An extension of the Brexit deadline looks likely, but for what?Recent political developments in the UK and the increased focus on an extension to the current Brexit deadline in particular, have reduced the risk of a ‘no deal’ Brexit on 29 March. Prime Minster Theresa May will put her divorce deal to another Parliament vote on 12 March. While the vote will likely be much narrower than the initial vote in January, we assume that it will also be rejected.This will open the door for another vote on 14 March, when Parliament will vote on an extension – possibly until end June – of the Brexit deadline, although this would also require the consent of all EU member states. We now assume an extension as our central scenario.An extension would keep a lot of uncertainties on the table, however.

Topics:

Team Asset Allocation and Macro Research considers the following as important: Brexit, Brexit sterling, Macroview

This could be interesting, too:

Claudio Grass writes “Inflation it is not an act of God”

Claudio Grass writes “Inflation it is not an act of God”

Dirk Niepelt writes The Economics of Brexit

Marc Chandler writes High Anxiety: China’s Covid and US Inflation

An extension of the Brexit deadline looks likely, but for what?

Recent political developments in the UK and the increased focus on an extension to the current Brexit deadline in particular, have reduced the risk of a ‘no deal’ Brexit on 29 March. Prime Minster Theresa May will put her divorce deal to another Parliament vote on 12 March. While the vote will likely be much narrower than the initial vote in January, we assume that it will also be rejected.

This will open the door for another vote on 14 March, when Parliament will vote on an extension – possibly until end June – of the Brexit deadline, although this would also require the consent of all EU member states. We now assume an extension as our central scenario.

An extension would keep a lot of uncertainties on the table, however. Notably, it would mean that a ‘no deal’ could still happen. From a macro perspective, an extension would likely continue to dampen business sentiment, which is already crystallising in subdued investment and dampening GDP growth. Risk to our annual UK GDP growth forecast of 1.4% are to the downside, as investment could continue to underwhelm.

While our view remains that Brexit will be ‘smooth’, we still cannot entirely rule out a hard Brexit, given the ongoing confused UK political scene. A hard Brexit could still happen by accident.

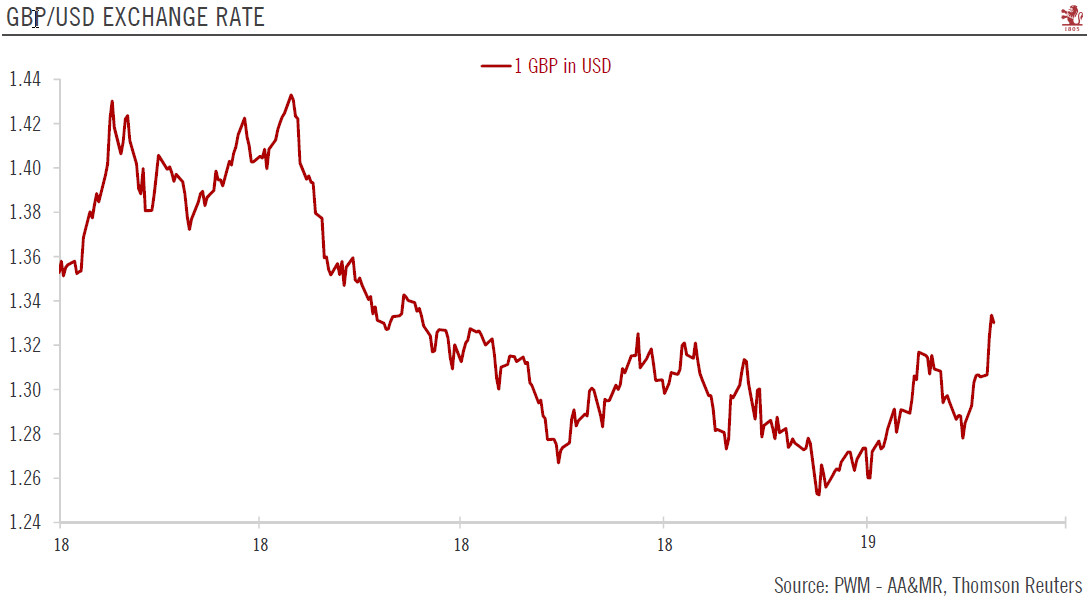

From a FX perspective, the prospect of a short-term extension is unlikely to be supportive of sterling, as it only extends uncertainty. We stick to our three-month projection of USD1.32 per GBP.