There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why they weren’t really wrong (so that populism can be described as indirectly illegitimate). US Nonfarm Payrolls Missing(see more posts on U.S. Nonfarm Payrolls, ) - Click to enlarge Today Bloomberg reports on a quarterly survey conducted and prepared by the National

Topics:

Jeffrey P. Snider considers the following as important: currencies, Economics, economy, Featured, Federal Reserve/Monetary Policy, incomes, labor shortage, Markets, national association for business economics, newsletter, The United States, Unemployment, wages

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

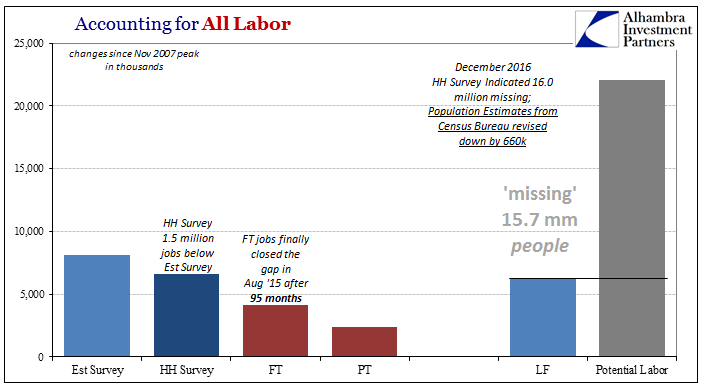

| There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is illegitimate), or find an excuse why they weren’t really wrong (so that populism can be described as indirectly illegitimate). |

US Nonfarm Payrolls Missing(see more posts on U.S. Nonfarm Payrolls, ) |

Today Bloomberg reports on a quarterly survey conducted and prepared by the National Association for Business Economics. Their results show, no surprise, the number of firms reporting trouble hiring workers has risen this year.

To make matters worse, for the study rather than the economy, basic economics (small “e”) is just ignored in favor of “the unemployment rate can’t be wrong.”

|

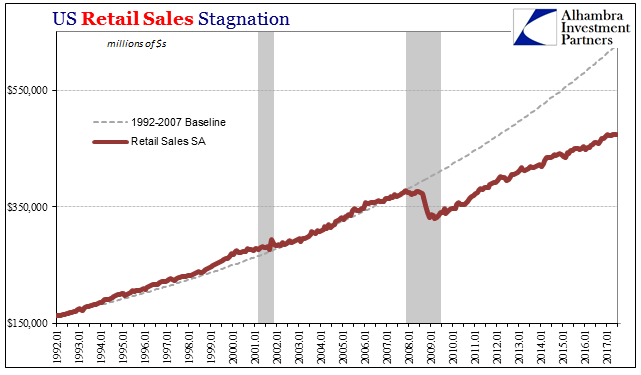

US Retail Sales Stagnation, Jan 1992 - Jul 2017(see more posts on U.S. Retail Sales, ) |

| Spoken like a true economist. What business in existence would let a shortage “affect your sales and affect your profits?” That’s utter nonsense, for any firm that is facing such a situation would immediately correct it by paying a market-clearing wage. Unlike fantasyland Economics, there is such a thing at every level. To believe otherwise is to live in a land of regressions and unquestioned allegiance to the BLS definition of the labor force. |

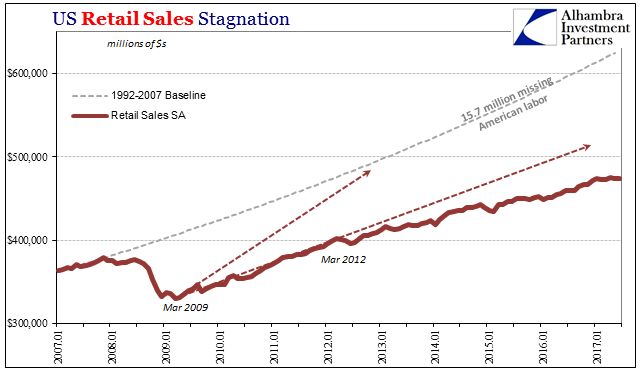

US Retail Sales SA Missing, Jan 2007 - Jul 2017(see more posts on U.S. Retail Sales, ) |

Instead, there is an unspoken stipulation that is never explicitly stipulated. Businesses are surely finding it difficult to hire good workers at the rate they today want to pay. Obviously, that rate is insufficient so as to clear market demand for supply. Why don’t they pay that market-clearing rate? Simple. Because unlike how the economy is talked about in the media, the one always derived from the unemployment rate, actual business is sluggish and uncertain at best. There is no rush to find qualified workers because in reality the economy is tight – not favorably tight as in no slack in the labor market, but more so tight in that there is little margin for addition. |

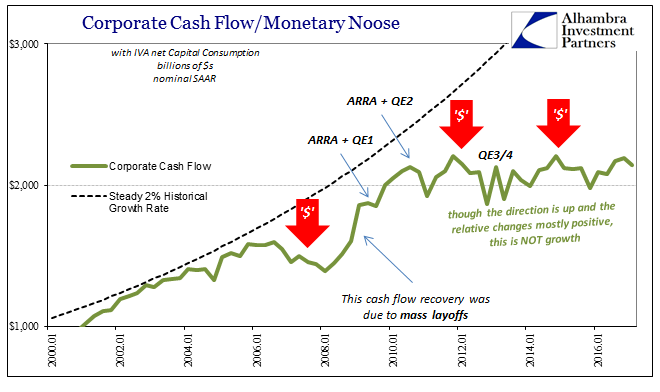

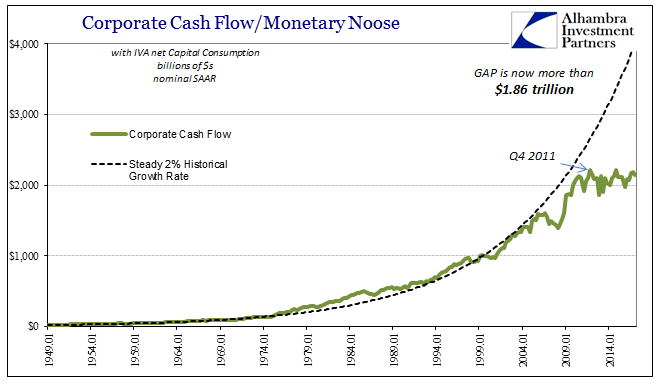

US GDP Corporate Cash Flow, Jan 2000 - 2017(see more posts on corporate cash flow, U.S. Gross Domestic Product, ) |

Businesses find employees when they can, hoping to luck into one here or there, paying them as little as possible as reflection of the lack of economic momentum that always characterizes this economy. There is no labor urgency because there is no economic urgency, and businesses in aggregate cash flow terms can’t afford to change it (see above). They would rather muddle through with what they have now than actually pay more for competence.

|

US GDP Corporate Cash Flow Longer, Jan 1949 - 2017(see more posts on corporate cash flow, U.S. Gross Domestic Product, ) |

| The [survey] results reinforce data coming out of the U.S. this year, which show a tightening labor market amid low interest rates and an economic expansion.

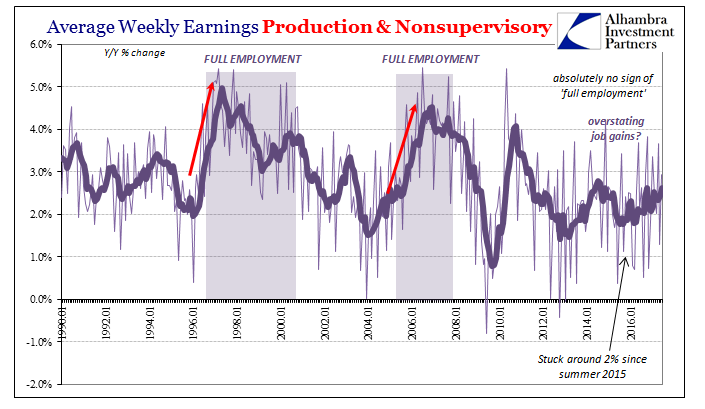

You can’t fool economics (small “e”). If that were anywhere close to being true wages would be surging right now. Therefore, all conclusions with respect to labor conditions have to include the following relevant caveats: 1. There can be a labor shortage at this very moment at the wage rates businesses are currently willing to pay; 2. The rate they are willing to pay is not the market-clearing rate; 3. They aren’t paying the market-clearing rate because actual economic conditions are, as they have been all along, poor. |

US Payrolls Average Weekly Earnings, Jan 1990 - 2017(see more posts on U.S. Average Earnings, U.S. Nonfarm Payrolls, ) |

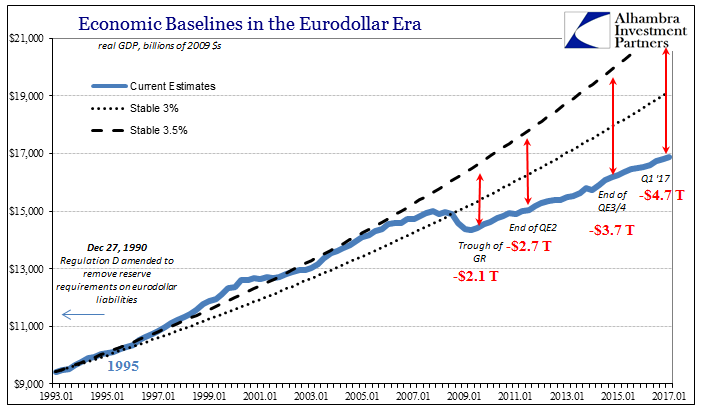

| The technical definition of recession is thought to be two consecutive quarters of negative GDP. That isn’t actually true, as the dot-com recession featured two quarters of contraction in GDP non-consecutively, spread out over three. Likewise, the mere fact that GDP is positive and has been positive for any number of quarters or years does not by itself technically meet the specifications for expansion. The difference between positive GDP, or any positive numbers for any economic account, and true expansion can be, as we observe in labor conditions, enormous. |

US GDP Baseline, Jan 1993 - 2017(see more posts on U.S. Gross Domestic Product, ) |

Tags: currencies,Economics,economy,Featured,Federal Reserve/Monetary Policy,incomes,labor shortage,Markets,national association for business economics,newsletter,Unemployment,wages