A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time. Correlations between CHF and the German economy The relationship between CHF and the German economy is very close for the following reasons: A big part of Swiss consumption is imported from Germany. Therefore, Swiss inflation is often related to German inflation. Germany is by far the biggest Swiss trading partner. Higher German spending is positive for the Swiss economy. Capital flows often move to Switzerland and Germany at the same time. The most prominent example is the housing market. Both Germany and Switzerland had a weak housing market between 1994 and 2006 and a strengthening one after the financial crisis. Both are inflation-hedges: While the German Mark improved by 30% against the dollar in the early 1970s during the Great Inflation, the Swiss franc rose by 40%. Quantitative trading algorithms have incorporated this strong relationship (and some how economic history!!). After good German fundamental data the EUR/CHF often weakens.

Topics:

George Dorgan considers the following as important: CHF, German economy, German stocks, Swiss Franc

This could be interesting, too:

Claudio Grass writes The Swiss franc’s “phenomenal” bull run

Claudio Grass writes The Swiss franc’s “phenomenal” bull run

Marc Chandler writes EMU GDP Surprises, while the Yen’s Short Squeeze Continues

Investec writes Swiss Franc worth more than a Euro

A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time.

Correlations between CHF and the German economy

The relationship between CHF and the German economy is very close for the following reasons:

- A big part of Swiss consumption is imported from Germany. Therefore, Swiss inflation is often related to German inflation.

- Germany is by far the biggest Swiss trading partner. Higher German spending is positive for the Swiss economy.

- Capital flows often move to Switzerland and Germany at the same time. The most prominent example is the housing market. Both Germany and Switzerland had a weak housing market between 1994 and 2006 and a strengthening one after the financial crisis.

- Both are inflation-hedges: While the German Mark improved by 30% against the dollar in the early 1970s during the Great Inflation, the Swiss franc rose by 40%.

- Quantitative trading algorithms have incorporated this strong relationship (and some how economic history!!). After good German fundamental data the EUR/CHF often weakens.

Apart from the relation to Germany, there are particular reasons why the Swiss outperforms the euro:

- The Swiss-European bilateral agreements in 2004 showed a new pattern of immigration to Switzerland: Highly qualified. Many highly-qualified Germans, e.g. computer scientists and engineers, moved to Switzerland, to a country with the same language and a closely related culture.

- Until the 1990s, Switzerland had enough capital but was missing labour, especially in the low-paid sectors. During the IT boom in the 1990s it became obvious that Swiss companies were also missing highly qualified personnel. With the bilateral agreements and with the financial crisis, they managed to overcome this lack with many talents from Europe, but also some from the United States. One example was 2008/2009, when the American Catarpillar laid off many engineers in the U.S. and elsewhere, but the Swiss ABB hired many of them.

- While many people think that Germany is the “best organized” economy in the euro zone, Switzerland is even better organized than Germany. One may think that comparing Germany to Switzerland is like comparing Italy to Germany.

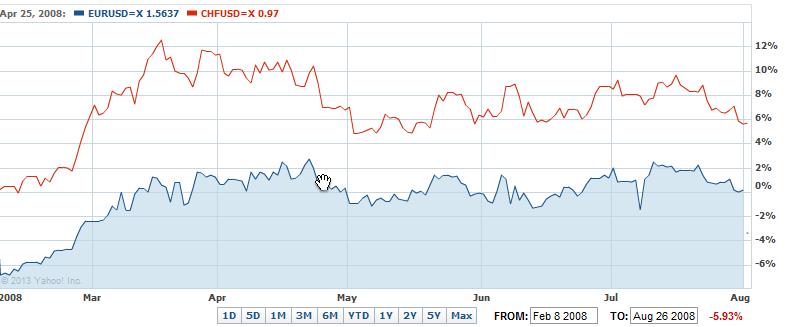

New highs in EUR/USD result in new lows of USD/CHFThe immediate result is the following technical rule, that has been valid since early 2008 – effectively since the German economy clearly outpaced France, Southern Europe and – as for GDP per capita growth – the United States. |

|

New highs in EUR/USD result in new lows of USD/CHF, 2008 |

|

CHF-Germany correlation in macro algorithmThe following economic data as January 23, 2014 show the strong relationship between the Swiss franc and the German economy, but also of Norway and Sweden. For us this correlation is implemented in macro algorithms by major investment banks. CHF appreciates against EUR, when German data is clearly better than other European data, as shown above. In the current low inflation environment, EUR/CHF is (slightly) negatively correlated to stocks performance. In this case, however, the stock market data would have explained only a EUR/CHF depreciation of around 5 bps, and not 30 bps. Both NOK and SEK appreciate against EUR, too, when German data is better. They have strong trade ties to Germany, too. The movements of NOK, however, may be overlaid by changes in the oil price for the oil exporter. |

European data of 2013, how CHF, SEK, NOK react to data

|

Read also:

FT Alphaville: Switzerland: Meet the new German Mark proxy