Thiam says the bank is well positioned to achieve future profitable growth. Credit Suisse CEO Tidjane Thiam has reiterated that he had nothing to do with the spying scandal that recently rocked the bank. Thiam insisted that the debacle has not damaged business as the bank presented better than expected third quarter results. The bank doubled profits for the period to CHF881 million ($886 million) compared to Q3 2018. Its International Wealth Management division,...

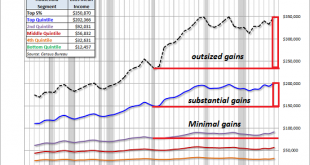

Read More »The Political Parties and the Media Have Abandoned the Working “Middle Class”

Where is the line between “working class” and “middle class”? Maybe there isn’t any. Defining the “middle class” has devolved to a pundit parlor game, so let’s get real for a moment (if we dare): the “middle class” is no longer defined by the traditional metrics of income or job type (blue collar, white collar), but by an entirely different set of metrics: 1. Household indebtedness, i.e. how much of the income is devoted to debt service, and 2. How much of the...

Read More »FOMC Preview

The FOMC begins a two-day meeting today with the decision due out tomorrow afternoon. The Fed is widely expected to cut rates 25 bp for the third meeting in a row. What’s next? RECENT DEVELOPMENTS US data have undeniably softened in September. Weakness in the manufacturing sector appears to have spread to the wider economy. ISM PMI, jobs, CPI, PPI, and retail sales all came in weaker than expected. So too have inflation expectations. October data is just...

Read More »Incrementum 2019 Gold Chart Book

The Most Comprehensive Collection of Gold Charts Our friends at Incrementum have just published their newest Gold Chart Book, a complement to the annual “In Gold We Trust” report. A download link to the chart book is provided below. The Incrementum Gold Chart Book is easily the most comprehensive collection of charts related to or relevant to gold available anywhere. It contains everything from a wealth of economic to monetary data, to charts detailing sources of...

Read More »FX Daily, October 30: All About Perspective

Swiss Franc The Euro has fallen by 0.13% to 1.1026 EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second...

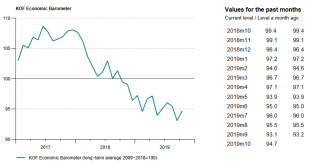

Read More »KOF Economic Barometer: Stabilization at a low level

The KOF Economic Barometer has halted its downward movement, at least for the time being. At 94.7 points, however, the barometer is still well below its long-term average. The Swiss economy is therefore likely to grow with below-average rates in the upcoming months. In October, the KOF Economic Barometer rose by 1.6 points, from 93.1 points in September (revised from 93.2 points) to 94.7 points. This increase is attributable in particular to bundles of...

Read More »USD/CHF technical analysis: Clings to 23.6 percent Fibo, eyes on Swiss ZEW, Fed

USD/CHF stays above 21-day EMA amid bullish MACD. A daily closing beyond the monthly trendline will trigger fresh upside. Given the monthly falling resistance line and 21-day EMA confusing USD/CHF traders on a key day, the quote seesaws near 0.9940 during pre-European session on Wednesday. Adding to the odds of pair’s run-up are bullish signals from the 12-bar Moving Average Convergence and Divergence (MACD) indicator. However, buyers need a sustained break above a...

Read More »Why Nobody Chants “End the Fed” Anymore

Americans hated it when the Federal Reserve handed trillions of dollars to crooked Wall Street banks following the 2008 Financial Crisis. Politicians were confronted about the merits of central banking and bailouts. For the first time in history, college students were chanting “End the Fed” at campaign rallies as Ron Paul took the central bank to task during his presidential campaigns. Virtually everyone in America vehemently opposed the central bank handing piles of...

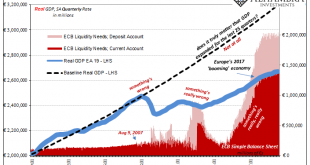

Read More »The Big Risks Left (and Right) In Europe

Another local election in Germany, another stunning defeat for the ruling center. How many more of these does anyone need before they realize the electorate is going to keep migrating toward the poles? And it all stems from the one reason; there is no and has been no economic growth. But because the so-called establishment has insisted the economy is booming, or it was, people are doing what people always do. They look for someone, anyone who can give them a...

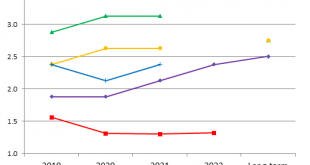

Read More »The Golden Autumn Season – One of the Most Reliable Seasonal Patterns Begins

The Strongest Seasonal Stock Market Trend Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market? I will answer...

Read More » SNB & CHF

SNB & CHF