So far, the White House has justified its unwavering support for Ukraine on lofty grounds such as defending democracy and freedom—both in Ukraine and in the West. However, with the American public—who bears the cost of the war in Ukraine—turning against it, several Republican lawmakers questioning its purpose and affordability, and elections approaching, the Biden administration has changed the messaging on the war. Its new line is that sending weapons to Ukraine is actually an investment in American industry, strengthening the economy and creating new jobs. Joe Biden’s new argument fits well into the flawed Keynesian logic of “Bidenomics” in which economic prosperity is built upon generous public spending for infrastructure, semiconductors, and clean energy

Topics:

Mihai Macovei considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

So far, the White House has justified its unwavering support for Ukraine on lofty grounds such as defending democracy and freedom—both in Ukraine and in the West. However, with the American public—who bears the cost of the war in Ukraine—turning against it, several Republican lawmakers questioning its purpose and affordability, and elections approaching, the Biden administration has changed the messaging on the war. Its new line is that sending weapons to Ukraine is actually an investment in American industry, strengthening the economy and creating new jobs.

Joe Biden’s new argument fits well into the flawed Keynesian logic of “Bidenomics” in which economic prosperity is built upon generous public spending for infrastructure, semiconductors, and clean energy rather than on free markets. It is not only unethical to think that a country should use foreign wars and human suffering to give a boost to its economy, but also obviously wrong from an economic point of view. One cannot increase wealth by making gifts—which is what United States military aid to Ukraine is anyway. Moreover, if military spending and wars are so good for the economy, then the US economy should be thriving after the trillions of US dollars spent for this purpose over the last two decades. In reality, the opposite seems to be true.

A Boost to US Manufacturing?

When the Iron Curtain fell in 1989 and socialism seemed defeated, the world moved to a “unipolar” phase with the US as uncontested leader, raising big expectations for a long period of global peace and prosperity. Instead of being drastically cut, however, the excessive spending on military in the US—larger than those of the next ten largest militaries combined—was kept almost flat at about $300 billion for a decade. After the 9/11 attacks and as the US got involved in countless wars and military operations, the defense budget swelled to more than $800 billion by 2023.

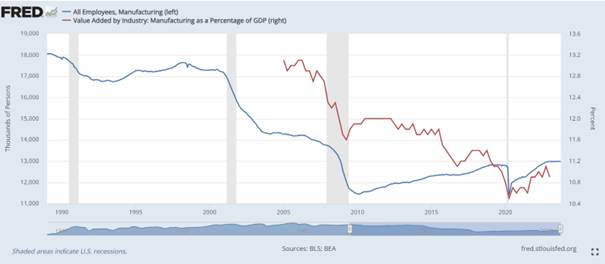

According to President Biden’s argument, this huge investment in the defense industry should have led to a manufacturing revival. This was certainly not the case. US manufacturing experienced a nightmare between 2000 and 2010 when the number of jobs, which had been relatively stable at about eighteen million since 1965, declined by one-third to below twelve million while output in the sector as a share of gross domestic product (GDP) dropped too (Figure 1). This was not due to productivity gains and automation but to the loss of competitiveness brought about by the financial and real estate bubbles, which drove US costs up. American companies accelerated offshoring while jobs shifted to services, construction, and the financial sector.

Figure 1: Employment and value added in manufacturing

Source: “All Employees, Manufacturing (MANEMP)“ and “Value Added by Industry: Manufacturing as a Percentage of GDP (VAPGDPMA),” FRED, Federal Reserve Bank of St. Louis, last updated October 1, 2023, and January 1, 2023. Data from the Bureau of Labor Statistics, “Current Employment Statistics,” last updated November 14, 2023, and the Bureau of Economic Analysis, “GDP by Industry,” last updated November 30, 2023.

More and Better Paid Jobs?

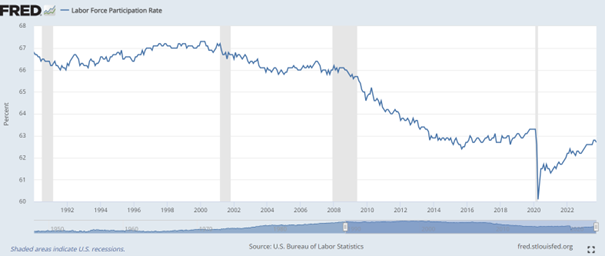

As American manufacturing declined, well-paying jobs for people with lower skills also disappeared, reducing work incentives. Together with an exponential increase in social welfare programs and government intervention in the economy, the decline in these work incentives has contributed to a steady decline in the participation of Americans in the labor market. Both the labor force participation and employment rates have been falling for almost three decades now (Figure 2). Although mainstream pundits blame the long-term decline in labor market participation on demographic shifts, this cannot be the main explanation as shown by the very low and falling participation rate of prime-age men. Only Italy, among developed countries, experienced a larger decline than the US in the labor market participation of 25- to 54-year-old men since 1990.

Figure 2: Labor force participation and employment

Source: “Labor Force Participation Rate (CIVPART),” FRED, Federal Reserve Bank of St. Louis, last updated October 1, 2023. Data from the Bureau of Labor Statistics, “Current Employment Statistics,” last updated November 14, 2023.

Also, wages and incomes took a hit from slowing productivity growth and the decline in manufacturing. The average wage of low-skilled high school graduates fell not only in real terms, but also in nominal terms by about 10 percent from 1990 to 2022. Despite some ups and downs, average real wages in the US have kept about the same purchasing power over the last four decades, barely increasing by less than 10 percent.

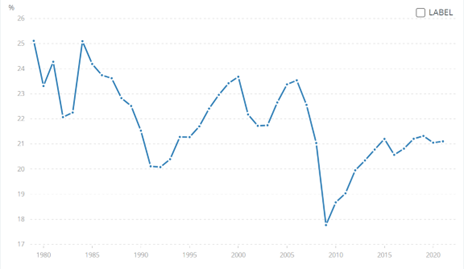

Ailing Productivity Growth and Investment

The main reason for the poor job creation and quasi-stagnation of real wages is the feeble growth of productivity and dwindling investment. Despite vast advances in digital technology, productivity growth has slowed to only 1.4 percent during the past fifteen years, well below its long-term average of 2.2 percent since World War II. As productivity growth is a function of both technological progress and capital accumulation, it means that the issue lies primarily with insufficient investment. Indeed, the US investment rate has been on a clear downward slope since 1980 (Figure 3). As residential investment remained almost constant at about 4 percent of GDP over the period, it means that the investment decline took place in equipment, intellectual property, and industrial structures, which are the main contributors to labor productivity. Moreover, these investment rates probably overestimate the amount of productive investment leading to sound capital accumulation because the two major boom-bust cycles that have occurred since the early 1990s were also accompanied by significant malinvestment.

Figure 3: Investment rate

Source: “Gross capital formation (% of GDP)—United States,” World Bank Open Data, World Bank Group, accessed December 4, 2023. Data from the World Bank national accounts and Organisation for Economic Co-operation and Development National Accounts data files.

Rising Debt and Economic Crises

One thing that did take off in the US economy together with the surge in military spending was the amount of public debt. The budgetary cost of the post-9/11 wars in Iraq and Afghanistan—as well as related operations in Somalia, Libya, and Syria—is estimated at around $8 trillion. This had a significant direct contribution to the surge in US public debt, from $6 trillion in 2001 to $33 trillion in 2023. As a share of GDP, US public debt ballooned from 55 percent in 2000 to 123 percent in 2023. The US ranks today among the top twelve most indebted countries in the world, greatly exceeding the euro area public debt of about 90 percent of GDP.

The US indebtedness is expected to grow further. According to the recent International Monetary Fund’s World Economic Outlook, the US budget deficit is set to explode at 8.2 percent of GDP this year and average about 7 percent of GDP until 2028, when projections end. In parallel, total government debt will rise further to almost 140 percent of GDP. By comparison, euro area budget deficits will likely average around 2.5 percent of GDP, and its government debt will fall to about 85 percent of GDP by 2028.

According to Ryan McMaken, the US may have entered a debt spiral with the strongly rising cost of debt, and pundits fear that the risk of failed auctions of US government bonds is becoming real. Treasury bond auctions have already recorded lower demand—in particular, from foreign investors—and the yield of the ten-year Treasury bond has shot above 5 percent, the highest yield since 2007. Even if the Federal Reserve steps in to buy the unsold bonds, it will do so with printed money, leading to higher inflation.

As an indirect outcome of hiking military spending, the Fed’s record low interest rates in the early 2000s paved the way for the boom-and-bust cycle, culminating with the global financial crisis. In addition to public debt, private debt has also soared. Between 2000 and 2022, the total outstanding of both public and private debt across all sectors increased about three times from $29 trillion to $93 trillion. The meager productivity growth shows that a large chunk of this debt is unproductive and a burden on future growth. Real GDP growth has already slowed to less than 2 percent per year on average since 2000, after it had averaged more than 3 percent each decade since World War II.

Conclusion

President Biden’s claim that more military spending to arm Ukraine will strengthen manufacturing and the US economy is baseless. After more than two decades of very high military outlays, public debt exploded while productivity and economic growth took a serious hit. The lavish subsidies that the Biden administration is pouring out today in the hopes of attracting high-tech manufacturing to the US show that militarism bears severe economic costs.

Tags: Featured,newsletter