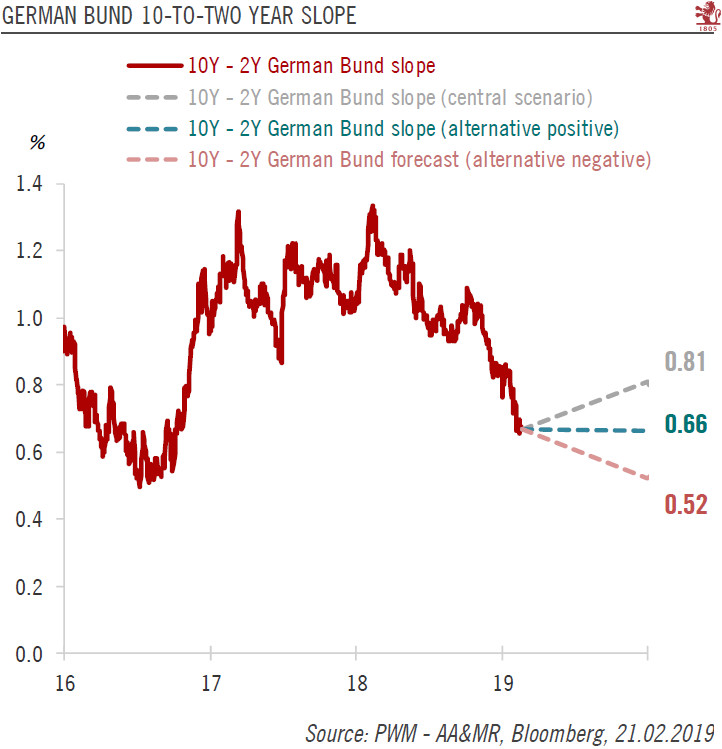

After a difficult second half of 2018, the outlook for Germany's economy and soverign bonds turns brighter.A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018, the economic slowdown and the Bund’s safe haven status are all factors behind the German bund’s yield fall.Based on our central scenario (to which we assign 55% probability), we expect the 10-year Bund yield to rise from its current low level of 0.13% (as on 21 February) to 0.3% by mid-year and 0.5% by the end of 2019. All in all, we continue to see limited value in core euro

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: German Bund yield, German PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After a difficult second half of 2018, the outlook for Germany's economy and soverign bonds turns brighter.

A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018, the economic slowdown and the Bund’s safe haven status are all factors behind the German bund’s yield fall.

Based on our central scenario (to which we assign 55% probability), we expect the 10-year Bund yield to rise from its current low level of 0.13% (as on 21 February) to 0.3% by mid-year and 0.5% by the end of 2019. All in all, we continue to see limited value in core euro government bonds and remain underweight.