When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time. That has proven to be valuable advice over the years and I think still relevant today. We continue to hear, on an...

Read More »State railway company beset with fresh problems

The new train, as seen in a photo taken at Zurich main station from 2018 (© Keystone / Ennio Leanza) All the Swiss Federal Railways’ new Bombardier double-decker trains will have to go in for repairs for certain parts to be replaced, it has emerged. The news of the latest technical problems was broken by Swiss public television SRFexternal link, citing internal documents. At present, 12 out of the 59 Bombardierexternal link trains are in operation on a line between...

Read More »Floating solar panels unveiled in Swiss Alps

Lac des Toules sits at 1,810 metres above sea level in canton Valais. (Keystone / Valentin Flauraud) A solar panel project which could power over 6,000 households has been launched in a mountain lake in southwestern Switzerland. The Romande Energie companyexternal link unveiled the first part of its floating solar project in Bourg-Saint-Pierre on Wednesday after six years of exploratory work. The installation consists of 2,240 square metres of solar panels sitting on...

Read More »FX Daily, October 11: Nothing Like Approaching the Edge to Focus the Minds

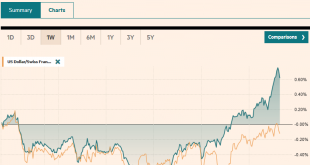

Swiss Franc The Euro has risen by 0.56% to 1.1031 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the edge of the abyss is approached in three distinct areas, there is hope that victory can be snatched from the jaws of defeat. US-China trade talks continue today, and there is hope of a small deal that could lead to the US not hiking tariffs next week. A shift in the UK toward a...

Read More »USD/CHF: Bulls have eyes on a break into the 1.000s in pursuit of channel resistance

USD/CHF has met a confluence of support as the US Dollar extends higher. Latest positioning data shows that CHF net shorts had been climbing for a third week. FOMC minutes at the top of the hour is next major risk. USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee’s Minutes today and US consumer Price Index tomorrow. Currently, USD/CHF is trading at 0.9952 having travelled between 0.9915...

Read More »EU removes Switzerland from tax haven lists

The move had been expected (Keystone / Peter Klaunzer) Switzerland has acknowledged the fact that European Union will remove the country from its grey list for tax havens following a reform of the corporate tax system. “Switzerland meets and implements international tax standards. The European Union has acknowledged this…” said a statement,external link released by the State Secretariat for International Finance (SIF), on Thursday. The country, which is a major EU...

Read More »Nationalbank und SIX kooperieren bei digitalem Zentralbankgeld

Im Kontext des neu gegründeten BIZ-Innovation-Hub-Zentrum in der Schweiz kooperieren die SNB und SIX bei einer Machbarkeitsstudie für digitales Zentralbankgeld. (Bild: Pixabay) Die Schweizerische Nationalbank (SNB) und die Bank für Internationalen Zahlungsausgleich (BIZ) haben am Dienstag eine operative Vereinbarung zum BIZ-Innovation-Hub-Zentrum in der Schweiz unterzeichnet. Ziel des Innovation-Hub ist es laut SNB, vertiefte Erkenntnisse über die relevanten...

Read More »Geneva commuters fall out of love with cars

Geneva officials are hoping that the Léman Express cross-border rail network, which is due to be inaugurated on December 15, will revolutionise local mobility and commuting (Keystone / Salvatore Di Nolfi) Commuters in the Geneva region are becoming increasingly disillusioned with private cars and are embracing “multimodal” forms of transport, a survey has found. An in-depth survey of commuter behaviour in the Greater Geneva region – covering canton Geneva, the Nyon...

Read More »The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much. Especially not with world’s economy roaring under globally synchronized growth. Even though there were warning signs already by...

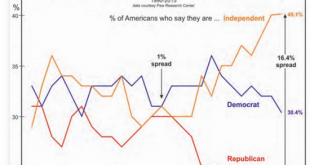

Read More »Will the Clintons Destroy the Democratic Party?

History is full of ironies, and perhaps it will suit the irony gods for The Donald to take down the Republican Party and the Clinton dynasty to destroy the Democratic Party. Let’s start by stipulating my bias: I would cheer the collapse of both self-serving, venal political parties, which have stood by for decades as the rich have become immeasurably richer and the politically powerful few have disempowered the many. The transparent “populist” bleatings of both...

Read More » SNB & CHF

SNB & CHF