Two Interesting Recent P&P Interviews Our friend Maurice Jackson of Proven and Probable has recently conducted two interviews which we believe will be of interest to our readers. The first interview is with Brien Lundin, the president of Jefferson Financial, host of the famed New Orleans Investment Conference and publisher & editor of the Gold Newsletter – an investment newsletter that has been around for almost five decades, which actually makes it the...

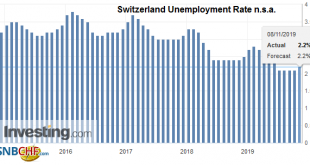

Read More »Switzerland Unemployment in October 2019: Up to 2.2 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment Rate (not seasonally adjusted) Unemployment registered in October 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of October 2019, 101’684 unemployed were registered at the regional employment agencies (RAV), 2 586 more than in the previous month. The unemployment rate rose from 2.1% in September 2019 to 2.2% in the month under review. Compared to the same month of the previous year, unemployment fell by...

Read More »FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.06% to 1.0987 EUR/CHF and USD/CHF, November 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week’s gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index...

Read More »Negative rates might go lower, says Swiss National Bank chairman

Thomas Jordan, Chairman of the Swiss National Bank Thomas Jordan, chairman of the Swiss National Bank (SNB), told the NZZ am Sonntag newspaper recently that central bank interest rates might need to go further into negative territory. Responding to growing criticism of negative central bank interest rates, Jordan said negative interest rates could continue and a further reduction is possible. The SNB did not introduce negative interest rates to harm people, said the...

Read More »USD/CHF extends rally to 0.9975, highest since mid-October

Swiss Franc amid the worst performers on Thursday amid positive trade headlines. US dollar rises supported by higher US yields; Wall Street hits a new record. The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels. Equity prices are higher in Wall Street amid reports that the US and...

Read More »Geneva to ban Uber if it doesn’t change its operating model

© Oleksandr Lutsenko | Dreamstime.com After a legal analyis the government of the canton of Geneva has decided that drivers of the ride hailing service are employees rather than independent contractors, effectively banning Uber from operating under its current model. In an interview with RTS, Mauro Poggia, a lawyer and Geneva state councillor, said that Uber is a transport company and as such must employ its drivers. Employees are treated differently to contractors....

Read More »Using lake water to help reduce Switzerland’s carbon footprint

A CHF800 million ($805 million) new pumping station is under construction north of Geneva as part of the Genilac project. Swiss lakes offer huge potential as renewable energy sources that can be used to cool and heat buildings. Geneva is expanding a pioneering thermal exchange project to help meet its climate goals, while other regions are taking the plunge. After transport, the second and third biggest sources of national greenhouse gas emissions are Swiss industry...

Read More »From Friends to Nemeses: JO and Jay

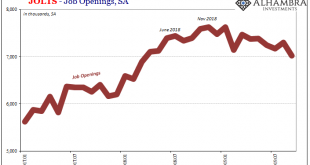

It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.” Things were so good, they said, the situation was in danger of...

Read More »Is blockchain real estate in need of renovation?

Is the room half full or half empty for blockchain property enterprises? (© Keystone / Christian Beutler) Our regular analysis of developments in the world of fintech and Crypto Nation. Property has for some time been hailed as prime real estate for blockchain disruption. The incorruptible ledger will replace mountains of paperwork while interested parties will have a sovereign claim to validate transactions in property sales. We are also told that smart contracts...

Read More »What does blockchain have to do with me?

(Keystone/ Valentin Flauraud) Blockchain and cryptocurrencies seem to be all over the news, but is this a flash-in-the-pan gimmick or a real digital service that can impact on the lives of ordinary people? People have been asking us what it all means, so we’d like to give you the opportunity to send in your own questions. What is blockchain’s value proposition? Why should I cash in my “real” money for cryptocurrencies? Who or what is behind blockchain? We’ll do our...

Read More » SNB & CHF

SNB & CHF