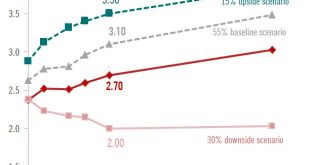

With global recession risks on the rise and the US treasury yield curve still threatening to invert, we remain neutral on US Treasuries.Since our December note on the 2019 outlook for US Treasuries, the environment for US bonds has shifted dramatically. The 10-year US Treasury yield reached a low of 2.56% on 3 January, the day before Jay Powell, chairman of the US Federal Reserve (Fed), made a U-turn from a hawkish to a dovish stance. Taking note of this regime shift, we are revising our...

Read More »OPEC+ discipline will be key for oil prices in 2019

An extension of the December agreement to cut production, plus a slight increase in demand, could potentially bring the oil market into balance this year.Global oil supply is undergoing a structural shift. The US oil industry is growing in importance relative to the OPEC. As a result increased production from non-OPEC producers more than compensated for the output collapse among important OPEC producers such as Iran and Venezuela in 2018.Slowing global growth, and new US pipelines facilities...

Read More »Weekly View – Christmas in January

The CIO office’s view of the week ahead.US equities recorded their best January performance in over three decades, with the S&P 500 up close to 8%. The market has been helped by the decision by Fed chairman Jerome Powell to step back from ‘quantitative tightening’, putting rate hikes on hold and contemplating an early end to balance sheet reduction. A number of factors explain this new dovishness: fears about global growth, the absence of inflation pressure and evidence that financial...

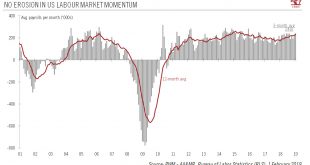

Read More »US jobs report shows recession risk is limited

In spite of the federal shutdown and the loss in growth momentum in other countries, the US continues to churn out jobs, while a dovish Fed may prolong the economic cycle.US employment rose by a solid 304,000 in January (+1.9% year on year, y-o-y), compared with 222,000 in December. The three-month average was a healthy 241,000/month. Meanwhile, the ISM manufacturing survey rose to a robust 56.6 in January from 54.3 in December.Overall, these two pieces of data suggest that US macro momentum...

Read More »House View, February 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWith expectations for earnings growth continuing to be ratcheted down, the recent rebound in equities owes a lot to the decline in valuations. We therefore remain neutral on equities overall. However, we believe central banks will be inclined to support financial markets this year and help ensure modest gains for risk assets. More than ever, an agile, tactical approach will be needed to...

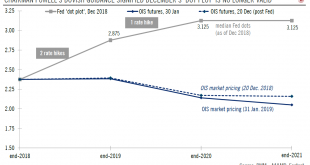

Read More »Review of the Federal Reserve’s January meeting

Fed signals end of rate hikes and that bank reserve liquidity tightening is near.Dovishness was on full display at the Fed meeting on 30 January. The Fed removed its rate tightening bias, and emphasised its “patience” until the next rate move.Chairman Powell seemed particularly anxious about the global growth backdrop and explained the more dovish stance is just “common sense risk management”.Another key focus was the balance sheet reduction as Powell hinted that a decision about ceasing the...

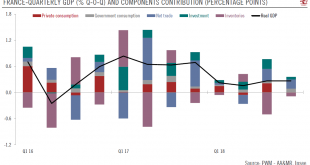

Read More »Exports save the day for French GDP growth

Prospects for French economic growth are looking up, but disruptions to consumption are possible.French GDP rose by 0.3% quarter-on-quarter (q-o-q) in Q4, the same pace as in Q3. The details reveal that Q4 exports surged significantly, while household consumption and investment slowed. This left growth for the year at +1.5%, following +2.3% in 2017.The breakdown of GDP data shows that household consumption growth decelerated significantly, to 0.0% from +0.4%, with the disruption to Christmas...

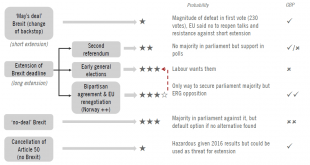

Read More »Brexit update – UK Parliament spins its wheels

'Wake up call' yet to happen as the clock ticks on.A series of votes in the British parliament resulted in little new progress on the Brexit front; the outcome being that Theresa May will return to Brussels to attempt to improve her ‘deal’, which a new parliamentary vote scheduled for mid-February.However, Brussels has rejected the idea of reopening negotiations and it is not clear that mere tweaks will be enough to overcome the intense opposition in parliament to May’s initial deal.Bottom...

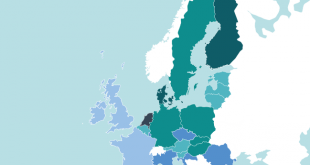

Read More »Cycling in the city

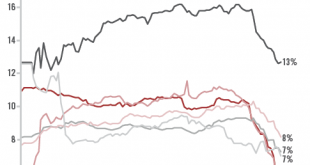

High-tech bicycle lights are making cycling safer and helping authorities to design cities that work better for two-wheeled commuters.While it is an oft-repeated truism that biking is as good for your health as for the environment, only a very small proportion of the population has embraced a two-wheel lifestyle. In the EU for example, on average just 12% of people cycle every day, while 50% go by car and 16% use public transport. Walking rates are high, but most journeys are too far to be...

Read More »Weekly View – Temporary open ahead of a crucial week

The CIO office’s view of the week ahead.President Trump put a temporary end to the shutdown on Friday after signing a funding package that reopens the US government for business until 15 February. Federal workers will receive their back pay, but the president continues to hold firm on his demand for funding for a border wall, threatening to resume the shutdown if a deal with Congress is not reached in three weeks. His disapproval ratings have reached their highest in a year due to the...

Read More » Perspectives Pictet

Perspectives Pictet