German economy should rebound this quarter, but external demand poses a downside risk.Real GDP in Germany fell 0.2% q-o-q in Q3, compared with a 0.5% rise in Q2. This was below consensus and marks the first quarterly contraction in GDP since Q1 2015. The headline number looks horrible, but the market was prepared, as high-frequency data were already pointing in that direction.As usual, the Federal Statistical Office will release more detailed information on the GDP expenditure components on November 23. Analysis of the press release shows that growth was dragged down by net trade for the second quarter in a row in Q3. Exports fell while imports rose. There were mixed signals from domestic demand. While gross fixed capital formation both in machinery and equipment and in construction rose

Topics:

Nadia Gharbi considers the following as important: euro area growth, German wages, Germany, Macroview

This could be interesting, too:

Marc Chandler writes French Government on Precipice, Presses Euro Lower

Marc Chandler writes Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Marc Chandler writes Searching for Direction

Marc Chandler writes Serenity Now

German economy should rebound this quarter, but external demand poses a downside risk.

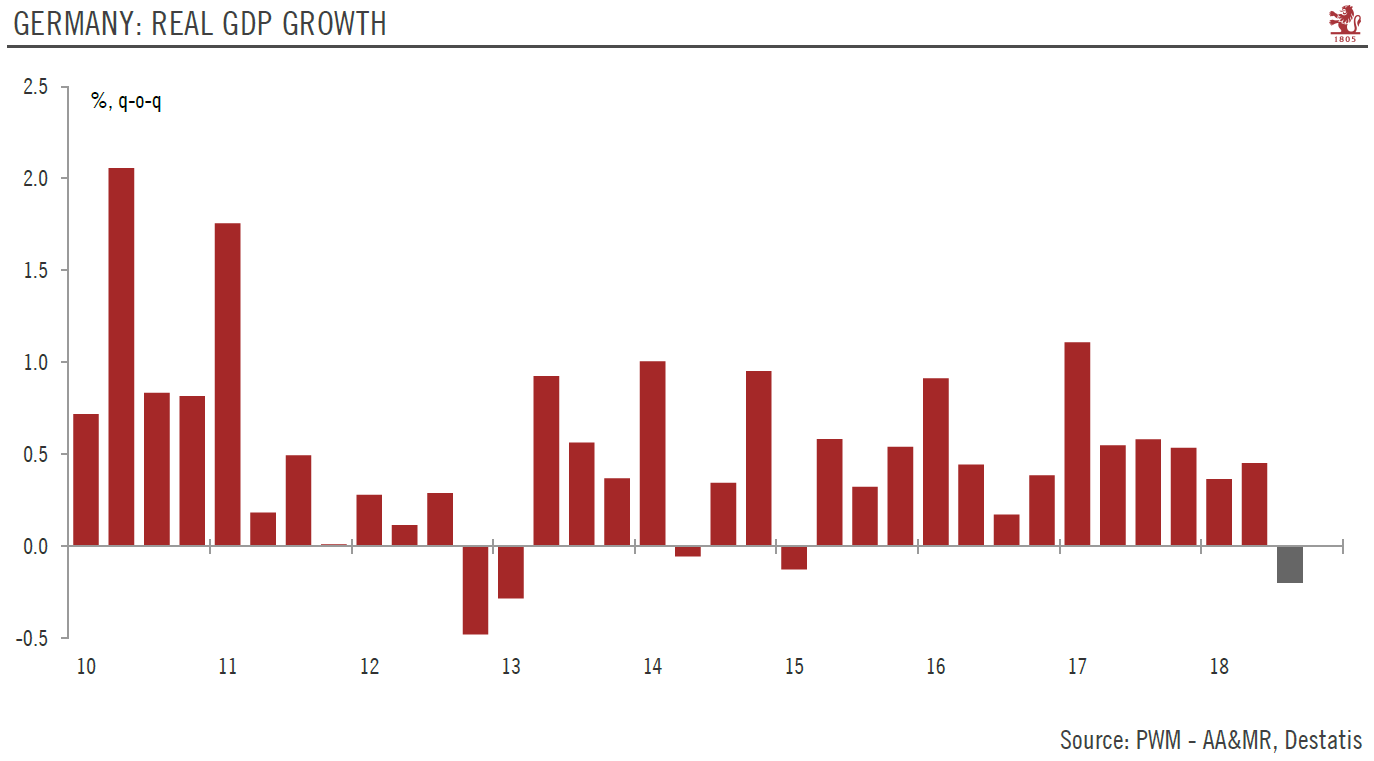

Real GDP in Germany fell 0.2% q-o-q in Q3, compared with a 0.5% rise in Q2. This was below consensus and marks the first quarterly contraction in GDP since Q1 2015. The headline number looks horrible, but the market was prepared, as high-frequency data were already pointing in that direction.

As usual, the Federal Statistical Office will release more detailed information on the GDP expenditure components on November 23. Analysis of the press release shows that growth was dragged down by net trade for the second quarter in a row in Q3. Exports fell while imports rose. There were mixed signals from domestic demand. While gross fixed capital formation both in machinery and equipment and in construction rose from the previous quarter, household consumption declined slightly. Government spending contributed modestly to growth.

The Q3 drop in private consumption was somewhat surprising given buoyant consumer sentiment and a booming labour market. Data published next week will probably help to understand what happened. Looking ahead, private consumption continues to be supported by a strong pick up in negotiated wages and healthy labour market.

The Federal Statistical Office did not mention the production accounts explicitly, but it is clear that weak production dynamics in the manufacturing sector weighed significantly on GDP growth in Q3. The shift to the new Worldwide Light-Vehicle Emissions Testing Protocol (WLTP) has disrupted the German auto industry, leading to a considerable decline in output in recent months. While we expect the negative impact on growth from WLTP to unwind progressively, it could take some time.

Apart from specific issues regarding the auto sector, the German economy was also impacted by the weakness in external demand in Q3. Given the open nature of Germany’s economy, net trade was a significant drag on growth for the second consecutive quarter.

Overall, we expect the German economy to return to growth in Q4, as private consumption should rebound and the negative effect of the new EU emission test protocol fade. However, uncertainty regarding the strength of external demand poses some downside risk.