Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar All eyes on non farm payrolls today for further signs of weakness in U.S. economy Gold recovers from 1.7% decline in June as dollar falls Gold outperforms stocks and benchmark S&P 500 YTD Gold gains 10.8% versus 10.6% gain for S&P – led by frothy tech sector (see performance table) Gold outperforms stocks globally – Euro Stoxx 50 up 5.7% ytd, FTSE up 4.8% and Nikkei up 4.5% Gold’s technicals increasingly positive; now trading above its 50-day & 200-day moving averages & looks set to target ,300 again Gold held steady today in Asian

Topics:

Mark O'Byrne considers the following as important: Featured, Gold, gold price, GoldCore, newsletter, S&P 500 Index, S&P 500 Index, Weekly Market Update

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

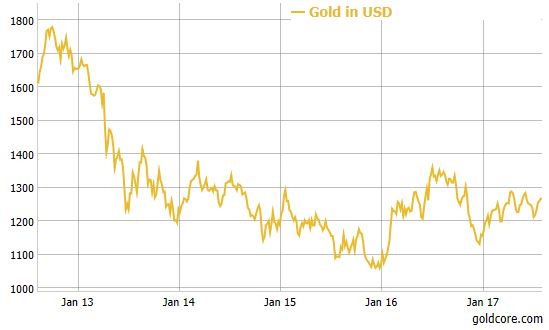

Gold held steady today in Asian and European trading and was flat for the week, consolidating near the $1,270 per ounce level and the 2.5% gain seen in July. It remains close to a seven-week high hit this week, as the dollar remains weak and vulnerable near multi-month lows after five consecutive months of declines. The dollar index, which tracks the greenback against a basket of six major peers, is languishing near 15-month lows hit earlier this week. “All eyes” are again on the monthly U.S. nonfarm payrolls data due today amid continuing very high levels of U.S. and global political uncertainty. Traders awaiting July’s employment repor for clues about the health of the U.S. economy after recent data highlighted risks to the downside. This is underlining how difficult it will be for the U.S. Federal Reserve to raise interest rates – even from these historically low levels in the current range between 1% and 1.25%. The complete mess that is the Trump administration and U.S. politics was underlined again this week. |

Gold in USD, Jan 2013 - 2017(see more posts on Gold, ) |

| Robert Mueller, the U.S. Special Counsel, has convened a grand jury investigation in Washington to examine allegations of Russian interference in last year’s contentious election and has started issuing subpoenas, according to sources familiar with the situation said on yesterday.

The dollar looks very vulnerable to further falls. Trump and the Republicans have seen repeated failures. These include overhauling healthcare. Now there is multiple congressional and federal investigations into President Donald Trump’s campaign. This is casting a shadow over his first six months in office and the vicious “civil war” politics that the U.S. finds itself in is casting a shadow over U.S. politics and America’s place in the world. Gold is performing very well this year and yet sentiment remains poor with little media coverage of gold’s robust performance year to date. |

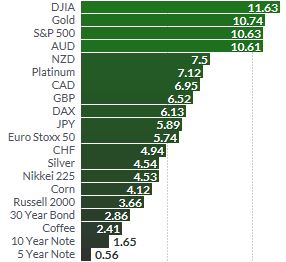

Gold Stocks for 2017(see more posts on Gold, ) |

| Gold has outperformed stocks and the benchmark S&P 500 YTD with gains of 10.8% versus a 10.6% gain in the S&P 500. Much of the gains are due to surge in prices in the increasingly frothy tech sector.

Indeed, gold is outperforming stocks globally – the Euro Stoxx 50 is up 5.7% ytd, the FTSE up 4.8% and the Nikkei up 4.5%. Silver gained 1% in July and is 5% higher so far this year. |

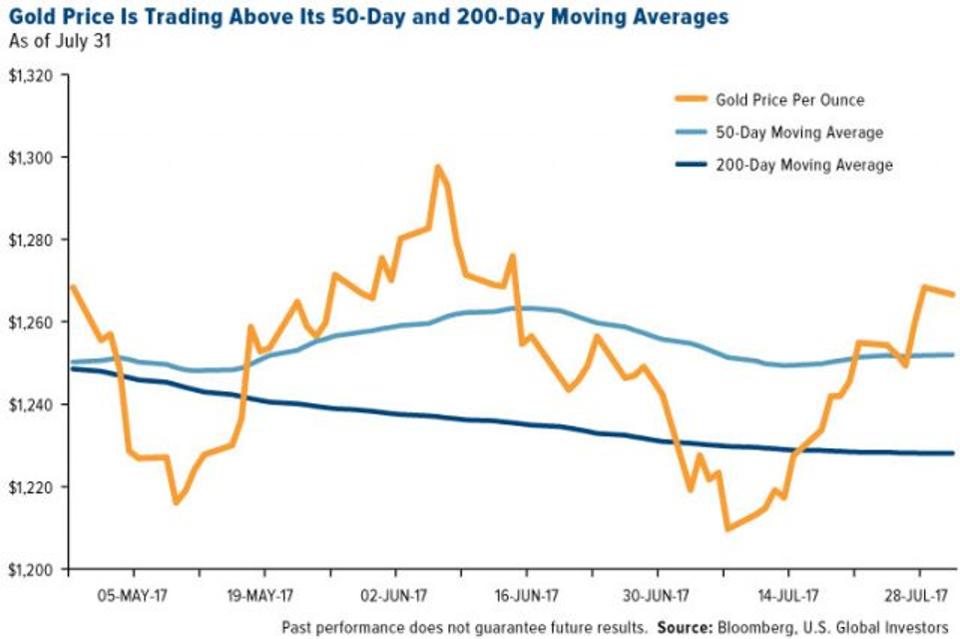

Gold Price - Trading, May 2017 - Aug 2017(see more posts on gold price, ) |

| Gold’s technicals look very good and it now trading above its 50-day and 200-day moving averages and looks set to target $1,300 again this month.

A daily or weekly close above $1,300 per ounce should see gold make quick gains and challenge the intermediate high of $1,361/oz seen 13 months ago. Next levels of resistance are $1,380 and $1,416. A failure to breach $1,300 in the coming days and weeks could see gold fall back to test very strong support at $1,200 per ounce. |

Gold and S&P 500 Index, Oct 2008 - Jul 2017(see more posts on Gold, S&P 500 Index, ) |

Tags: Featured,Gold,gold price,newsletter,S&P 500 Index,Weekly Market Update