Area Index Price orPerformance index Type Funds ISIN Methode Ausschüttungsart Spread Okt 19 KGV KBV Titelzahl Fonds Tielzahl Benchmark Vola 5J Agio TER Disagio Bemerkung Small Caps MSCI EM SM GDTR Smart Beta: Small SPDR MSCI Emerging Markets Small Cap UCITS ETF IE00B48X4842 Optimized Sampling Thesaurierend 0,50% 12,33 1,24 1472 17,1% 0% 0,55% 0% China 11% Europa MSCI Europe Small Cap Value Weighted Index...

Read More »Swiss government cuts drug prices by 100 million francs

© Tero Vesalainen Dreamstime.com Switzerland’s Federal Office of Public Health (FOPH) recently announced it had reduced the price Swiss healthcare providers and patients will pay for 257 drugs by 16.3%. These lower prices, which take affect on 1 December 2019, are expected to save CHF 100 million annually. The FOPH looked at the prices of 478 drugs and achieved price reductions on 257 (54%) of them. The government has promised to cut healthcare costs via a range of...

Read More »Minimum Swiss internet speed to triple in 2020

© Andrey Metelev | Dreamstime.com The Federal Council, Switzerland’s executive, has confirmed a decision made by parliament to raise the minimum speed of broadband internet connections in Switzerland. From 1 January 2020, the minimum download speed specified in Switzerland’s universal service agreement with Swisscom will rise from 3 to 10 megabits per second (Mbits/s) and the minimum upload speed will rise from 0.3 to 1 Mbit/s. The change aims to boost social and...

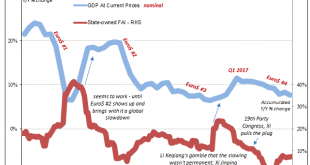

Read More »More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, )...

Read More »Switzerland calls time on phone booths

Sign of the times: a Swisscom box in Lausanne in 2017. It had been converted into a book exchange The last telephone box in French-speaking Switzerland, on the shores of Lake Geneva, was dismantled on Thursday. Swisscom will remove the one in the country – in Baden, northern Switzerland – on November 28. An era in the history of Swiss telecommunications is thus coming to an end, an era that witnessed millions of declarations of love, tears and banal conversations in...

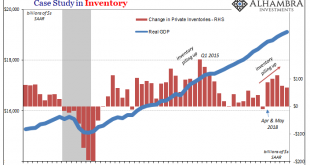

Read More »The Inventory Context For Rate Cuts and Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

Read More »Mexico vs. Brazil Near-Term Outlook

Both Brazil and Mexico are in a good position to benefit from the current improvement in market sentiment. However, when comparing the factors driving the currencies of both countries, we think there are relatively more near-term positives for the Mexican peso than for the Brazilian real. These include: (1) the peso will maintain its carry advantage for some time; (2) hedging-related flows should be mixed for the real, but could net as a drag; (3) Mexico’s near-term...

Read More »Time To Replace Bonds With Gold

◆ “It may be time to replace bonds with gold”according to the just released excellent new Investment Update by the World Gold Council. ◆ Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns. ◆ As negative yielding debt increases alongside stock-to-yield valuations to all-time highs, gold may become an attractive and more effective diversifier than bonds, justifying a higher portfolio allocation than historical...

Read More »Swiss commission supports new laws to protect whistleblowers

© Shawn Hempel | Dreamstime.com A commission of the Council of States, Switzerland’s upper house, is in favour of new rules to protect whistleblowers. The proposed rules, which would help to protect those who expose secretive information or activity that is deemed illegal or unethical, were supported by 6 commission votes to 2 with 4 abstentions. The proposal, which would be incorporated into employment law, would follow the cascade principle put forward by the...

Read More »FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Swiss Franc The Euro has risen by 0.24% to 1.1023 EUR/CHF and USD/CHF, November 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: An unexpected increase in China’s Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of...

Read More » SNB & CHF

SNB & CHF