade especially have picked up. While the SNB expects international economic developments to remain positive in 2017, itsbaseline scenario for the global economy is still subject to considerable risks. Chief among these are political uncertainty with respect to the future course of economic policy in the US, upcoming elections in Europe, and the complex exit negotiations between the UK and the EU.

In Switzerland, fourth-quarter GDP growth was lower than expected. According to an initial quarterly estimate, GDP grew – as in the third quarter – at an annualised rate of just 0.3%. However, a more extensive analysis of the available economic indicators points to an ongoing moderate recovery in the final months of the year; developments on the labour market support this view. Although the seasonally adjusted unemployment rate remained stable, the number of people out of work declined slightly from August onwards. Discussions with company representatives conducted by the SNB’s delegates for regional economic relations also suggest a moderate improvement of the economic situation.

Given favourable economic developments internationally, the outlook for Switzerland’s economy is cautiously optimistic. Overall, the SNB continues to expect GDP growth of roughly 1.5% for 2017. Nonetheless, the for ecast for Switzerland, too, is marked by considerable uncertainty emanating from international risks.

Growth on the mortgage and real estate markets remained fairly constant at a relatively low level in the fourth quarter of 2016. At the same time, the slowdown in price momentum in the residential property market continued. Imbalances on the mortgage and real estate markets nevertheless persist. The SNB will continue to monitor developments on these markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer.

|

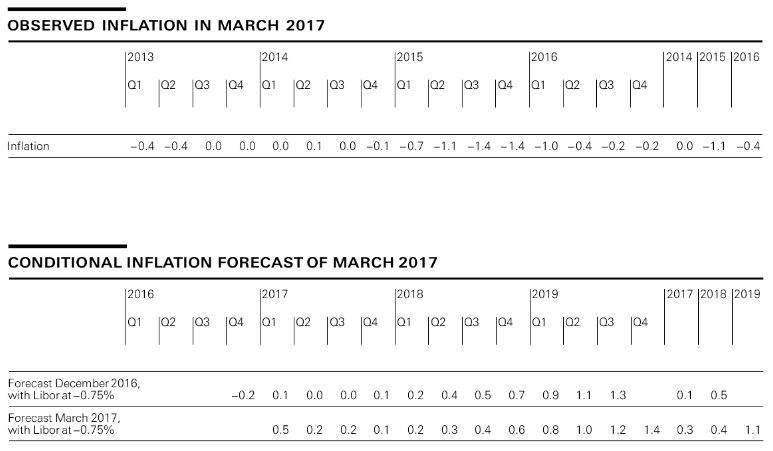

Observed Inflation, March 2017 |

Tags: Featured,newsletter