We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. Flipping Homes, Consuming Capital First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size. For some reason, Ian offers to trade houses with Tim. Both own their houses free and clear, with no debt. So the swap is easy (though dubious why Ian would want to do it). Of course, being twice the size, the four-bedroom house is worth twice as much. The two-bedroom is worth 0,000 and the four-bedroom is 0,000. Mr. Housetrader feels very affected by the

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, capital consumption, dollar price, entrepreneur, Featured, gold basis, Gold co-basis, gold price, gold silver ratio, interest, liquidation, newsletter, principal, Profit, purchasing power, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer.

Flipping Homes, Consuming Capital

First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size. For some reason, Ian offers to trade houses with Tim.

Both own their houses free and clear, with no debt. So the swap is easy (though dubious why Ian would want to do it).

Of course, being twice the size, the four-bedroom house is worth twice as much. The two-bedroom is worth $200,000 and the four-bedroom is $400,000. Mr. Housetrader feels very affected by the wealth effect of having a house that’s worth twice as much. So he drains his bank account of $200,000, and goes on a drinking and gambling binge to Las Vegas.

Is this not perfectly rational? After all, we are taught to think of assets as being just as good as a bank account. We are told that the purpose of an asset is to store, and hopefully increase, one’s purchasing power. And Tim has done nothing more than spend the increase in his purchasing power. We are confident most people would recoil from this. There’s something about it that just feels wrong.

The Business of Home Flipping

So for our next example, we will try to blur the line a bit. Frank Flipper lives in a similar two-bedroom house as Timothy. His next door neighbor, Ram Arundownahomi, has a four-bedroom house. But it’s in bad condition. His carpets are stained and reek of cat urine. The walls are full of holes punched by his then-teenage son who is now a rock star. The landscaping is half-overgrown and half-dead. And the roof leaks.

Frank wants to buy the house. So he sells his two-bedroom house for $200,000, and uses the proceeds to buy the larger but rundown house. That house is in such poor condition, that Frank has money left over. He buys carpet, drywall, roofing materials, and new plants. He does all of the work himself. When he is done, he has an even money trade, and a house worth twice what his old house was worth—$400,000.

He sees that the buyer of his former house next door is getting transferred overseas and needs to sell. So Frank sells his newly-renovated four-bedroom house for $400,000 to Billy Bigborrower, and buys his old two-bedroom house back for $200,000. And he has $200,000 left over.

You see where this is going. Straight to a casino in Las Vegas, where Frank lives and gambles like a king until the $200,000 is all gone. Does hearing this story make you feel any less bad for Frank as compared to Timothy?

It may feel less wrong than the first, because Frank earned a profit. We will get back to that.

Now consider that Billy, the buyer of Frank’s newly-remodeled four-bedroom house, had $200,000 from the sale of his old house. And he borrowed the other $200,000. In this case, can we say that Frank’s binge is paid for by the borrowed funds provided by the depositors in Fort Bender Bank. The savers who live in Fort Bender paid for Frank’s bender, because Billy promises to repay them out of his future income.

Suppose Frank’s cousin, Homer Builderberg sells his house for $200,000. He buys a lot and builds a house on it. He sells the finished house to Inigo Prodigallo. Inigo has just inherited $400,000 from his deceased father, which he hands over to Homer. Homer—you guessed it—goes to Las Vegas to spend $200,000 which he says is well-earned. It would seem that Vegas is the place preferred by 9 out of 10 consumers to go to eat and drink the seed corn. At least in Monetary Metals’ fictitious anecdotes!

Consuming Gold Capital

For our final example, we will depart from houses and look at a gold mine. Mikey Miner finds an opportunity. A great big pile of old mine tailings is sitting on the ground on a 100-acre site. A century ago, with then-available technology, the miners extracted what gold they could. But their waste material still has several grams of gold per ton.

Mikey and his investors put 1,000 ounces of gold into the project to extract the gold from the tailings. Net of expenses, they end up with 2,000 ounces of gold.

Like Timothy, Mikey has traded a smaller asset for a larger. He and his investors had 1,000 ounces, and through business acumen and being in the right place at the right time, he was able to trade that up to 2,000 ounces.

These are all examples of capital consumption. Viewed one way, they range from easiest to see to hardest. In the first example, Timothy exchanges a capital asset for booze and entertainment. But in the last one, Mikey is clearly running a business venture. A business is supposed to make a profit, and that profit goes to the investors. We loudly and often say that the interest should be spent, not the principal. After interest to the investors, the rest is profit to the owners.

On the other hand, the gold example may be the clearest because gold is a capital asset. If one has 1,000oz gold or 2,000oz—if one trades a 1,000oz pile of gold for a 2,000oz pile—one still has a pile of gold which can command the capital that can be used in production. It’s the output of that capital—the produced goods—which should be consumed. Not the productive capital itself.

That’s why in the first example, we were excited that Timothy traded up to a better house, but we felt bad for him that he squandered the entire gain. We don’t feel quite the same way for Frank, Homer, and Mikey because they are expending productive effort to add value. So this leads to an important point that we have not heard, aside from one discussion with Professor Antal Fekete many years ago.

How to Account for the Gains

Conceptually, we can look at a profitable enterprise under a lens. If it is profitable, then (at least in a free market) it is creating wealth. It is adding value. And it captures some of this added value in the form of profit. We can break down this profit into various components. Those components are paid in the following order (which is not necessarily the order of importance).

First, labor is paid. It is both the law and it is right. If you hire a man to work, he is not taking the risk that your venture will be successful. He must be paid an honest wage for an honest day’s work. Second, the lender is paid. If you borrow money, you must pay it back with interest. If you cannot do that, then you arte bankrupt and the lender will get the assets in bankruptcy court. Third, management is paid its bonus for operating a profitable business. Next, the equity investors are paid a return on their capital. Finally, the entrepreneur earns his profit.

In small business, as with Frank and Homer, one person may occupy most or all of these distinct roles: labor, lender, manager, investor, and entrepreneur. However, even in such a case it is useful to consider the returns owned to each role separately.

In this light, we see that there is nothing wrong with even Timothy, as well as Frank, Homer, and Mikey, spending some of the gain. They literally earned it.

Frank and Homer first earned wages working in their own little enterprises. They should spend those wages on food and living expenses. They also put up the capital, and thereby earn some return on capital. Call it 10% for argument’s sake. They acted as manager, and earn a bonus, say 5%. And they are also entrepreneurs. The entrepreneur is paid last, and hence takes the biggest risk. And therefore, he often gets the biggest payday, at least in those ventures which achieve sufficient success to pay it. We will concede 35% to this portion.

That means that Timothy (who did not act as wage-earning worker, nor manager) might spend $80,000. Frank might spend $100,000, and Homer $120,000. Mikey is a more complicated case, as we did not discuss the details of labor, management, borrowing, equity, etc. But clearly he and his investors can justify spending some of that 1,000oz gain.

Don’t Squander the Gain to Capital

Our point, today, is that some of the $200,000 gain in the house examples and some of the 1,000oz gain in the gold mine example, is an increase in capital. While monetary policy and its bloody falling interest rate makes it tempting to think in terms of the purchasing power of capital, this is a deadly mistake. We mean literally deadly—this will kill our civilization, if taken to its logical end (for a current case study, look at Venezuela).

Keith talked about operating a farm to grow food vs. exchanging it for groceries (video at bottom of page). The same applies to other capital assets, such as real estate.

If one has a pile of gold, one should seek to earn a return on it rather than be a spender to go on a bender.

Supply and Demand

The price of gold dropped $20, and silver 43 cents. For reference, $20 was once worth just about an ounce of gold. Dollar was a unit of measure, a weight of gold equal to 1/20.67 ounce of fine gold. Today, it is an irredeemable currency, defined not as a unit of weight but as a unit of central bank liability which is backed by government debt, which is payable in this unit. The price of this unit is constantly changing, and mostly dropping. It is currently 1/1497 ounce.

It has dropped from 0.048 to .00067, which is a loss of over 98.6%. Gold, not consumer prices, should be used to measure changes in economic value over long periods of time. The cost of producing everything is vastly VASTLY lower today than it was a century ago. Even with the added useless ingredients. So using consumer prices to measure the dollar—which are themselves measured in dollars—is rather like using a falling chunk of wood to measure the velocity of a falling brick. The brick may be falling faster than the wood, but one should use sea level as the objective reference for altitude. And gold for economic value.

Anyways, stress in the repo market is not showing up as fear of counterparty risk. If it were, we would expect to see backwardation rear its head in the gold market. Nada.

Does that mean that there aren’t systemic problems, built up over a decade of zero interest rates and other new perverse incentives, piled on top of all the perverse incentives that existed prior to—and caused—the 2008 crisis? Oh, there are problems aplenty.

It’s just that market participants don’t fear them imminently. This may be because they expect the Fed and other central banks to jump on top of each incipient crisis, quashing it before it can blow up a major financial intermediary.

Of course, central bank intervention can no more prevent bank insolvency than jamming pennies in the fusebox can prevent circuit overloading. It does two things. One, it postpones the problem. Two, it ensures the problem will be larger or even systemic. Instead of burning out a fuse, the penny approach causes the house to burn down.

Market participants do not look so far into the future. As Chuck Prince, then CEO of Citigroup said on July 10, 2007, just over a year before the crisis went thermonuclear:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Today, everyone believes the Fed will be faster to react and will act more decisively than it did back then. All taboos have been shattered, it has no reason to hesitate as it did before 2008.

It is possible that there will be no more crises until the dollar and the monetary system collapse. Or, if there is a crisis, it will be something that no one recognizes as a problem.

One thing is for sure. The Fed recognizes that lack of liquidity can be a problem. Ergo, liquidity won’t be allowed to dry up and trigger a catastrophic process. Thus, last week’s Fed intervention in the repo market.

Another thing we would bet on: the system is now fragile enough that if another crisis gets going, it will carry a greater threat of banking system collapse than the crisis of 2008. So the Fed will act in any way it deems necessary to prevent this. Reason, morality, economics, and law be damned, if necessary.

Who knows how long they can keep it going? The Bank of Japan is about to enter the fourth decade of managing what has become a zombie system. For much of that time, observers have watched the debt to GDP ratio rise and rise, the interest rate approach zero, and other signs of The End. It hasn’t come yet. So some economists of the Cargo Cult persuasion have said it never will. Meanwhile, indicators keep moving further into unsustainable territory.

Now, the same zombification is occurring in Switzerland, Germany, and other countries in Europe. The interest rate on long Treasurys has resumed its fall.

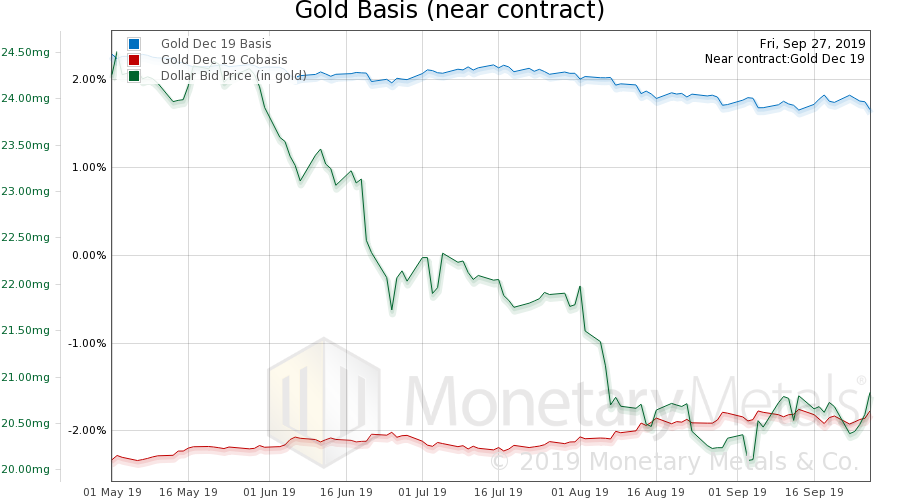

Gold backwardation will be our early warning signal. The gold price will not tell us if risk is rising or defaults are imminent. On the gold basis will indicate this.

Last week, we said:

“Whatever the ramifications of the repo crisis, they do not yet include systemic trust concerns. We do not expect the repo problem, in itself, to lead to such concerns or gold backwardation.”

And it did not, at least this week. And, like a respiratory distress patient in the Intensive Care Unit after a bad vape, survival after a week indicates a high probability of survival.

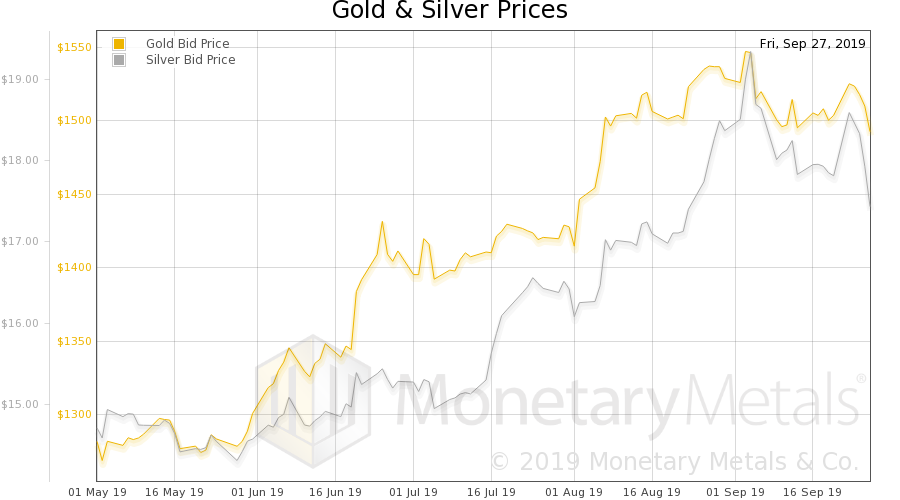

Gold and Silver PricesWe will look at the basis, which is the only true picture of the supply and demand fundamentals. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The scarcity (i.e. cobasis) rose a little bit this week. At least the near contract (but not the gold basis continuous). There is no profit to decarry gold. The profit is to carry it—that is buy gold and simultaneously sell it forward, warehousing it for the duration. For December, which is just 3 months, one can make about 1.7% annualized. This week, the Monetary Metals Gold Fundamental Price fell $33, to $1,459 |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

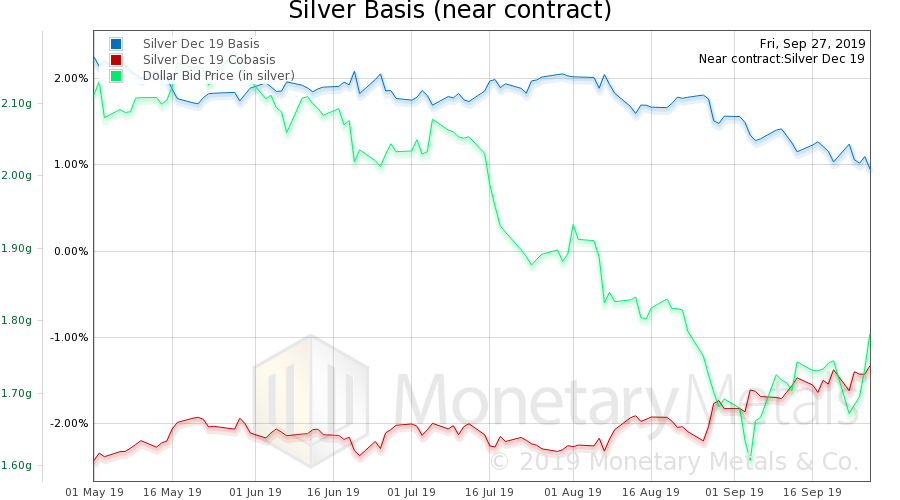

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, there was a small rise in the scarcity along with a big rise in the price of the dollar. The Monetary Metals Silver Fundamental Price dropped 62 cents, to $17.30 |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Tags: Basic Reports,capital consumption,dollar price,entrepreneur,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,interest,liquidation,newsletter,principal,profit,purchasing power,silver basis,Silver co-basis,silver price