The big news in gold is two-fold right now; gold hit new all-time highs in several currencies and central bank demand for physical gold remains strong hitting a year-to date record in Q3 this year. Gold at $2,000? So whilst the headlines were all about dollar-denominated gold showing us that it’s still destined for levels north of $2,000 the real news is about other currencies and gold. Ahead of yesterday’s FOMC announcement the price of the yellow metal hit...

Read More »Why we couldn’t be happier that gold is boring

We’re the first to admit that investing in gold can be pretty boring. Don’t get us wrong, when you first decide to buy gold then the newness of it is exciting, as you choose which gold bullion dealer to use then it is interesting and when you actually see the gold bars or coins appear in your account then it’s really exciting. But then what? There aren’t any major price moves, it’s not like you see any huge crashes or major leaps to keep you on your toes, not like...

Read More »More energy blows are dealt to Europe, causing a cold chill to be even colder

When people ask why they should invest in gold or buy silver coins, we often explain that they should do so because they are a form of insurance. Many of us are taking steps right now to protect ourselves from the impact of inflation on our day-to-day spending, others are trying to manage the increase in interest rates and maybe you are preparing your home so your energy bills won’t be impossible to manage. These are all ways of insuring ourselves against major...

Read More »Long Term Gold Price Prediction

What do the weather and the markets have in common? Quite a bit says this week’s guest! Kevin Wadsworth is a meteorologist-turned-chart analyst who has a lot of interesting insight and predictions into market movements and the price of gold. Kevin joins GoldCore TV host Dave Russell to discuss how he applies his 35 years of experience and methodology to financial markets. He takes us through the range of outcomes he sees for the economy, the US Dollar and precious...

Read More »The Changing Role of Gold

In our post on August 11 titled End of an ERA: The Bretton Woods System and Gold Standard Exchange, we discussed the significance of then-President Nixon’s action of closing the gold window thereby ending the Bretton Woods Monetary system. Under the Bretton Woods monetary system, central banks could exchange their US dollar reserves for gold. This also ended the gold fixed price of US$35 per ounce. This week we explore the two questions that concluded last week’s...

Read More »Update on gold – bad news is good news

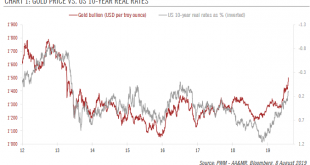

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled with strong demand from central banks, the medium-term outlook of the yellow...

Read More »Update on gold – bad news is good news

Increased trade tensions have boosted the gold price to above USD 1,500. The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce. The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled...

Read More »Gold boosted by dovish central banks

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term. The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower...

Read More »Gold boosted by dovish central banks

Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term.The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower recently, reducing the opportunity cost of holding gold. Indeed, since...

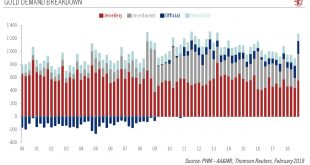

Read More »Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better. Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org