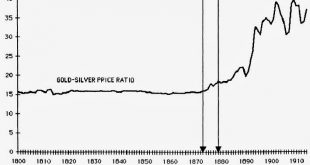

How We Got Used to Fiat Money Most false or irrational ideas about money are not new. For example, take the idea that government can just fix the price of one monetary asset against another. Some people think that we can have a gold standard by such a decree today. This idea goes back at least as far as the Coinage Act of 1792, when the government fixed 371.25 grains of silver to the same value as 24.75 grains of...

Read More »Small Swiss firms struggle to recruit qualified staff

Nearly all (99.6%) of all businesses in Switzerland are small and medium-sized enterprises (SMEs) (Keystone) One in four small and medium-sized Swiss firms (SMEs) suffers due to a serious lack of qualified staff, a new Credit Suisse survey reveals. The economic situation in Switzerland is generally favourable to most SMEs, which are slightly more optimistic about the future than they were last year, a Credit Suisse...

Read More »Euro Flirting with Near-Term Downtrend

Summary: North American traders began the week by selling dollars. Euro is testing a downtrend off the year’s high. DXY is testing its uptrend. After consolidating in the Asian session and European morning, the euro has been bid higher in North America. It is testing a downtrend line, drawn off the year’s high set in early August near $1.1910, as depicted in this Great Graphic, composed on Bloomberg. It is met the...

Read More »Questions

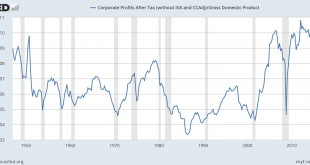

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000. Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why? What changed in 2000 to elevate corporate profits so much? Is this just...

Read More »FX Daily, August 23: Consolidation in Capital Markets Conceals Coming Turbulence

Swiss Franc The Euro has risen by 0.04% to 1.1389 CHF. EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates A mixed US dollar will greet the North American participants today. It is softer against the euro and yen, but firmer against the dollar-bloc currencies. Among the emerging market currencies, the eastern and central European currencies are...

Read More »U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

US Treasury Secretary Steve Mnuchin visits Fort Knox Gold Later tweeted ‘Glad gold is safe!’ Only the third Treasury Secretary to visit the fortified vault, last visit was 1948 Last Congressional visit was 1974 Speculation over existence of gold in Fort Knox is rife Concerns over Federal Reserves lack of interest in carrying to an audit on gold Gold was last counted in 1953, nine years before Mnuchin was born Mnuchin...

Read More »Swiss business lobby rejects idea of ‘robot tax’

Robots are used a lot in industry (Keystone) - Click to enlarge The Swiss Business Federation (economiesuisse) rejects imposing a so-called robot tax on companies to make up for lost income taxes as workers are gradually replaced by machines. Rather than focusing on a robot tax, Switzerland should encourage the development of a faster internet network and cooperation between business and Swiss research institutes,...

Read More »Swiss firms face greater shareholder opposition

At a stormy shareholders meeting in April, Tidjane Thiam, CEO of Switzerland's second biggest bank Credit Suisse, faced a revolt from shareholders over compensation and management bonuses for its top managers despite financial losses (Keystone) - Click to enlarge Shareholder rebellion over executive pay at Credit Suisse earlier this year is just one example of growing dissent by Swiss company owners. While annual...

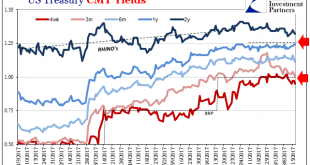

Read More »United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day. A lot has happened between now and then, including three additional “rate hikes” dating back to December 2016, the last in June 2017. The yield...

Read More »Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments Last week he price of gold was up nine bucks, and that of silver 6 cents. These small changes mask the relatively big drop on Tuesday—$13 in gold and $0.48 in silver — and recovery the rest of the week. The gains above previous week occurred on Thursday. Speculators have lately warmed up to...

Read More » SNB & CHF

SNB & CHF