On Thursday, only one return trip from Paris to Basel is planned (Keystone) A national strike in France is causing severe disruptions to high-speed TGV rail traffic between Paris and Switzerland. Swiss Federal Railways issued an advisory discouraging travel along this route from December 5 to 8. Only one TGV train will operate between France and Switzerland on Thursday. The disruption began on Wednesday afternoon with several trains from Paris cancelled, including...

Read More »All Signs Of More Slack

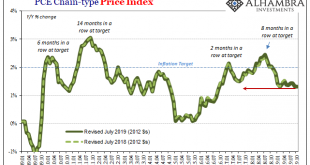

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years. Despite constantly referencing a tight labor market and its fabulous unemployment rate, broad...

Read More »More Signals Of The Downturn, Globally Synchronized

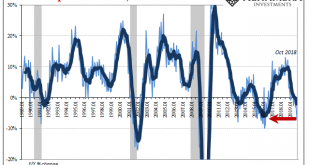

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October. For the Census Bureau’s trade data, that means this is the month that shines above...

Read More »Blue Laws: Consumers, Not Capitalists, Are the Reason We’re Working on Sunday

It has now become commonplace for politicians and media pundits to casually assert that "everyone" — to use Alexandria Ocasio-Cortez's term — is now working more and more hours — and perhaps two or three jobs — just to attain the most basic, near-subsistence standard of living. This is repeated time and time again, usually without context or supporting evidence. Never mind, for example, that the Bureau of Labor Statistics reports only around 5 percent...

Read More »FX Daily, December 6: And Now for the Employment Report

Swiss Franc The Euro has risen by 0.26% to 1.0977 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600...

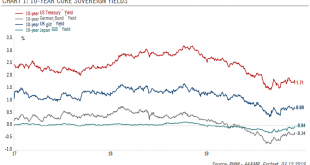

Read More »Core sovereign bonds 2020 Outlook

Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario. Overall, we expect a positive single-digit total return for 10-year Treasuries next year and a steepening...

Read More »USD/CHF Technical Analysis: Sluggish below 100-DMA, 38.2 percent Fibonacci

USD/CHF declines for the second consecutive day. 50% Fibonacci retracement, October low could challenge sellers. An upside break of 0.9890 highlights 200-DMA, 23.6% Fibonacci retracement. USD/CHF extends the recent pullback while flashing 0.9870 as a quote during early Friday. The pair recently pulled back from 100-Day Simple Moving Average (DMA) and 38.2% Fibonacci retracement of August-October rise. Prices are now likely declining towards 50% Fibonacci retracement...

Read More »Environmental spending and jobs on the rise

Spending on biodiversity was modest compared with expenditure on waste treatment and waste water management. (Keystone) Swiss spending on environmental protection has increased 45% in the last eighteen years, while the number of people employed in the sector has almost doubled. Environmental protection spending rose from CHF8.5 billion ($8.6 billion) in 2000 to CHF12.4 billion in 2018, according to the Federal Statistical Officeexternal link. As a percentage of GDP,...

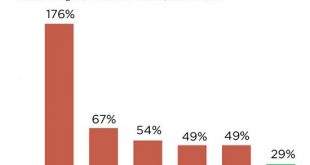

Read More »Costs Are Spiraling Out of Control

And how do we pay for these spiraling out of control costs? By borrowing more, of course. If we had to choose one “big picture” reason why the vast majority of households are losing ground, it would be: the costs of essentials are spiraling out of control. I’ve often covered the dynamics of stagnating income for the bottom 90%, and real-world inflation, i.e. a decline in purchasing power. But neither of these dynamics fully describes the relentless upward spiral...

Read More »Largest Gold Nugget in Britain Found in River in Scotland – “Experts” Concerned About a Scottish Gold Rush

The largest gold nugget in Britain has been found in a Scottish river, as experts reveal that members of the public are taking up hunting after watching YouTube clips. The diver, who wishes to remain anonymous, discovered the £80,000 “doughnut-shaped” nugget using a method called “sniping”, in which a prospector uses a snorkel and hand tools to scan the riverbed for treasures. The 22-carat lump, found in two separate pieces ten minutes apart in an undisclosed river...

Read More » SNB & CHF

SNB & CHF