Not Just Wrong, but Monumentally Wrong Massive flaws at SUNE (Sun Edison) + VRX (Valeant) were somehow missed by both of these high profile/ well resourced hedge funds. Photo credit: Brendan McDermid, Eduardo Munoz / Reuters David Einhorn (Greenlight Capital) and Bill Ackman (Pershing Square) – both fund managers had a terrible year 2015 (down about 20% each), but while Mr. Einhorn has changed his way and righted his ship so far in 2016, Mr. Ackman stubbornly stuck (and at one point even doubled down) on his biggest losing bet. As of early March, the performance spread between the two managers in 2016 had widened to 2,400 basis points in favor of Mr. Einhorn. Much has been written about the very poor Q1 ’16 industry-wide hedge fund performance. Hedge funds are clearly under attack, primarily because of their fee structures. But it ought to be noted that the performance fees (20%) tied to their high water marks have not been triggered for some time in many cases. Management fees (in most cases) are still being applied though. It seems the legacy hedge fund compensation structure of 2 & 20 will soon enough be replaced by 2 or 20. For further insight into this issue I encourage all to read my post from 12.08.15 .

Topics:

Dominique Dassault considers the following as important: Bill Ackman, David Einhorn, Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, Sun Edison, SUNEQ weekly, Valeant Pharmaceuticals, VRX weekly

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Not Just Wrong, but Monumentally Wrong

Massive flaws at SUNE (Sun Edison) + VRX (Valeant) were somehow missed by both of these high profile/ well resourced hedge funds.

David Einhorn (Greenlight Capital) and Bill Ackman (Pershing Square) – both fund managers had a terrible year 2015 (down about 20% each), but while Mr. Einhorn has changed his way and righted his ship so far in 2016, Mr. Ackman stubbornly stuck (and at one point even doubled down) on his biggest losing bet. As of early March, the performance spread between the two managers in 2016 had widened to 2,400 basis points in favor of Mr. Einhorn.

Much has been written about the very poor Q1 ’16 industry-wide hedge fund performance. Hedge funds are clearly under attack, primarily because of their fee structures. But it ought to be noted that the performance fees (20%) tied to their high water marks have not been triggered for some time in many cases.

Management fees (in most cases) are still being applied though. It seems the legacy hedge fund compensation structure of 2 & 20 will soon enough be replaced by 2 or 20. For further insight into this issue I encourage all to read my post from 12.08.15 .

So why the poor performance? Of course it varies from fund to fund and it is a difficult task to manage a hedge fund – a fact frequently overlooked by the mainstream media. Anyway, of greatest concern to hedge fund investors ought not to be the fees (which definitely gnaw into performance) but rather the questionable investment calculus (on many very large portfolio positions) deeply cutting into returns. That they were wrong is not the issue. That they were monumentally wrong – that is the issue.

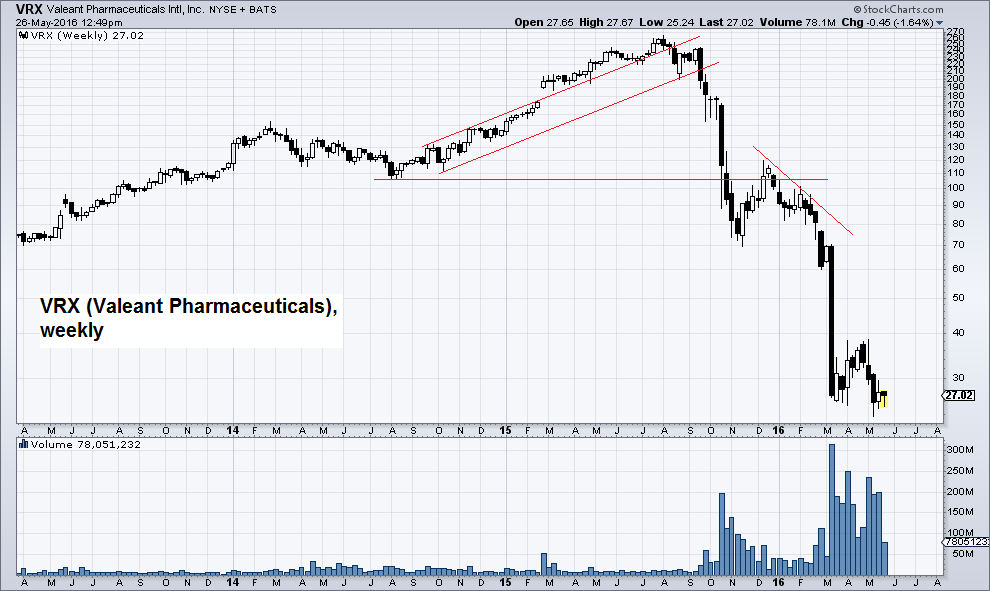

Let’s graphically examine these specific positions: SUNE = Einhorn/ Greenlight Capital + VRX = Ackman/ Pershing Square. The two price charts below illustrate the significant disappointments both of these companies delivered to Wall Street after peaking around the same time in July 2015.

SUNEQ (Sun Edison), weeklySUNEQ (Sun Edison) – from $33.45 at the 2015 peak to a mere 15 cents today. |

|

VRX (Valeant Pharmaceuticals), weeklyVRX (Valeant) – from $263.81 at the 2015 peak to $27.02 as of today. |

The price moves “down and to the right” were especially swift and brutal…a classic “penthouse to outhouse” result. And both for good reasons. SUNE is currently bankrupt and VRX is in the throes of a complex company overhaul highlighted by CEO Michael Pearson’s “dismissal” and a realignment of the board of directors.

Misplaced Conviction and Concentration Risk

The most obvious, and biggest, risk in money management is the possibility of a permanent loss of capital. It is a legitimate consideration that is rarely contemplated at most hedge funds, as historically, position sizes used to be somewhat limited (even with the application of margin).

Furthermore, most hedge fund portfolio managers seldom consider that a stock they elect to buy could actually invert…and sustain a price move toward zero. And this was just the case with Einhorn and Ackman, as they both walked emphatically straight into Two Enormous & Stinky Piles of Equity “Dog-Pinch”, i.e., SUNE and VRX respectively.

To complicate matters, both of these positions were among each firm’s top holdings, suggesting very high levels of confidence – of course, right as the share prices were peaking. According to the SEC’s 13F filings, as of 6.30.15 Greenlight had committed 9.32% (second largest holding) of its portfolio to SUNE, while Pershing shoveled 29.95% (largest holding) of its capital into VRX.

The hardened conviction regarding the prospects for these companies by both portfolio managers was plainly evident to all who cared enough to notice.

David Einhorn on SUNE: at the October 2014 Robin Hood Conference, Einhorn showed a 37 slide presentation/ hypothesis on Sun Edison. He claimed it was the highest quality solar company and indicated it could only get better.

His post-crash laments provided quite a contrast – 10 months later, on occasion of the release of the fund’s August 2015 portfolio performance letter, he remarked:

“The overall market environment has become acutely unfavorable for our investment strategy,” Einhorn said Tuesday in a conference call discussing results at Greenlight Capital Re Ltd., the reinsurer where he is chairman. “While we could have done better in a couple spots, we don’t expect to do well when investors shun value stocks in favor of momentum stocks.”

I hate to break it to him, but SUNE was anything but a value stock.

David Einhorn at the poker table. Going “all in” on SUNE wasn’t the best idea, but to his credit Mr. Einhorn has abandoned this bet and successfully changed course this year. Photo via dealbreaker.com

Bill Ackman on VRX at the May 2015 Ira Sohn Conference:

“We spent a year working with Valeant trying to take over Allergan, and one of the frustrations we had, as we got to see Valeant trading at $110 a share, was that we couldn’t buy the stock,” Ackman said during his closing presentation at the 20th annual Sohn Investment Conference on Monday. “But the moment we could, we bought it. You could say we’re late to the party.”

Yes, Bill was quite tardy.

Mr. Ackman’s contrasting post-crash laments were provided 11 months later in a Congressional testimony in April 2016, when he commented on VRX as follows:

“The first thing I’ve been doing is trying to make sure this company doesn’t go bankrupt.”

Bill Ackman at a Senate hearing into price gouging by Valeant and other pharmaceutical firms in April. To his left, former VRX chief financial officer Howard Schiller Photo credit: Bloomberg

SUNE and VRX – Glaringly Obvious Flaws

The cold/hard facts regarding the fundamental outlooks at both SUNE and VRX were anything but inspiring for a long while. Short interest had built, receded and rebuilt in these tickers many times over. But as my partner likes to say, ”they are shorted for a reason…lets figure out why”.

And in some cases, it is an arbitrage/hedge and/or a pairs trade. In many instances it can actually be quite difficult to ascertain. However, in both of these cases there were widespread and considerable doubts about the sustainability of their business models. Consider the Following:

SUNE:

Never in its history did it produce a 3 month period of positive EBITDA despite massive revenue growth. This revenue growth was mostly subsidized by the U.S. taxpaying public and then morphed into a creative/clever Wall Street financing scheme, by securitizing/selling future revenue streams tied to the company’s currently unprofitable (despite the subsidies) solar installations. Naturally there was also a boat load of debt and a boastful CEO. It is no wonder it all fell apart.

VRX:

Wall Street’s “roll-up” strategy of serially acquiring companies, employed by Valeant’s CEO Michael Pearson (an ex-McKinsey consultant), is a well worn path. Pearson successfully waved his magic wand for about 5 1/2 years in the hinterlands of Canada (Laval, Quebec)…reeking of “hiding out” from more extensive investor scrutiny. Not surprisingly, Biovail (the predecessor company to Valeant) was also a comedy of errors, continually fending off allegations of financial malfeasance.

What finally exposed VRX was an egregious/aggressive price gouging scheme. Recently acquired drugs, important to patients, but not to the prescription drug market as a whole, were sharply increased in price. Eventually U.S. regulators questioned/scrutinized VRX’s pricing tactics. This was the beginning of the end, and like all roll-ups, when the currency (in this case equity) collapses, so does the company’s business strategy. For now, unlike SUNE, Valeant has survived. However, the legacy of billions in goodwill and long term debt (to repurchase shares) still looms on its balance sheet.

How Could They Miss All This?

How could Einhorn and Ackman, both armed with well paid analysts/consultants, have missed any of these bright red, and very obvious, flags? And given these plausible concerns did both equities warrant such large portfolio positions?

And then as these red flags became fluorescent red, and the stories began to crack, it seems these two simply froze for a while as the proverbial tables “turned” and their investment hypothesis’ were eviscerated. Einhorn eventually bailed (thought it took a while), while Ackman is now even more intimately involved at VRX, after boldly – and unsuccessfully – attempting to trade around his core position.

So what gives – how could this happen? The only real answer, as the title of this post indicates is: sloppy stock selection and sloppy capital management. These are very large and very serious investment mistakes, typically the types of mistakes made by rookie day traders, not seasoned veterans like Messrs. Einhorn and Ackman.

And regarding the quick synopsis of both SUNE + VRX (from above), they must both have been well aware of the obvious flaws of these companies. This is not a case of ignorance, which makes these errors look even worse.

Conclusion

Investors at both Greenlight Capital and Pershing Square ought to be seriously concerned. These outrageous errors will resonate even in the minds of their cornerstone investors for a long while. Recent substantial investment outflows at both funds confirm that there is growing unease. Einhorn and Ackman can expect to be under tremendous investor scrutiny for some time to come – and deservedly so.

Charts by: StockCharts

Chart and image captions by PT

This article has originally appeared at Global Slant.

Previous post Next post