Macroview After hitting a low point at the end of 2015, fundamentals point to a rise in gold prices--but market conditions suggest the upside potential remains limited Read the full report here After the hefty gains made by gold this year, the attached Flash Note examines what might lie ahead for the precious metal by analysing the five key underlying drivers of gold prices: financial stress, inflation, real interest rates, the US dollar and supply and demand. Our conclusions are as follows: Presently, we do not see financial stress as a driver of sustainable gold price appreciation in the coming months. Inflation is currently sending mixed signals for gold prices. Helicopter money might appear on central banks’ agenda if inflation expectations were to keep dropping, but this is not part of our central scenario. We expect low real interest rates to remain mildly supportive of gold, although we believe that rates (real and nominal) have probably reached their bottom in Europe and Japan, and may rise moderately in the US. We believe renewed US dollar strength later this year will be negative for gold prices. Supply and demand conditions remain mildly supportive of gold prices (see chart hereunder).

Topics:

Luc Luyet considers the following as important: Gold, gold price appreciation, gold prices, Macroview

This could be interesting, too:

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Claudio Grass writes “THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

Claudio Grass writes Gold climbing from record high to record high: why buy now?

Claudio Grass writes Gold climbing from record high to record high: why buy now?

After hitting a low point at the end of 2015, fundamentals point to a rise in gold prices--but market conditions suggest the upside potential remains limited

After the hefty gains made by gold this year, the attached Flash Note examines what might lie ahead for the precious metal by analysing the five key underlying drivers of gold prices: financial stress, inflation, real interest rates, the US dollar and supply and demand. Our conclusions are as follows:

- Presently, we do not see financial stress as a driver of sustainable gold price appreciation in the coming months.

- Inflation is currently sending mixed signals for gold prices. Helicopter money might appear on central banks’ agenda if inflation expectations were to keep dropping, but this is not part of our central scenario.

- We expect low real interest rates to remain mildly supportive of gold, although we believe that rates (real and nominal) have probably reached their bottom in Europe and Japan, and may rise moderately in the US.

- We believe renewed US dollar strength later this year will be negative for gold prices.

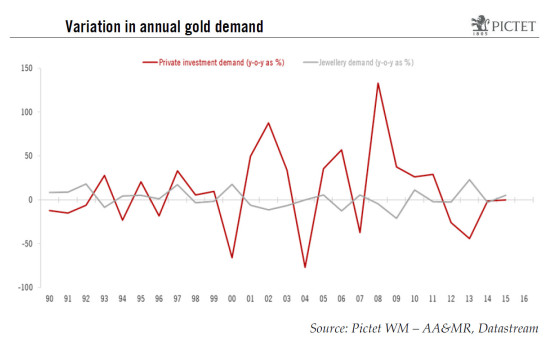

- Supply and demand conditions remain mildly supportive of gold prices (see chart hereunder). While the Indian government has sought to curb gold demand, the measures it has undertaken will not be felt for a couple of years yet, while the continued growth of wealth both in China and India should help gold.

All in all, taking the contrasting effects of various drivers, we believe that gold prices hit a cyclical low in December 2015, when prices sank to USD 1046. But given the high cost of holding gold and its rather limited upside potential, we do not currently see any compelling reason to invest in this precious metal.