Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we’ll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession. But when it comes to the latest data on home prices, there’s still no sign of any deflation or even moderation. For example, the latest Case-Shiller home price data shows home prices surged above 20 percent year-over-year in April, marking yet another month of historic highs in home price growth. It’s now abundantly clear that a decade of easy money, followed by two-years of covid-induced helicopter money, has pushed home price growth to levels that dwarf even the pre-2008 housing bubble. This continues to make housing less affordable for potential

Topics:

Ryan McMaken considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Michael Njoku writes Totalitarianism Begins With A Denial of Economics

Nachrichten Ticker - www.finanzen.ch writes US-Wahl treibt Bitcoin über 90’000 US-Dollar – wie Anleger vom neuen Krypto-Hype profitieren können

Jim Fedako writes Subjectivity and Demonstrated Preference: A Possible Paradox

Connor O'Keeffe writes The Context Behind Donald Trump’s “Takeover” of the American Right

Real wages are falling, inflation is at a 40-year high, and the Atlanta Fed predicts we’ll find GDP growth at zero for the second quarter. Meanwhile, both the yield curve and money-supply growth point to recession.

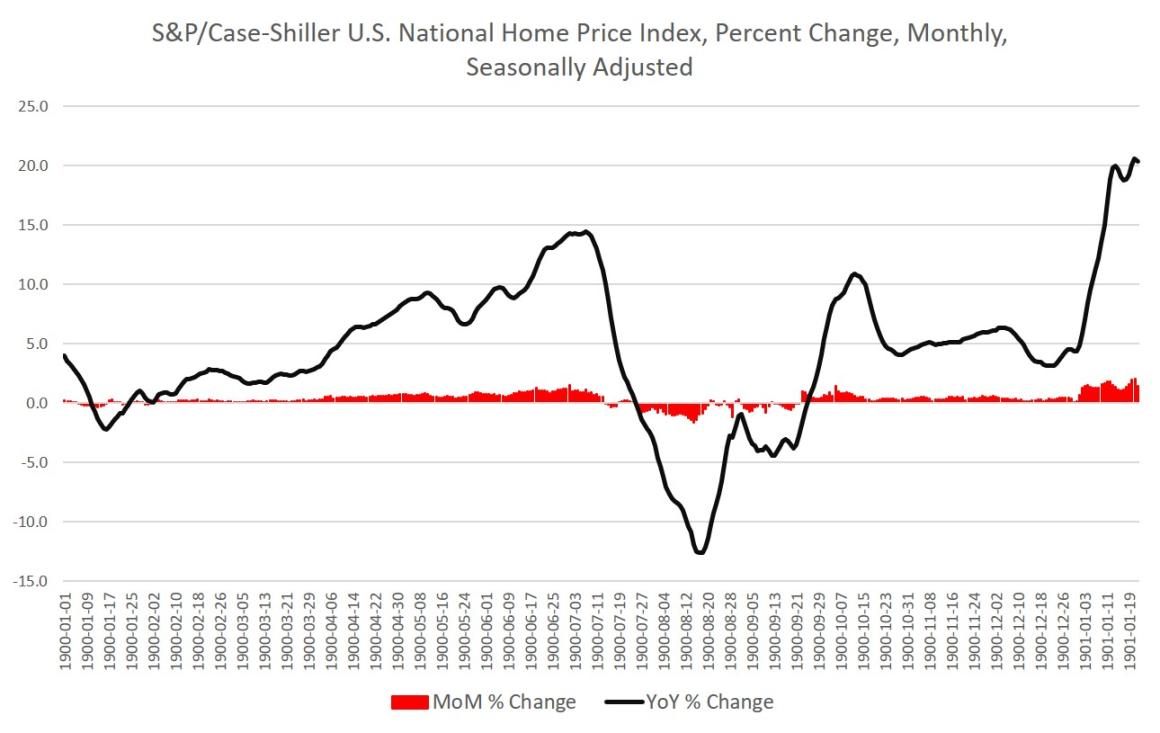

But when it comes to the latest data on home prices, there’s still no sign of any deflation or even moderation. For example, the latest Case-Shiller home price data shows home prices surged above 20 percent year-over-year in April, marking yet another month of historic highs in home price growth. It’s now abundantly clear that a decade of easy money, followed by two-years of covid-induced helicopter money, has pushed home price growth to levels that dwarf even the pre-2008 housing bubble. This continues to make housing less affordable for potential first-time home buyers and for renters. Unfortunately, the options for “doing something” are limited, and probably require a recession.

But in the meantime, those who are already lucky enough to be property owners continue to see some big gains. According to the latest Case-Shiller home price report, released Tuesday:

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 20.4% annual gain in April, down from 20.6% in the previous month. The 10-City Composite annual increase came in at 19.7%, up from 19.5% in the previous month. The 20-City Composite posted a 21.2% year-over-year gain, up from 21.1% in the previous month.

Tampa, Miami, and Phoenix reported the highest year-over-year gains among the 20 cities in April. Tampa led the way with a 35.8% year-over-year price increase, followed by Miami with a 33.3% increase, and Phoenix with a 31.3% increase. Nine of the 20 cities reported higher price increases in the year ending April 2022 versus the year ending March 2022…

In April, all 20 cities reported increases before and after seasonal adjustments.

| According to the index, year-over-year changes have exceeded 18 percent for each month since June 2021, a rate well in excess of the growth rates experienced during the housing bubble leading up to the financial crisis of 2008. This growth is also reflected in month-over-month growth which has not fallen below 1 percent in 21 months. In other words, as of April, there was still no sign at all that price inflation and declining real wages was doing much to dampen demand for home purchases. The reader may remember that price inflation began to surge well above the Fed’s target 2% rate as early as April 2021. Price inflation hit 40-year highs of more than 8% during early 2022. Moreover, April of this year was the thirteenth month in a row during which price inflation was outpacing growth in average earnings. | |

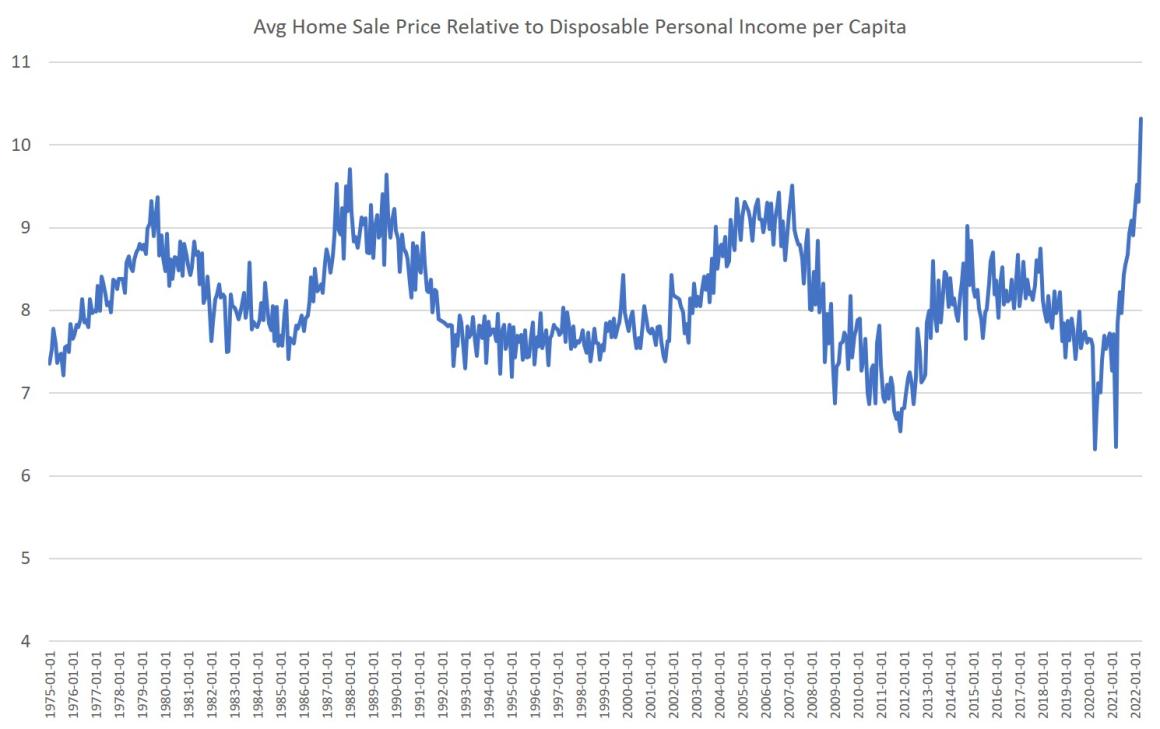

Housing Is Less Affordable, But There Are Plenty of BuyersPeople are getting poorer in real terms, so it’s not surprising that April data also shows historic imbalances between disposable income and home prices. As of April this year, the Census Bureau’s estimate for the average sales price of new houses sold reached 10.3 times the size of disposable personal income per capita. The average home sale price has been more than nine times disposable income for the past six months of available data. In recent decades, home prices have only been this unaffordable in periods leading up to recessions and financial crises—i.e., 1980, 1991, and 2007. April’s home-price-to-income ratio is higher than in any other period in more than 45 years. One reason we have yet to see any sign of declining home prices in April data is that employment data—a lagging economic indicator—still showed a relatively strong job market in April. Although total non-farm employment remains below 2019 pre-covid levels, job growth has been strong enough to combine with monetary inflation and fuel big growth in prices. Moreover, as of April, mortgage rates had not yet climbed out of very-low-rate territory. The average 30-year fixed rate did not even reach 5 percent until mid April. This, combined with continued job growth, helped to keep demand high.(As of mid-June, however, the average 30-yar fixed rate is now 5.8 percent, a 13-year high.) |

So what will it take before we begin to see any real reductions in home prices?

Unfortunately, the only real way out is probably a recession. This is thanks to a mixture of the regime’s fiscal and monetary policies. After so many months of reckless monetary inflation fueling out-of-control demand, all that newly-created money continues to chase relatively stagnant supply. Supply has been hobbled by lockdown-induced logistical bottlenecks, US sanctions on Russia, and rising energy prices due to the regime’s war on fossil fuels. Thus, consumers can’t benefit from the sort of supply-driven disinflationary forces that helped keep price inflation at manageable levels during many periods in the past. Now, we’re just left with surging demand fueled by new money, but without the market freedom necessary to provide breathing room through growth in supply.

Will the Fed Tighten Enough?

Fed Chairman Jerome Powell denied at this month’s FOMC meeting that the Fed is trying to bring about a recession to rein in price growth. But whether or not that is the intent, even the Fed’s very mild tightening has already accelerated the US economy’s slide toward recession—or at least toward job losses. For instance, there is growing evidence of sporadic mass layoff events. JP Morgan announced last week “that it was laying off hundreds of employees due to rising mortgage rates amid a troubling housing market plagued by inflation.” Redfin last week announced layoffs for 470 workers. Hiring freezes and mass layoffs are a growing area of concern in Silicon Valley.

If the US is indeed headed toward job losses and recession, the danger now is of the Fed not backing off monetary inflation long enough and hard enough to actually allow the economy to clean out the malinvestments and bubbles created by the monetary inflation of the past decade. The danger of too-weak tightening has been evident before. For example, the Fed moderately reined in monetary inflation during from 1972 to 1974. But these measures proved to be too little to really end the inflationary boom. Thus, much malinvestment and price inflation piled up until more tightening had to be done during the early 1980s to finally bring inflation under control.

So the question now is this: will the Fed pull its foot off the easy-money accelerator only long enough to get a few flat months in price inflation and then return to the same old inflationary stimulus policies? That could win a brief reprieve for first-time home buyers and renters in terms of housing prices. But more than a brief reprieve is greatly needed. Of course, what the Fed should do is completely sell off its portfolio and stop manipulating interest rates altogether. But failing that, it needs to at least allow interest rates to rise enough—and shrink its portfolio enough—to allow for some real modicum of “normalization” in the financial sector.

In any case, real deflation—both monetary inflation and price inflation—is necessary, and that can only be accomplished if the Fed can resist the temptation to keep doing what it’s been doing since 2008 with “non-traditional monetary policy” including quantitative easing, financial repression, and bubble creation.

Tags: Featured,newsletter