We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners. On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”. Charts from the Swiss customs data release (in French). Exports and Imports YoY Development In February 2017, Swiss foreign trade progressed in both directions of traffic. Exports adjusted for the number of working days increased by 0.9% (real: -2.5%). Doped by three groups, imports grew more (+5.4%, real: -1.2%). The trade balance loops with a surplus of 3.3 billion francs.

Topics:

George Dorgan considers the following as important: Featured, newsletter, Swiss Macro, Switzerland Exports, Switzerland Exports by Sector, Switzerland Imports, Switzerland Trade Balance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners.

On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

Charts from the Swiss customs data release (in French).

Exports and Imports YoY DevelopmentIn February 2017, Swiss foreign trade progressed in both directions of traffic. Exports adjusted for the number of working days increased by 0.9% (real: -2.5%). Doped by three groups, imports grew more (+5.4%, real: -1.2%). The trade balance loops with a surplus of 3.3 billion francs. In short ▲ Metal exports: highest level since November 2010 ▲ Imports: energy products, chemicals – pharmaceuticals and vehicles alone generated an increase of 1.1 billion Swiss francs ▼ Jewelery and jewelery weighs on both directions of traffic ▼ Exports: pharma pushes US in red numbers |

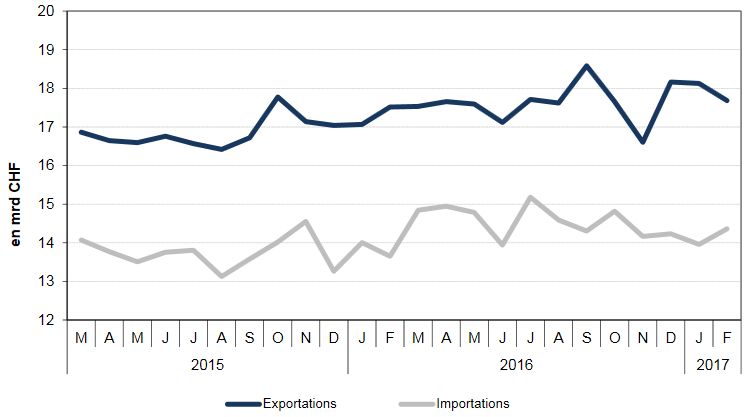

Swiss exports and imports, seasonally adjusted (in bn CHF), Feb 2017(see more posts on Switzerland Exports, Switzerland Imports, ) Source: Swiss Customs - Click to enlarge |

Overall EvolutionIn February 2017, exports adjusted for working days increased by 0.9% over one year (real: -2.5%). On one month (seasonally adjusted), they contracted by 2.5%. Despite this, the positive trend has continued, albeit at a slower pace. Imports increased by 5.4% per year (real: -1.2%). After de – marking, they were up 2.9% from January (real: +2.9%). They have reached a higher level over the last four months. |

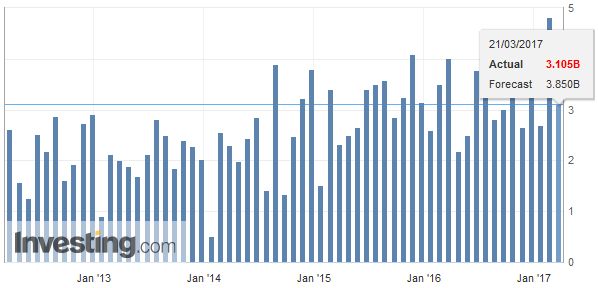

Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

Exports: chemistry – pharma offset the reverse of watchmaking and jewellery

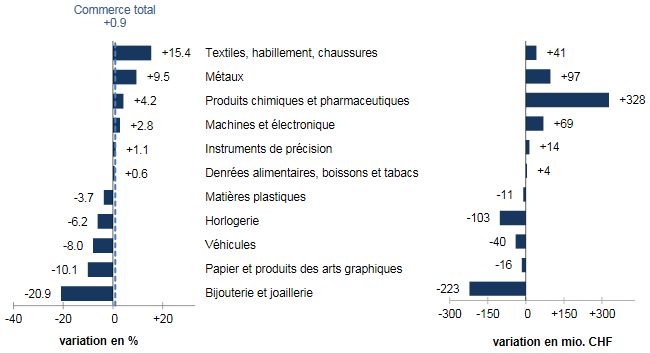

In February 2017, exports increased by 1%. The evolution of the groups was split into two, with half rising and the other losing ground. Metals rose by 10% compared to 4% for chemicals and pharmaceuticals (+328 million francs). Conversely, watchmaking (-6%) and jewellery (-21%) weighed on the result. Excluding pharma, exports declined by 2%. The growth of chemicals and pharmaceuticals was largely driven by the performance of active ingredients (+18%) and immunological products (+17%). The machinery and electronics sector gained 3%. Here, foreign demand increased by 16% for textile machines and 6% for electrical and electronic products. Sales down 6%, but watch sales were unable to stem their negative spiral. Apart from Africa (-27%) and North America (-5%; USA: -7%), all continents have gained ground. Asia and Europe increased by 2%. The rise in Asia was led by South Korea (+37%, pharma and jewellery) and China (+24%). Exports to Qatar (-49%, jewellery) and Saudi Arabia (-32%), however, plunged. On the Continent, sales increased, mainly driven by pharma products, to Belgium (+20%) and to Germany and Austria (+10% each). On the other hand, the Netherlands (-21%) and Spain (-13%) took the nose. |

Swiss Exports per Sector February 2017 vs. 2016(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) |

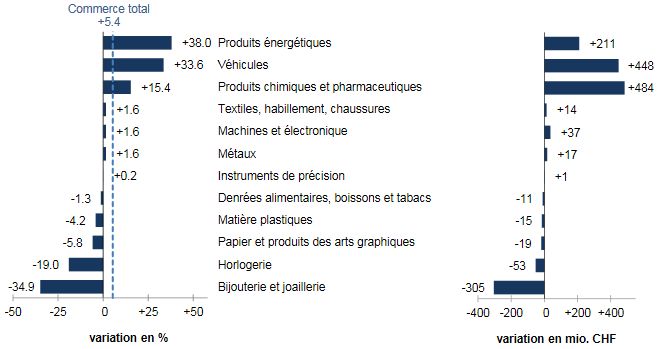

Imports of airliners at a high levelIn February 2017, imports by commodity group fluctuated. Energy products (+38%, mainly price effects), vehicles (+34%) and chemicals and pharmaceuticals (+15%) were the most dynamic. These three groups alone generated an increase of 1 billion francs. Conversely, jewellery and jewellery suffered a heavy setback (-35%, -305 million francs). |

Swiss Imports per Sector February 2017 vs. 2016(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Trade Balance