Historical data suggest that, instead of boosting consumer spending, lower oil prices can harm the US economy’s growth prospects and persuade the Fed to stall its tightening plans.The link between oil prices and the health of the US economy has changed considerably this decade, especially as a result of the domestic energy sector boom. The US produced a record high of 11.7 million barrels per day last week, versus only around 5 million in 2008.The epicentre of this oil boom, linked to developments in shale oil extraction, has been Texas, whose economy has flourished as a result. Even if locals insist that the Texas economy has diversified significantly since the 1980s (when it suffered from the oil boom and bust cycle), a look at recent growth data suggests otherwise: the link between

Topics:

Thomas Costerg considers the following as important: Macroview, Oil, oil prices, Texas oil production, US economic growth

This could be interesting, too:

Marc Chandler writes Greenback Returns Better Bid

Douglas R. Terry, CFA writes Macro: Sep CPI stuck at 3.7% YOY

Marc Chandler writes The Dollar and Oil Steady After Yesterday’s Advance

Marc Chandler writes Dollar Comes Back Bid

Historical data suggest that, instead of boosting consumer spending, lower oil prices can harm the US economy’s growth prospects and persuade the Fed to stall its tightening plans.

The link between oil prices and the health of the US economy has changed considerably this decade, especially as a result of the domestic energy sector boom. The US produced a record high of 11.7 million barrels per day last week, versus only around 5 million in 2008.

The epicentre of this oil boom, linked to developments in shale oil extraction, has been Texas, whose economy has flourished as a result. Even if locals insist that the Texas economy has diversified significantly since the 1980s (when it suffered from the oil boom and bust cycle), a look at recent growth data suggests otherwise: the link between growth in Texas and oil prices is still very strong.

The first test of the shale oil boom came in 2015-2016 when oil prices dropped sharply, especially when WTI oil dropped below USD 30 per barrel (bbl) in January 2016. Most local oil producers, backed up by a recent Dallas Fed survey, say that a new well only becomes profitable at around USD55/bbl.

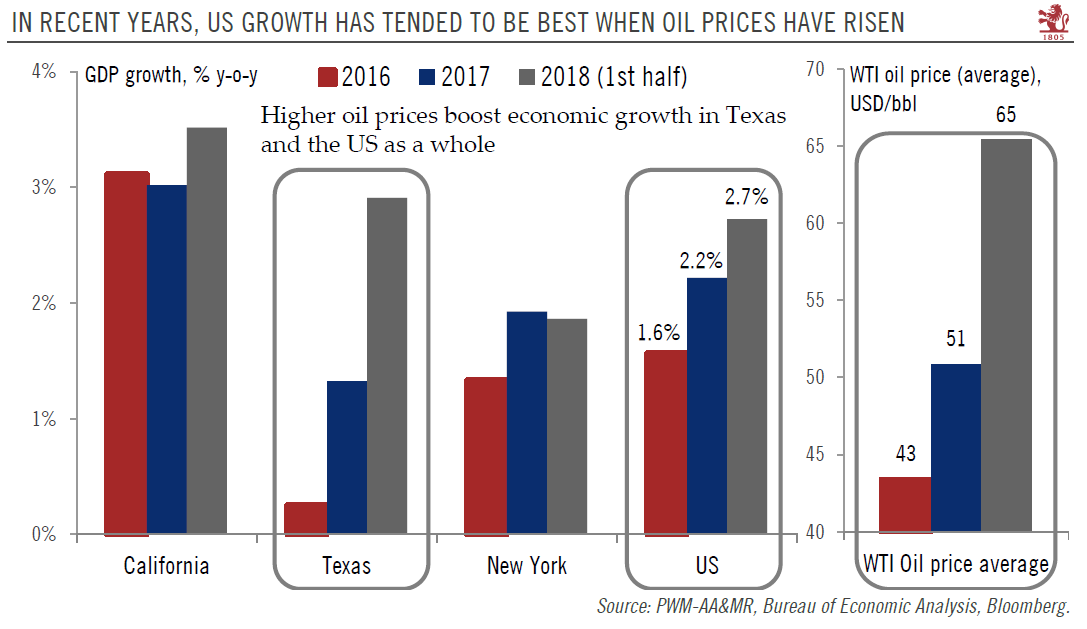

GDP growth in Texas slumped to only 0.3% in 2016. By 2017, as oil prices recovered, annual growth rose to 1.3%, while an average oil price of USD 65/bbl in the first half of this year lifted prosperity even more: Texas’ GDP growth averaged 2.9% in the first half of this year, higher than nationwide growth of 2.7%. (State-level GDP data for Q3 2018 is not yet available).

A detailed look at data shows that much of the variation in US growth in the past couple of years is due to Texas (see Chart). US growth is closely tied to developments in its second-biggest state. By contrast, drops in oil prices do not seem to have much of an impact on growth in big gasoline-consuming states like California and New York (respectively the first and third biggest states by GDP, where lower prices should, theoretically, boost consumers’ disposable incomes).

We will therefore watch how oil prices evolve very closely, since the impact on Texas could affect the growth outlook for the US as a whole in 2019. A further slide in oil prices could bring back memories of 2016, when the slump in the Lone Star State took nationwide growth with it. This being said, 2016 was also marked by a sharp tightening in financial conditions (in part because credit markets tensions for energy companies rippled across broader markets). As well as oil, how financial conditions evolve will thus be a key ingredient for the 2019 outlook.

The drop in oil prices in early 2016 unsettled the Fed, which had just started to hike rates (in December 2015). The Fed did not raise rates again until December2016, and only decided to cease its QE programme in September 2016. Since then, it has systematically increased rates once per quarter. Should oil prices continue to slide, the Fed would likely have to revise down its 2019 growth forecast, (as would we), and, conceivably, the Fed may pause the rate-hiking cycle earlier than in September 2019, which is our current baseline scenario.