Tariffs on Chinese goods would seem to be having little impact on some retail prices so far.US core inflation (excluding energy and food prices) remains relatively muted, slowing slightly to 2.1% y-o-y in October, from 2.2% in September. The average over the past year is 2.1%.To some degree, the surprise was that prices did not increase more, especially given fresh tariffs on Chinese imports. In late September the Trump administration imposed a 10% tariff on roughly USD200 billion of Chinese imports after having placed a 25% tariff on USD50 billion of imports over the summer. The tariff rate is set to increase from 10% to 25% (still on half of Chinese imports) in January, with American officials suggesting possible bilateral discussions at the end-November G20 meeting in Buenos Aires

Topics:

Thomas Costerg considers the following as important: China trade war, Chinese import tariffs, Macroview, US consumer inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Tariffs on Chinese goods would seem to be having little impact on some retail prices so far.

US core inflation (excluding energy and food prices) remains relatively muted, slowing slightly to 2.1% y-o-y in October, from 2.2% in September. The average over the past year is 2.1%.

To some degree, the surprise was that prices did not increase more, especially given fresh tariffs on Chinese imports. In late September the Trump administration imposed a 10% tariff on roughly USD200 billion of Chinese imports after having placed a 25% tariff on USD50 billion of imports over the summer. The tariff rate is set to increase from 10% to 25% (still on half of Chinese imports) in January, with American officials suggesting possible bilateral discussions at the end-November G20 meeting in Buenos Aires would not change anything in the near term.

The latest US tariffs on Chinese imports mostly fall on consumer goods such as consumer electronics (but not yet smart phones or tablets) as well as furniture.

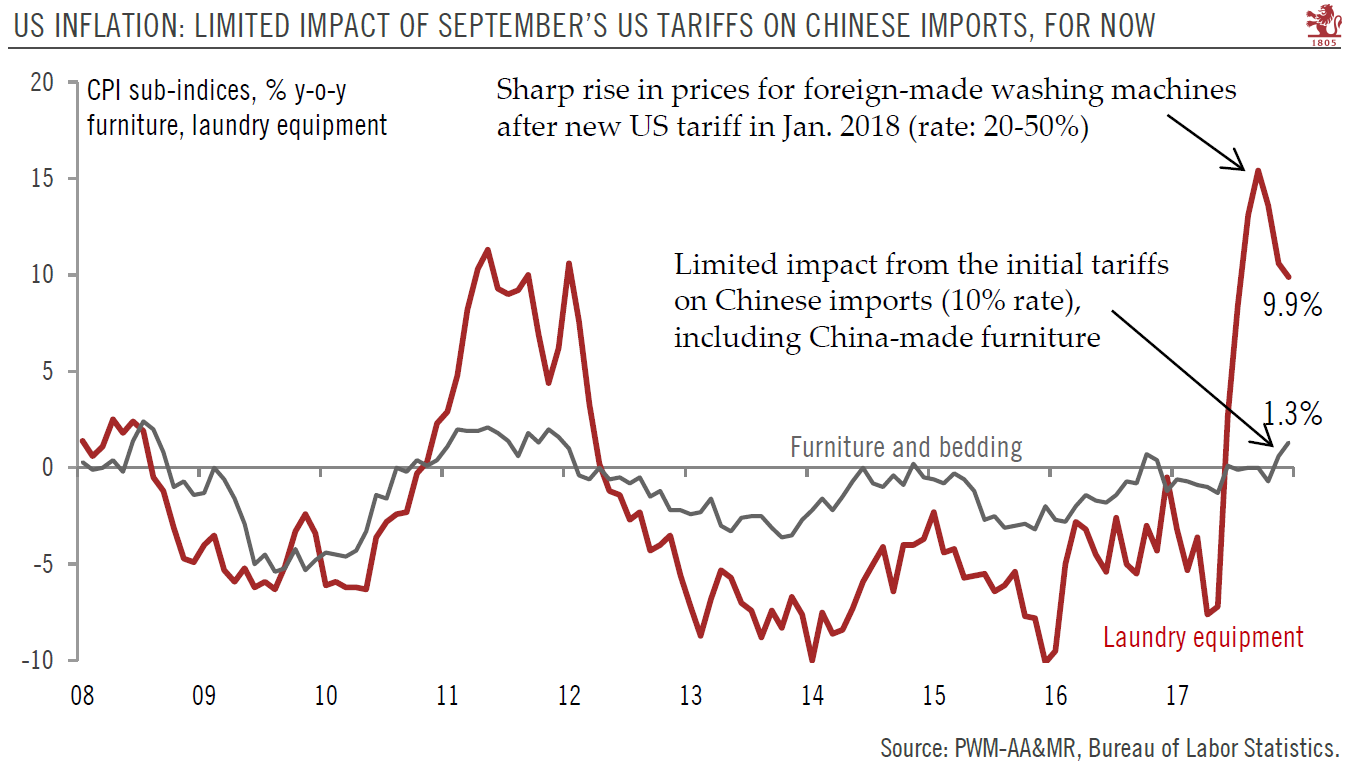

So it was to some degree reassuring to see that the new tariffs on furniture have not produced a big rise in furniture prices. Prices rose only 1.3% y-o-y in October, although that was still a step up from +0.6% in September and -0.7% in August. Furniture prices have actually decreased by an average of 1.1% per annum since 2008.

There may still be further increases in furniture prices in November and December. Still, early indications are that retail firms have preferred to cut their margins to absorb the new tariffs rather than pass on the extra cost to consumers. Also, other furniture makers do not seem to have used the US tariffs as a convenient excuse to raise their prices.

Perhaps the 10% tariff price is more easily absorbed, and less a catalyst for price hikes across the sector, than the 20-50% tariffs placed on foreign-made washing machines last January. The retail price for washing machines in the US is up about 10% year on year as retailers reacted to the tariffs.

Overall, the limited evidence we have so far slightly undermines our view that the current tariffs could initially add at least 0.2 percentage points to core PCE inflation in 2019, increasing to 0.4 percentage points if the tariffs are extended to all Chinese imports, as is currently our base case scenario. We will monitor furniture prices closely in next month’s CPI release to form a better judgement of the extent to which tariffs are being absorbed by cutting profit margins, and by enduring dollar strength.