The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »Consumers continue to expect a positive economic development

Bern, 02.11.2017 – Consumer sentiment in Switzerland remains above average. At -2 points, the overall index is virtually unchanged in October compared to the previous quarter (-3 points). Continued optimism regarding economic development and unemployment are supporting the positive outlook in particular, while expectations regarding the financial situation of households remain below average. This indicates that...

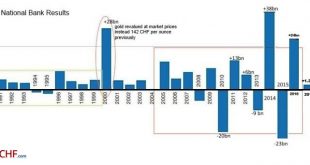

Read More »La stratégie de la BNS pénalise toujours le pays et la population

33,7 milliards de francs suisses. Voici le montant du bénéfice, réalisé par la BNS à fin septembre, dont se félicitent nos médias. Le problème est qu’un chiffre sorti de son contexte ne sert à rien. Si votre patron vous augmente de 100 et qu’en parallèle, votre loyer augmente de 200, à la fin de l’année vous êtes en déficit de 100 n’est-ce pas? Dans un ménage, une entreprise ou un Etat, il convient de garder une...

Read More »FX Daily, November 01: Super 48 Hours

(early post ahead of start of a new business trip to Europe. Posts will continue albeit irregularly) Swiss Franc The euro has appreciated by 0.19% to 1.1637 CHF. EUR/CHF and USD/CHF, November 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates This is it: The next 48 hours will be among the busiest of the year. The Bank of England meets tomorrow, and it not only gives a...

Read More »Lausanne cancels artist’s appearance over security fears

A book festival in Lausanne has cancelled an invitation to Marsault, a controversial French comic book artist, after the organisers said they received threats from activists. The organisers of the Lausan’noir crime thriller book festivalexternal link say they will not be welcoming the French comic book artist Marsault to their event, which takes place in the Swiss city from October 27-29. “The conditions were not met...

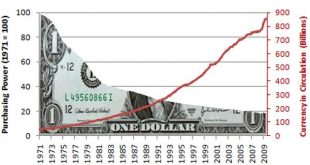

Read More »Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

– Gold versus bitcoin debate makes further headlines as tech experts weigh in – Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold – Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar -Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency – Gold continues to hold...

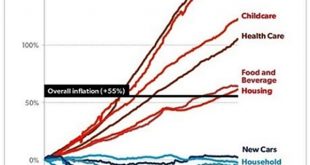

Read More »What Could Pop The Everything Bubble?

As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop. I’ve long held that if a problem can be solved by creating $1 trillion out of thin air and buying a raft of assets with that $1 trillion, then central banks will solve...

Read More »Gold and Silver Get Powelled – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Rumors Driving Short Term Price Swings The prices of the metals dropped a bit more this week, -$7 and -$0.16. We all know the dollar is going down, that it is the stated policy of the Federal Reserve to make it go down. We all know that gold has been valued for thousands of years. So why do we measure the timeless metal...

Read More »The good years have started, increasing SNB Profits

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But in 2017, the picture is changed. Assuming a “biblical” cycle of seven good years and seven bad years, the SNB could now increase profits every year – thanks to a weaker franc and the seven good years. … until the next recession comes and the...

Read More »FX Daily, October 31: Month-End Leaves Market at Crossroads

Swiss Franc The Euro has risen by 0.41% to 1.628 CHF. EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe’s Dow Jones Stoxx 600 is also flattish today, but up 1.6%...

Read More » SNB & CHF

SNB & CHF