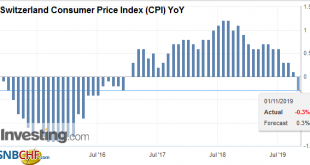

01.11.2019 – The consumer price index (CPI) fell by 0.2% in October 2019 compared with the previous month, reaching 101.8 points (December 2015 = 100). Inflation was –0.3% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The decrease of 0.2% compared with the previous month can be explained by several factors including falling prices for international package holidays and hotel accommodation. The prices...

Read More »Swiss Retail Sales, August 2019: +0.6 percent Nominal and +0.9 percent Real

01.11.2019 – Turnover adjusted for sales days and holidays rose in the retail sector by 0.6% in nominal terms in September 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 0.9% in September 2019 compared with the previous year. Real growth...

Read More »SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc. “Without negative rates, the Franc would be more attractive and rise in value,” Jordan further argued. The USD/CHF pair largely ignored Jordan’s comments and was last seen trading at 0.9875, down 0.18% on a daily basis....

Read More »USD/CHF technical analysis: Greenback nearing the October lows, consolidating near 0.9870 level

USD/CHF is consolidating its losses this Thursday. The level to beat for bears is the 0.9855 support. USD/CHF daily chart On the daily chart, USD/CHF is trading in a range below its main daily simple moving averages (DSMAs). The market is approaching the October low, currently at the 0.9837 price level. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart USD/CHF is under bearish pressure below its main SMAs as the market...

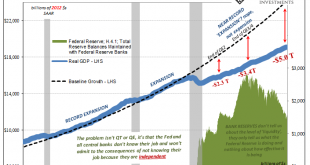

Read More »Three (Rate Cuts) And GDP, Where (How) Does It End?

The Federal Reserve has indicated that it will now pause – for a second time, supposedly. Remember the first: after raising its benchmark rates apparatus in December while still talking about an inflationary growth acceleration requiring even more hikes throughout 2019, in a matter of weeks that was transformed into a temporary suspension of them. Expecting the easy disappearance of “transitory” factors, that Fed pause was to be followed by the second half rebound...

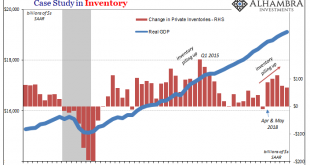

Read More »The Inventory Context For Rate Cuts And Their Real Nature/Purpose

What typically distinguishes recessions from downturns is the inventory cycle. Even in 2008, that was the basis for the Great “Recession.” It was distinguished most prominently by the financial conditions and global-reaching panic, true, but the effects of the monetary crash registered heaviest in the various parts of that inventory process. An economy for whatever reasons slows down. That leads to inventory piling up across the various levels of the supply chain....

Read More »Global Economy Faces ‘Scary Situation’ – Billionaire Investment Manager Dalio Warns

Likely to have a downturn while “there is noteffective monetary policy and that is a ‘scary situation’ – Billionaire Investment Manager Ray Dalio [embedded content] Prepare Now! Risk Of Contagion In Today’s Fragile Monetary World [embedded content] Related posts: JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’ Oil prices and the global economy SNB to cut rates in early 2020 as global economy sours – UBS...

Read More »FX Daily, October 31: No Good Deed Goes Unpunished

Swiss Franc The Euro has fallen by 0.32% to 1.0993 EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity and bond rally in North America yesterday carried over into today’s session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P...

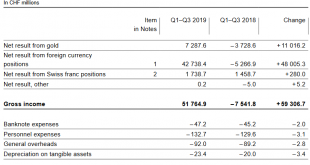

Read More »The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »SNB erzielt in den ersten 9 Monaten 2019 Gewinn von über 50 Milliarden Franken

Insgesamt verdiente die Nationalbank in der Periode von Januar bis September 2019 51,5 Milliarden Franken, wie sie am Donnerstag mitteilte. Nach einem Plus von 38,5 Milliarden in der ersten Jahreshälfte kamen damit im dritten Jahresviertel nochmals 13,0 Milliarden dazu. Der Löwenanteil des Neunmonats-Gewinns stammt wie schon zum Halbjahr von den Fremdwährungspositionen mit 42,7 Milliarden Franken. Auf dem Goldbestand der SNB resultierte derweil ein Bewertungsgewinn...

Read More » SNB & CHF

SNB & CHF