Suspicion isn’t Merely Asleep – It is in a Coma (or Dead) There is an old Monty Python skit about a parrot whose lack of movement and refusal to respond to prodding leads to an intense debate over what state it is in. Is it just sleeping, as the proprietor of the shop that sold it insists? A very tired parrot taking a really deep rest? Or is it actually dead, as the customer who bought it asserts, offering the fact...

Read More »Switzerland Unemployment in October 2017: Situation on the Labor Market

Unemployment Rate (not seasonally adjusted) Bern, 09.11.2017 – Registered unemployment in October 2017 – According to surveys by the State Secretariat for Economic Affairs (SECO), 134,800 unemployed people were registered at the Regional Employment Centers (RAV) at the end of October 2017, 1,631 more than in the previous month. The unemployment rate remained at 3.0% in the month under review. Compared with the same...

Read More »Health insurance rise in 2018 even higher, according to new calculation

© Pogonici | Dreamstime - Click to enlarge At the end of September the Swiss government announced an average nationwide health premium rise of 4% in 2018. This government calculation is rather narrow. It only looks at the price of standard compulsory insurance, including accident cover, for an adult with a CHF 300 deductible. Price comparison site bonus.ch calculates that this policy configuration only applies to 18.3%...

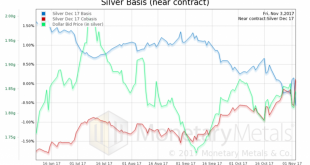

Read More »A Different Powelling – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. New Chief Monetary Bureaucrat Goes from Good to Bad for Silver The prices of the metals ended all but unchanged last week, though they hit spike highs on Thursday. Particularly silver his $17.24 before falling back 43 cents, to close at $16.82. Never drop silver carelessly, since it might land on your toes. If you are at...

Read More »Stumbling UK Economy Shows Importance of Gold

– UK economy outlook bleak amid Brexit, debt woes and rising inflation – Confidence in UK housing market at five-year low – UK high street sales crash at fastest rate since 2009– Number registering as insolvent in England and Wales hit a five-year high in Q3 – UK public finance hole of almost £20bn in the public finances set to grow to £36bn by 2021-22– Protect your savings with gold in the face of increased financial...

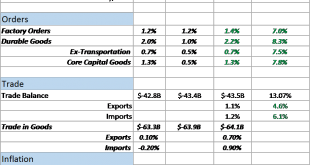

Read More »Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017. And it took a hurricane to get the most recent...

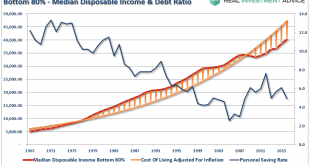

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

Read More »Is a Rapid Advance in the Japanese Stock Market Imminent?

Japanese Market About to Break Out The Japanese stock market is quite unique: it would need to rally by approximately 80% to reach its former historical peak. What’s more, said peak was attained on the final trading day of 1989, more than 25 years ago. In short, Japanese stocks have been anything but a good investment in recent years. Conversely this means that the market has a lot of potential if it were to return to...

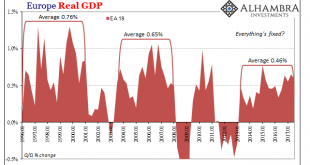

Read More »Europe Is Booming, Except It’s Not

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss. At 0.6%, that doesn’t even equal the average growth rate exhibited from either...

Read More »World’s Largest Gold Producer China Sees Production Fall 10 percent

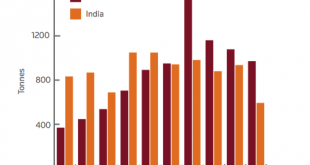

Gold mining production in China fell by 9.8% in H1 2017 Decreasing mine supply in world’s largest gold producer and across the globe GFMS World Gold Survey predicts mine production to contract year-on-year Peak gold production being seen in Australia, world’s no 2 producer Peak gold production globally while global gold demand remains robust China Gold Mine Production 1H 2016 vs 1H 2017 - Click to enlarge Gold...

Read More » SNB & CHF

SNB & CHF