What Steel’s study shows is that, as with any monetary force, it is how it is managed rather than what it is that carries responsibility for conflicts and the resulting financial situation. Steel’s work also demonstrates the strength and protection access to gold will give a country or army during times of conflict. Allies are able to have faith in countries that have managed their gold supply and economy responsibly, helping to finance conflicts and maintain crucial trading relationships. We are at an unprecedented time in our global history. Countries have far larger weapons and armies than we have previously known. The financial system is also more connected than ever before. In the background super powers such as

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| What Steel’s study shows is that, as with any monetary force, it is how it is managed rather than what it is that carries responsibility for conflicts and the resulting financial situation.

Steel’s work also demonstrates the strength and protection access to gold will give a country or army during times of conflict. Allies are able to have faith in countries that have managed their gold supply and economy responsibly, helping to finance conflicts and maintain crucial trading relationships. We are at an unprecedented time in our global history. Countries have far larger weapons and armies than we have previously known. The financial system is also more connected than ever before. In the background super powers such as China and Russia are accumulating gold, whilst preparing their militaries. Meanwhile the likes of Britain no longer has quite the same access to either based gold reserves or the Empire, as she once did. Steel reminds us that it is not who has the most gold, but who is able to best utilise it. Central bankers should take note of this, but so too should investors. A judiciously managed, well-balanced portfolio with an allocation to gold is a prudent way to secure your wealth in these uncertain times. |

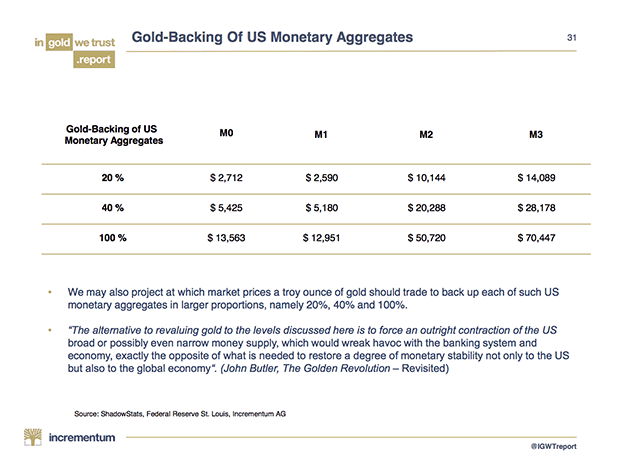

Gold Backing US Monetary Aggregates |

Tags: Daily Market Update,Featured,newsletter