© Cecilia Lim | Dreamstime - Click to enlarge This week, Switzerland moved closer to requiring minimum percentages of women on company boards and management teams. A parliamentary commission came out in support of the Federal Council’s plan to require greater gender balance in the boardrooms of Switzerland’s large listed companies. A commission majority (14 versus 11) would like to see a minimum of 30% of board members...

Read More »OECD Country Report 2017 on Swiss economic policy

On Tuesday, November 14, 2017, the OECD presents the OECD Country Report 2017 on Swiss economic policy at a media conference. This takes place at 15.00 clock in the media center Bundeshaus, Bundesgasse 8-12, 3003 Bern.The report, in French and English, will be delivered on request by the OECD ([email protected]) the day before from 3pm on CEREMONY 14 November 2017 at 15.00. The Speakers: State Secretary...

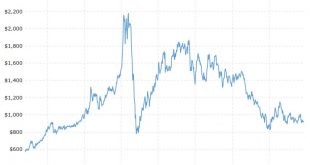

Read More »Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’

Platinum Bullion ‘May Be One Of The Only Cheap Assets Out There’ Platinum “may be one of the cheap assets out there” and “is cheap when compared with stocks or bonds” according to Dominic Frisby writing in the UK’s best selling financial publication Money Week. Frisby writing in Money Week laments the total absence of value in today’s markets. He then identifies an asset that is both cheap (on a relative basis) and is...

Read More »The Strange Behavior of Gold Investors from Monday to Thursday

Known and Unknown Anomalies Readers are undoubtedly aware of one or another stock market anomaly, such as e.g. the frequently observed weakness in stock markets in the summer months, which the well-known saying “sell in May and go away” refers to. Apart from such widely known anomalies, there are many others though, which most investors have never heard of. These anomalies can be particularly interesting and profitable...

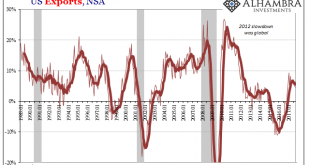

Read More »Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is. Japan was common then among the world’s various economies to be...

Read More »Trust in online content takes a big hit

Most internet users in Switzerland search the web for information about products, notably to buy online and book holidays (Keystone) - Click to enlarge Internet users in Switzerland rate their computer skills as good, but trust in online news content has dropped significantly, according to a survey by the University of Zurich. An overwhelming majority (83%) of users stated they can easily distinguish...

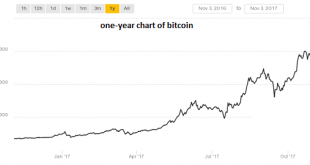

Read More »How Will Bitcoin React in a Financial Crisis Like 2008?

If the ownership of bitcoin is as concentrated as some estimate, then the liquidity issue distills down to the actions of the top tier of owners. Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other...

Read More »Four Point One

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k. For those two months combined, the headline advanced at an...

Read More »Let’s Clear Up One Confusion About Bitcoin

If bitcoin can be converted into fiat currencies at a lower transaction cost than the fiat-to-fiat conversions made by banks and credit card companies, it’s a superior means of exchange. One of the most common comments I hear from bitcoin skeptics goes something like this: Bitcoin isn’t real money until I can buy a cup of coffee with it. In other words, bitcoin fails the first of the two core tests of “money”: that it...

Read More »Credit Spreads: The Coming Resurrection of Polly

Suspicion isn’t Merely Asleep – It is in a Coma (or Dead) There is an old Monty Python skit about a parrot whose lack of movement and refusal to respond to prodding leads to an intense debate over what state it is in. Is it just sleeping, as the proprietor of the shop that sold it insists? A very tired parrot taking a really deep rest? Or is it actually dead, as the customer who bought it asserts, offering the fact...

Read More » SNB & CHF

SNB & CHF