In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September. The switch from a negative to a positive SNB policy rate required us to make an adjustment to the implementation of our monetary policy in the money market. The new approach comprises two elements: reserve tiering – that is, tiered remuneration of the sight deposits that banks and other financial market participants hold at the SNB – and reserve absorption. This approach has proved successful. Following our monetary policy decision on 22 September, secured short-term

Topics:

Andréa Maechler considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

| In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

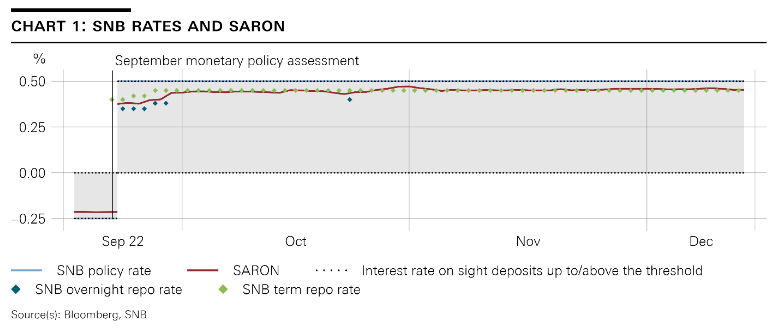

The switch from a negative to a positive SNB policy rate required us to make an adjustment to the implementation of our monetary policy in the money market. The new approach comprises two elements: reserve tiering – that is, tiered remuneration of the sight deposits that banks and other financial market participants hold at the SNB – and reserve absorption. This approach has proved successful. Following our monetary policy decision on 22 September, secured short-term Swiss franc money market rates moved quickly towards the new SNB policy rate (cf. chart 1). We are also continuing to see solid activity among participants in the money market, which ensures a robust basis for the calculation of SARON. |

|

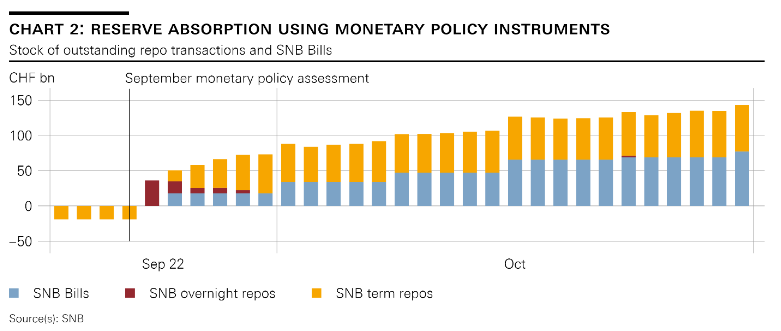

| From the outset, the market responded favourably to the deployment of our monetary policy instruments to absorb liquidity. On the very day of the monetary policy assessment in September, we started conducting repo transactions on a daily basis and issuing SNB bills on a weekly basis (cf. chart 2). In this way, we were able to reduce the liquidity supply in the money market sufficiently to allow us to steer interest rates effectively.

With today’s interest rate increase, we are also raising the interest rate on sight deposits above the threshold. For domestic banks, this threshold is calculated on the basis of their minimum reserve requirements.1 By remunerating sight deposits above the threshold now at 0.5%, we ensure that our tighter monetary policy will continue to be passed through efficiently to interest rates in the money market overall. |

Tags: Featured,newsletter