Swiss cantons have very different tax bases, tax rates and costs. To even things up, and temper tax rate competition between cantons that jockey to attract the wealthiest residents with the lowest tax rates, Switzerland has a system known as la péréquation financière nationale in French, or Finanzausgleich in German, which requires “rich” cantons to give money to “poor” cantons. Yesterday, the Swiss federal government published the numbers for 2017. Swiss Finanzausgleich: Rich cantons pay for poor cantons. In 2017, the top three payers will be Zurich (CHF 444 million), Zug (CHF 341 million) and Geneva (CHF 258 million), while the top three recipients will be Bern (CHF 1,287 million), Valais (CHF 663 million) and St. Gallen (CHF 419 million). Vaud will receive CHF 39 million and Basel-Stadt will pay CHF 109 million. The map below, shows paying cantons in red and receiving ones in green. Source: Swiss federal government report The residents of the cantons of Jura, Uri, and Valais will receive the highest per capita sums of CHF 2,247, CHF 2,161 and CHF 2,025 per resident respectively, while the top per-capita payers will be Zug (CHF 2,913), Schwyz (CHF 1,210) and Nidwalden (CHF 893). Residents of Basel-Stadt (CHF 573), Zurich (CHF 314) and Geneva (CHF 554) will all effectively contribute a tidy sum.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Featured, newsletter, Personal finance, Swiss federal income, Swiss Macro, tax equalisation Switzerland

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

Swiss cantons have very different tax bases, tax rates and costs. To even things up, and temper tax rate competition between cantons that jockey to attract the wealthiest residents with the lowest tax rates, Switzerland has a system known as la péréquation financière nationale in French, or Finanzausgleich in German, which requires “rich” cantons to give money to “poor” cantons.

Yesterday, the Swiss federal government published the numbers for 2017.

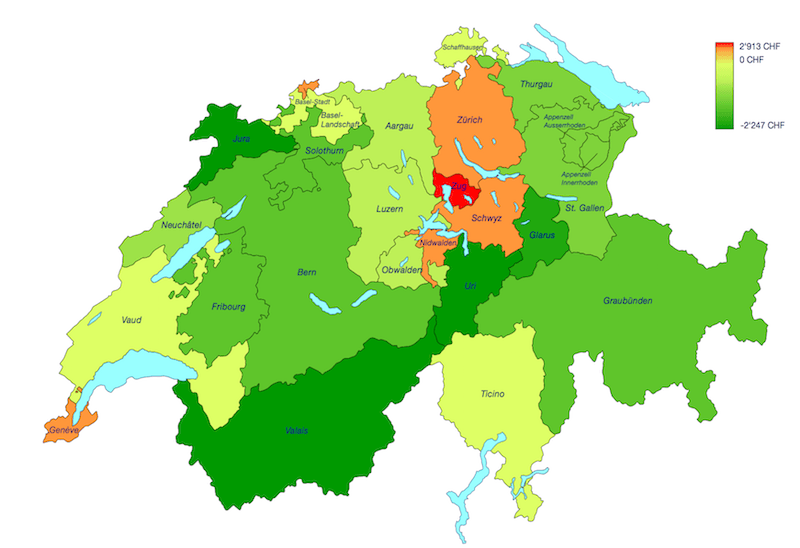

Swiss Finanzausgleich: Rich cantons pay for poor cantons.In 2017, the top three payers will be Zurich (CHF 444 million), Zug (CHF 341 million) and Geneva (CHF 258 million), while the top three recipients will be Bern (CHF 1,287 million), Valais (CHF 663 million) and St. Gallen (CHF 419 million). Vaud will receive CHF 39 million and Basel-Stadt will pay CHF 109 million. The map below, shows paying cantons in red and receiving ones in green. |

The residents of the cantons of Jura, Uri, and Valais will receive the highest per capita sums of CHF 2,247, CHF 2,161 and CHF 2,025 per resident respectively, while the top per-capita payers will be Zug (CHF 2,913), Schwyz (CHF 1,210) and Nidwalden (CHF 893). Residents of Basel-Stadt (CHF 573), Zurich (CHF 314) and Geneva (CHF 554) will all effectively contribute a tidy sum.

The system relies on complicated formulae that look at both the inward and outward sides of cantonal finances. For example the calculation requires Geneva to make a net contribution of CHF 258 million – Geneva pays CHF 356 million based on its revenue but gets to deduct CHF 98 million due to its “excessive” outgoings. Vaud will receive 39 million after offsetting its revenue-based contribution of CHF 27 million with an offsetting “excessive” outgoings deduction of CHF 66 million.

All of these payments to and from cantons do not add up to zero. For 2017, net movements between cantons come to minus CHF 3.3 billion, so the federal government is required to step in to cover this deficit out of its annual revenue of between CHF 60 to 70 billion (federal revenue in 2015 was 68 billion), which comes mainly from VAT (33% of the 2015 total), federal income taxes (40%) and other consumption taxes such as fuel and tobacco taxes (21%).

More on this:

Federal report (in German)

Federal report (in French) – Take a 5 minute French test now

Payments data by canton (in French)

Swiss federal finances at a glance (in English)