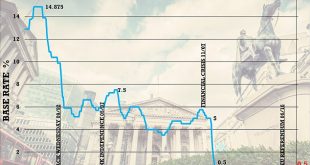

– Bank of England raised interest rates for the first time in ten years – President Trump announces Jerome Powell as his choice to lead the U.S. Federal Reserve – Most investors outside the US Dollar and Euro see gold prices climb after busy week of central bank news – Inflation now at five-year high of 3% – Inflation, low-interest rate, debt crises and bail-ins still threaten savers and pensioners Gold Price in...

Read More »Global Asset Allocation Update

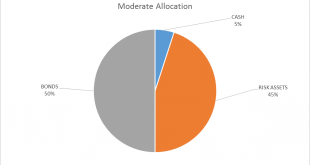

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

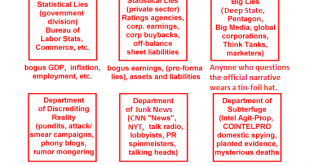

Read More »What’s Driving Social Discord: Russian Social Media Meddling or Soaring Wealth/Power Inequality?

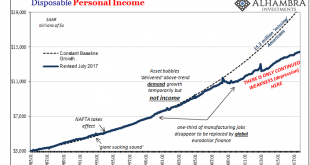

The nation’s elites are desperate to misdirect us from the financial and power dividethat has enriched and empowered them at the expense of the unprotected many. - Click to enlarge There are two competing explanatory narratives battling for mind-share in the U.S.: 1. The nation’s social discord is the direct result of Russian social media meddling– what I call the Boris and Natasha Narrative of evil Russian...

Read More »Swiss wind power at a standstill

Following the vote in favour of Energy Strategy 2050, the government announced its target of building up to 800 wind turbines. To reach this goal, twenty new wind turbines would need to go up each year until 2050. Yet not a single wind farm was built this year. What's behind this lack of progress? (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international...

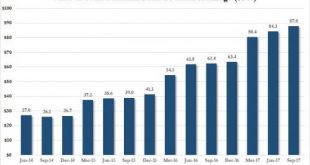

Read More »The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented “coordinated growth spurt”, and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money”...

Read More »Emerging Markets: What has Changed

Summary Russia’s Finance Ministry announced plans to increase its dollar. purchases in November Bahrain has reportedly asked its Gulf allies for financial assistance. S&P upgraded Argentina a notch to B+ with stable outlook. Brazil raised BRL6.15 bln ($1.9 bln) by auctioning off the rights to explore 6 of the 8 deep-water oil blocks. Venezuela bowed to the inevitable, announcing that it would have to restructure...

Read More »What the Kennedy Assassination Records Reveal: Uncontrollable Incompetence

Imagine Harvey Weinstein wielding a “top secret” stamp to block any exposure of the uncomfortable truth and you have the FBI, CIA and NSA. One way to interpret the intelligence community’s reluctance to let all the Kennedy assassination archives become public is that the archives contain evidence of a “smoking gun”: that is, evidence that the intelligence agencies of the United States of America were complicit in the...

Read More »Bonds And Soft Chinese Data

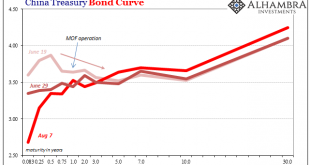

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year. China Treasury Bonds(see more posts on china...

Read More »The (Economic) Difference Between Stocks and Bonds

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average. It is...

Read More »Agriculture suisse: trop, c’est trop. LHK

Avant-propos: Après la place financière, la production d’électricité, le secteur de la santé, des assurances-maladie, voici arrivé le tour de la destruction du secteur agricole. Remarquez la chose est déjà bien emmanchée avec des suicides et des faillites d’agriculteurs harcelés par un Etat qui poursuit l’agenda d’un « marché » financier et non celui des électeurs, quand bien même ceux-ci financent leur salaire … Les...

Read More » SNB & CHF

SNB & CHF