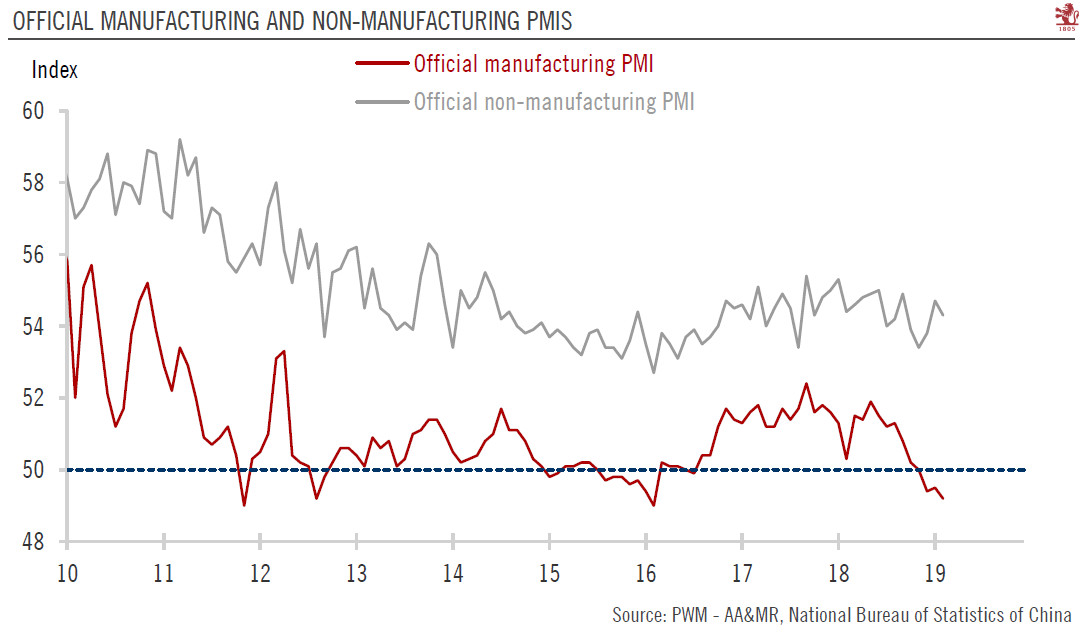

Latest data point toward continued deceleration in China in February, especially in the external sector.Chinese official manufacturing and non-manufacturing purchasing manager indexes (PMI) fell again in February, following a pause in January. The manufacturing PMI came in at 49.2, down from 49.5 in the previous month. The non-manufacturing PMI, while continuing to signal expansion, also fell in February—to 54.3, from 54.7 the previous month.The data show a divergence between the performances of large enterprises and small- and medium-sized enterprises (SMEs), suggesting that the government’s stimulus so far has mainly benefited the former.After a rebound in January, trade activity remained weak, with the new export and imports orders sub-indexes falling again in February.On the domestic

Topics:

Dong Chen considers the following as important: China PMI, Chinese economy, Chinese manufacturing, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest data point toward continued deceleration in China in February, especially in the external sector.

Chinese official manufacturing and non-manufacturing purchasing manager indexes (PMI) fell again in February, following a pause in January. The manufacturing PMI came in at 49.2, down from 49.5 in the previous month. The non-manufacturing PMI, while continuing to signal expansion, also fell in February—to 54.3, from 54.7 the previous month.

The data show a divergence between the performances of large enterprises and small- and medium-sized enterprises (SMEs), suggesting that the government’s stimulus so far has mainly benefited the former.

After a rebound in January, trade activity remained weak, with the new export and imports orders sub-indexes falling again in February.

On the domestic front, the picture is mixed. The production sub-index slid into contraction territory (49.6) in February, compared to 50.9 in January. The employment sub-index moved lower from the previous month and also signals a contraction in activity.

Overall, the latest PMI report is consistent with our expectation for further deceleration of the Chinese economy, despite the encouraging credit growth in January. We maintain our view that growth may continue to decelerate in H1 2019 before staging a modest rebound in H2.