With stronger US growth than expected in the fourth quarter, we do not expect a recession in 2019.Q4 2018 GDP growth was healthy at 2.6% quarter-on-quarter (q-o-q) seasonally adjusted annual rate (SAAR), close to the average over the previous three quarters (2.5%). Annual growth for 2018 was 2.9%.A particularly bright spot in Q4 was business investment, led by spending on equipment and software. Such business investment strength is particularly good news for the sustainability of the US business cycle. The risk of a recession this year remains remote, in our opinion.Still, US growth is likely to slow this year as both consumer spending and investment may decelerate. We continue to expect 2.2% annual growth in 2019, in line with the average since 2010.Q1 GDP growth could be affected by the

Topics:

Thomas Costerg considers the following as important: Macroview, US GDP growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

With stronger US growth than expected in the fourth quarter, we do not expect a recession in 2019.

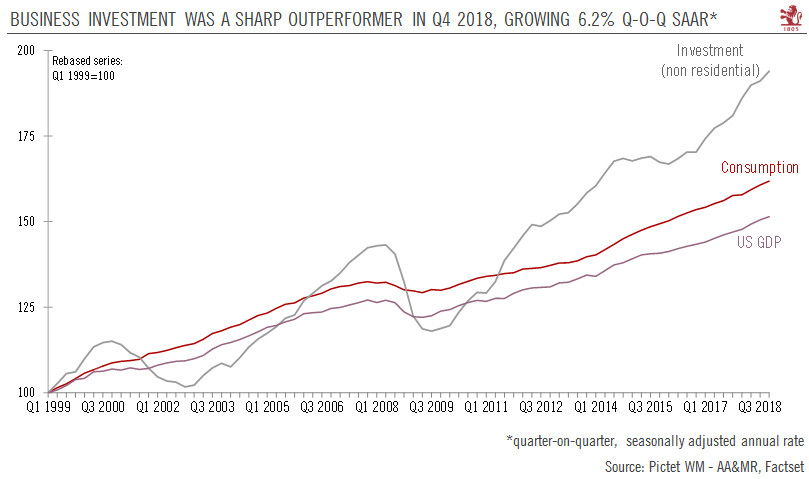

Q4 2018 GDP growth was healthy at 2.6% quarter-on-quarter (q-o-q) seasonally adjusted annual rate (SAAR), close to the average over the previous three quarters (2.5%). Annual growth for 2018 was 2.9%.

A particularly bright spot in Q4 was business investment, led by spending on equipment and software. Such business investment strength is particularly good news for the sustainability of the US business cycle. The risk of a recession this year remains remote, in our opinion.

Still, US growth is likely to slow this year as both consumer spending and investment may decelerate. We continue to expect 2.2% annual growth in 2019, in line with the average since 2010.

Q1 GDP growth could be affected by the partial federal government shutdown; we expect a slowdown in growth below 2%, followed by a rebound in Q2 2019.

The Federal Reserve is unlikely to roll back its dovish rhetoric – even if this healthy Q4 print is evidence that it may have backed down on hikes too pre-emptively – and we still expect rates to remain unchanged at the March meeting. We continue to expect one rate hike this year, in June, with the risk to our scenario remaining to the downside (no hike). Much will depend on how growth in China evolves in coming months.