What’s been normalized are policies and cultural norms that seek to enrich and protect the few at the expense of the many. When the initially extraordinary fades into the unremarkable background of everyday life, we say it’s been normalized. Put another way, we quickly habituate to new conditions, and rationalize our ready acceptance of what was previously unacceptable. Technology offers many examples of extraordinary advances quickly becoming normalized as we...

Read More »Global Gold Buyers Are ‘Confident’ in Gold

‘Retail Gold Insights 2019’ has just been published by the World Gold Council. It is a thematic analysis of their new consumer research survey. With a base of 18,000 participants across India, China, Russia, Germany, the US and Canada, we believe it is the largest ever consumer survey on the global gold market. 5 main themes of the report People are confident in – and loyal to – gold. Gold already has strong foundations and it’s important to know where that...

Read More »The Financial System Is Broken (w/ Jeff Snider)

Jeff Snider, head of global research at Alhambra Investment Partners, has been covering the repo market breakdown since May 2018. With the recent spike in repo rates, it seems like the rest of the market has finally started to take notice. Snider explains why this problem is not coming up out of the blue and breaks down why he views recent market moves as a sign that the banks are telegraphing their knowledge of major threats to the monetary system. Filmed on September 27, 2019 in New York....

Read More »FX Daily, November 22: Europe’s Flash PMI Disappoints and Hong Kong Shares Advance Ahead of Sunday’s Election

Swiss Franc The Euro has risen by 0.18% to 1.0997 EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities in the Asia Pacific managed to mostly shrug off the drag of the losses in US equities yesterday. China and India could not escape the pull, but most other bourses were higher, led by Singapore and Hong Kong. It was the second consecutive week that the MSCI Asia Pacific Index...

Read More »UBS Has No Choice In Passing Negative Rate Pain To Customers

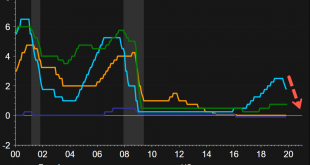

There’s been talk that the Federal Reserve will slam interest rates to zero or even negative when the next recession strikes. President Trump’s support for negative interest rates has quickly increased in the last several months as the latest tracking estimates for Q4 GDP have tumbled to sub 0.4%. It seems that policy rates in the US are too high — and will likely conform to the rest of the world, which is near zero to negative territory. This has undoubtedly...

Read More »USD/CHF Technical Analysis: 200-day SMA, 7-week-old trendline cap rise to 8-day high

Following its latest recovery, USD/CHF rises to the highest since the previous Tuesday. 200-day SMA and multi-week-old resistance line hold the key to pair’s run-up towards 1.0000 mark. 0.9870 can entertain short-term sellers. Based on its U-turn from 0.9870, the USD/CHF pair current takes the bids to the highest in eight-day while trading around 0.9940 during early Friday. However, 200-day Simple Moving Average (SMA) and a downward sloping trend line since...

Read More »The Deep State: The Headless Fourth Branch of Government

School children learn that there are three branches of government: the legislative, executive, and judicial. In actual practice, however, there are four branches of government. The fourth is what for decades now has been called a “headless fourth branch of government,” the administrative state. As early as 1937, in a ” Report of the President’s Committee on Administrative Management ,” the authors write: Without plan or intent, there has grown up a headless “fourth...

Read More »Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue South Africa is expected to cut rates by 25 bp to 6.25% Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected The dollar is mostly weaker against the majors in very narrow ranges as markets...

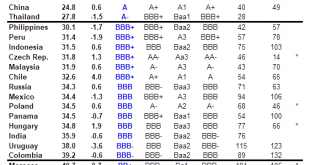

Read More »EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance. These scores...

Read More »Freedom Means a Right to Discriminate

Should employers have the right to discriminate in hiring on the basis of obesity? The Washington State Supreme Court recently ruled that “it is illegal for employers in Washington to refuse to hire qualified potential employees because the employer perceives them to be obese.” That follows guidelines released by the New York City Commission on Human Rights stating that discrimination against people based on their hairstyle will now be considered a form of racial...

Read More » SNB & CHF

SNB & CHF