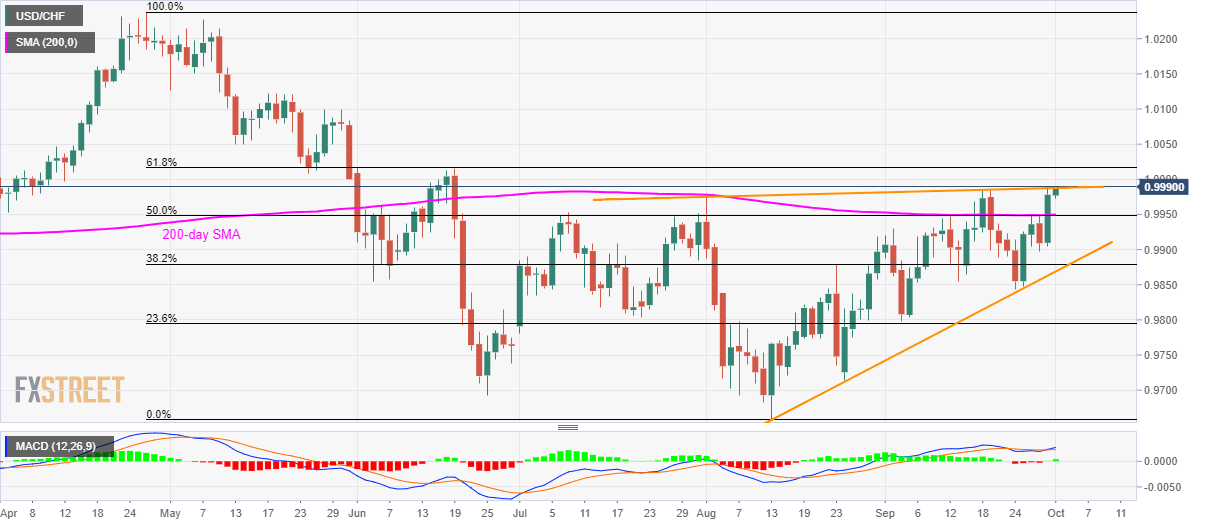

USD/CHF again aims to break two-month long rising trend-line, part of a bearish technical formation. Bullish MACD can trigger an uptick to 61.8% Fibonacci retracement. Sustained trading above 0.9948/50 confluence again propels USD/CHF to confront near-term key resistance-line while taking the bids to 0.9988 amid Tuesday’s Asian session. A rising trend-line since August-start, coupled with another one connecting lows marked since August 13, portrays a short-term bearish technical formation that gets confirmed on the break of the support line. However, pair’s run-up beyond 0.9990 resistance will defy the pattern and could extend the run-up to 61.8% Fibonacci retracement level of April-August declines, at 1.0016. During the pair’s further advances past-1.0016,

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF again aims to break two-month long rising trend-line, part of a bearish technical formation.

- Bullish MACD can trigger an uptick to 61.8% Fibonacci retracement.

| Sustained trading above 0.9948/50 confluence again propels USD/CHF to confront near-term key resistance-line while taking the bids to 0.9988 amid Tuesday’s Asian session.

A rising trend-line since August-start, coupled with another one connecting lows marked since August 13, portrays a short-term bearish technical formation that gets confirmed on the break of the support line. However, pair’s run-up beyond 0.9990 resistance will defy the pattern and could extend the run-up to 61.8% Fibonacci retracement level of April-August declines, at 1.0016. During the pair’s further advances past-1.0016, mid-May lows nearing 1.0050 and 1.0100 will flash on bulls’ radar. Alternatively, pair’s decline below 0.9950/48 support-confluence including 200-day simple moving average (SMA) and 50% Fibonacci retracement could recall 0.9900 to the chart while formation’s support-line close to 0.9870 might challenge bears then after. |

USD/CHF daily chart, April - October 2019(see more posts on USD/CHF, ) |

Trend: bullish

Tags: Featured,newsletter,USD/CHF